What is the purpose of the Act 221 Disclosure form?

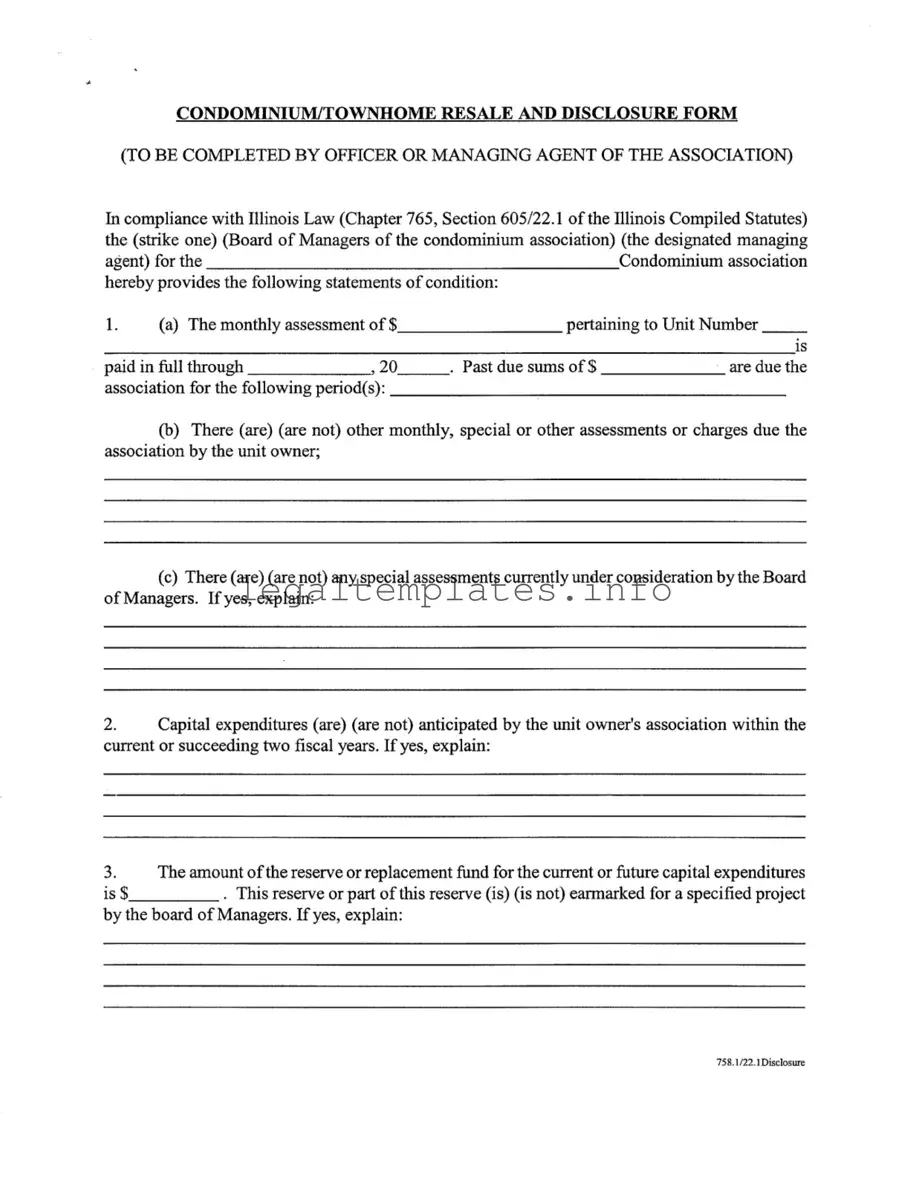

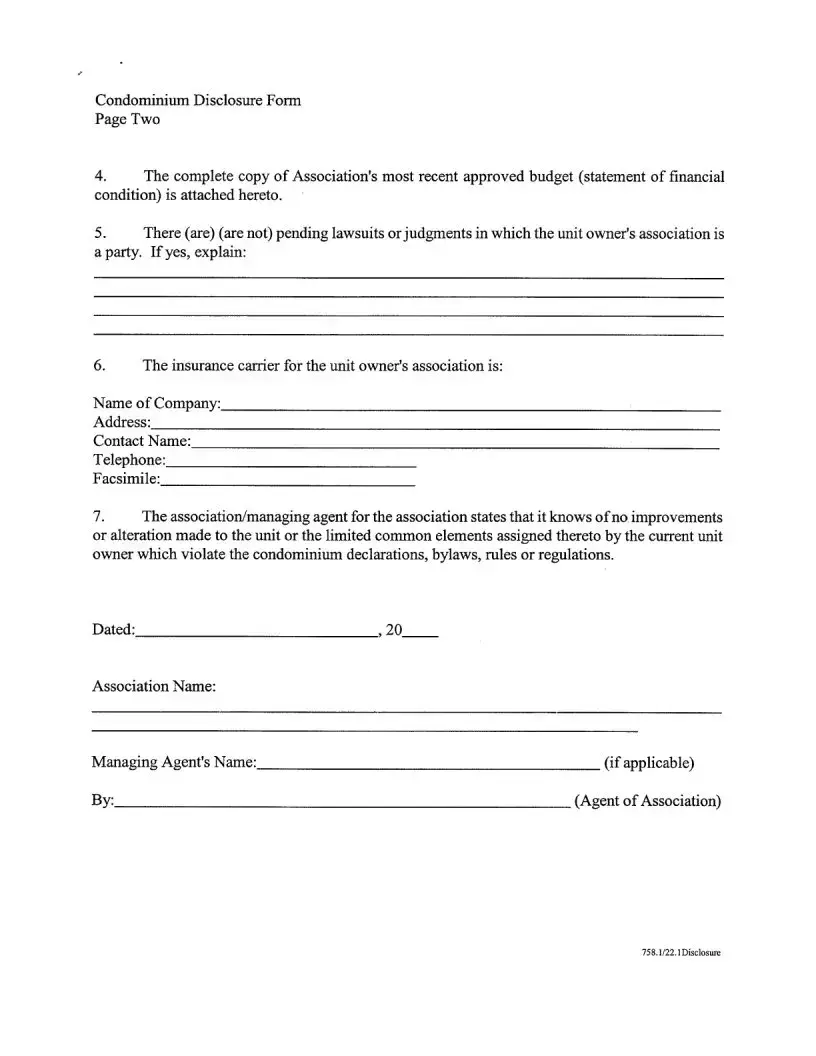

The Act 221 Disclosure form serves a significant purpose in the context of condominium or townhome resale transactions in Illinois. It is required by law, specifically outlined in Chapter 765, Section 605/22.1 of the Illinois Compiled Statutes, to ensure transparency and provide potential buyers with essential information about the financial and physical status of the condominium association. This disclosure includes details about monthly assessments, any outstanding charges, anticipated capital expenditures, the reserve fund for future expenses, the most recent approved budget, pending legal actions, and the insurance coverage of the association. By providing this form, officers or managing agents help buyers make informed decisions.

Who is responsible for completing the Act 221 Disclosure form?

Either the Board of Managers of the condominium association or the designated managing agent for the condominium association is responsible for filling out the Act 221 Disclosure form. Their role involves accurately reporting the financial health and administrative status of the association, any current or upcoming financial obligations, and any other significant information that can affect an owner's interest or liability.

Are there any assessments or charges that need to be disclosed?

Yes, the form requires disclosure of not only the current monthly assessments paid in full up to a certain date but also any past due sums, other monthly, special, or additional assessments or charges due to the association by the unit owner. If there are special assessments currently under consideration by the Board of Managers, these must also be disclosed, with an explanation if applicable. This information provides potential buyers with a clear understanding of their financial commitments toward the association.

What information about capital expenditures and reserve funds is disclosed?

The form includes sections for disclosing whether capital expenditures are anticipated within the current or succeeding two fiscal years and details about the reserve or replacement fund. It specifically asks if the reserve is earmarked for a specified project, requiring an explanation if it is. This section gives buyers insight into future projects that may impact the financial stability of the association or lead to additional assessments.

How is insurance information handled in the disclosure?

The disclosure requires detailed information about the insurance carrier for the unit owner's association, including the name of the company, address, contact name, telephone, and facsimile numbers. This information is crucial for understanding the scope of coverage and ensuring that potential liabilities are adequately insured against, providing peace of mind for potential buyers.