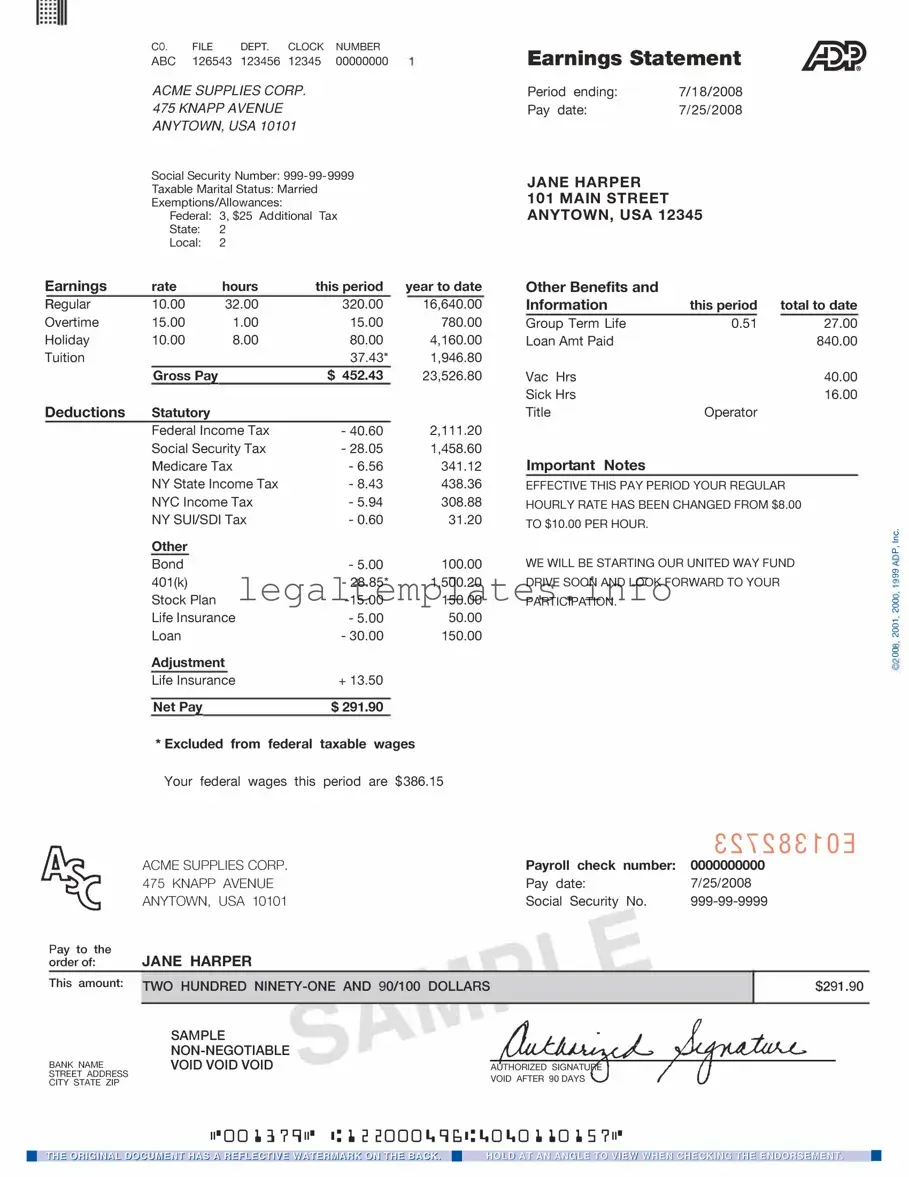

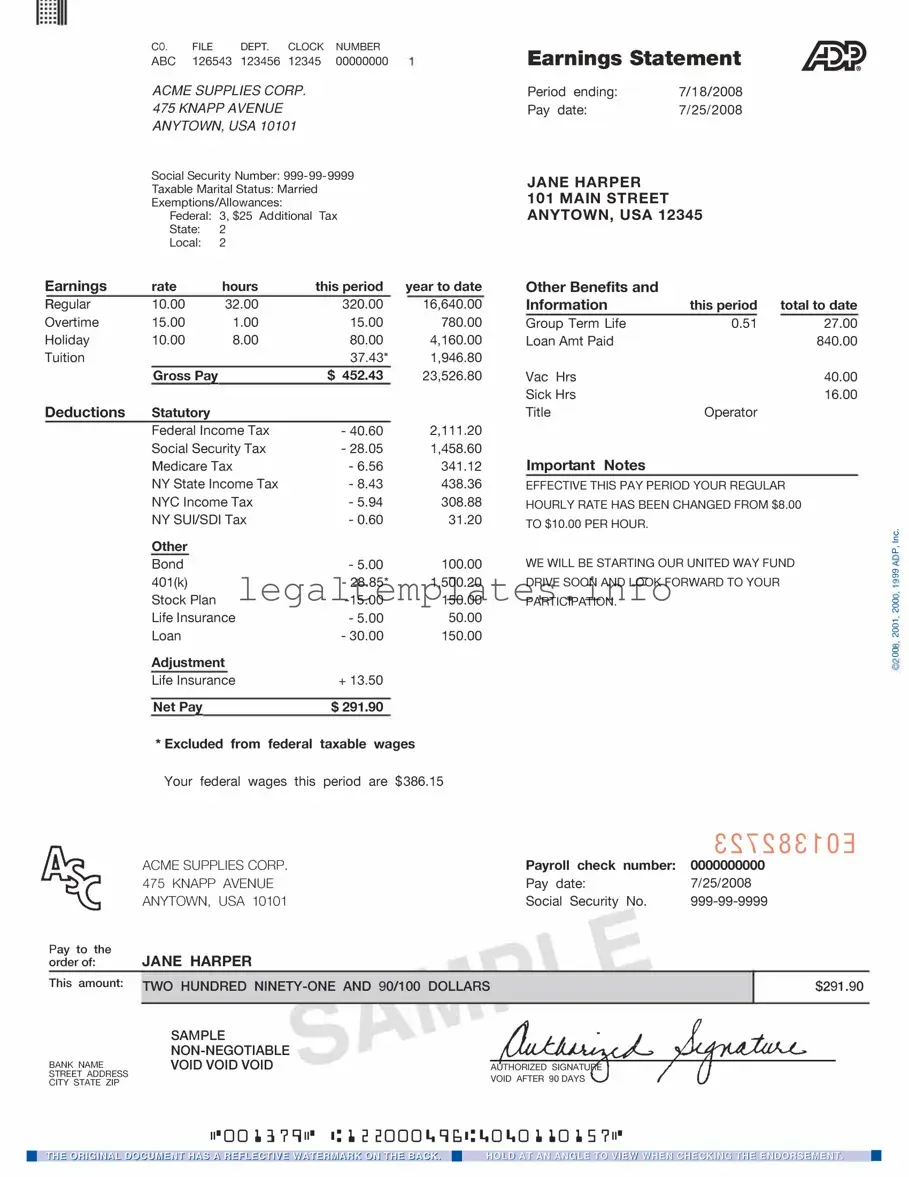

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by employers, particularly those who use ADP payroll services, to their employees every pay period. It details the employee's earnings, including hours worked, gross pay, and net pay, after all deductions such as federal and state taxes, insurance premiums, and retirement contributions have been subtracted. This document serves as proof of income and can be used for various personal finance matters including loan applications, renting or buying a home, and more.

How can I access my ADP Pay Stub?

Employees can access their ADP Pay Stubs through the ADP portal or mobile app, provided their employer uses ADP payroll solutions. To do so, they must first register an account with ADP using the registration code provided by their employer. Once registered, employees can log in to their account anytime to view, download, or print their pay stubs. If you encounter any issues accessing your account, you should contact your employer's payroll or HR department for assistance.

What information is included on an ADP Pay Stub?

An ADP Pay Stub includes a wealth of information critical to understanding one's income and deductions. This includes the employee's personal details (such as name and employee ID), pay period and date, hours worked, and rates of pay. It also breaks down earnings (including any overtime, bonuses, or commissions), federal and state tax withholdings, Social Security and Medicare contributions, and any other deductions such as health insurance premiums or retirement plan contributions. Finally, it displays the net pay, or take-home pay, after all deductions have been made.

Why do deductions vary between pay periods on my ADP Pay Stub?

Deductions on an ADP Pay Stub can vary for several reasons. Changes in federal or state tax withholdings due to updates in tax brackets or personal allowances (such as marriage status or number of dependents) could affect the amount. Additionally, deductions for benefits like health insurance or retirement savings plans might differ if these plans are not deducted in every pay period or if the employee or employer changes their contribution amount. Seasonal or one-time bonuses, and overtime work, can also lead to variations, as higher earnings may result in higher tax withholdings and contributions.

Can I use my ADP Pay Stub for tax purposes?

Yes, your ADP Pay Stub contains essential information that can be incredibly useful for tax purposes. It shows your earnings and deductions throughout the year, which can help you or your tax advisor prepare your annual tax return. It’s especially important for verifying the income reported on your W-2 form matches your actual earnings. However, for filing your taxes, you will typically need your W-2 form, which provides a yearly summary of your income and taxes paid, although it's beneficial to keep your pay stubs as a record and for personal tracking.