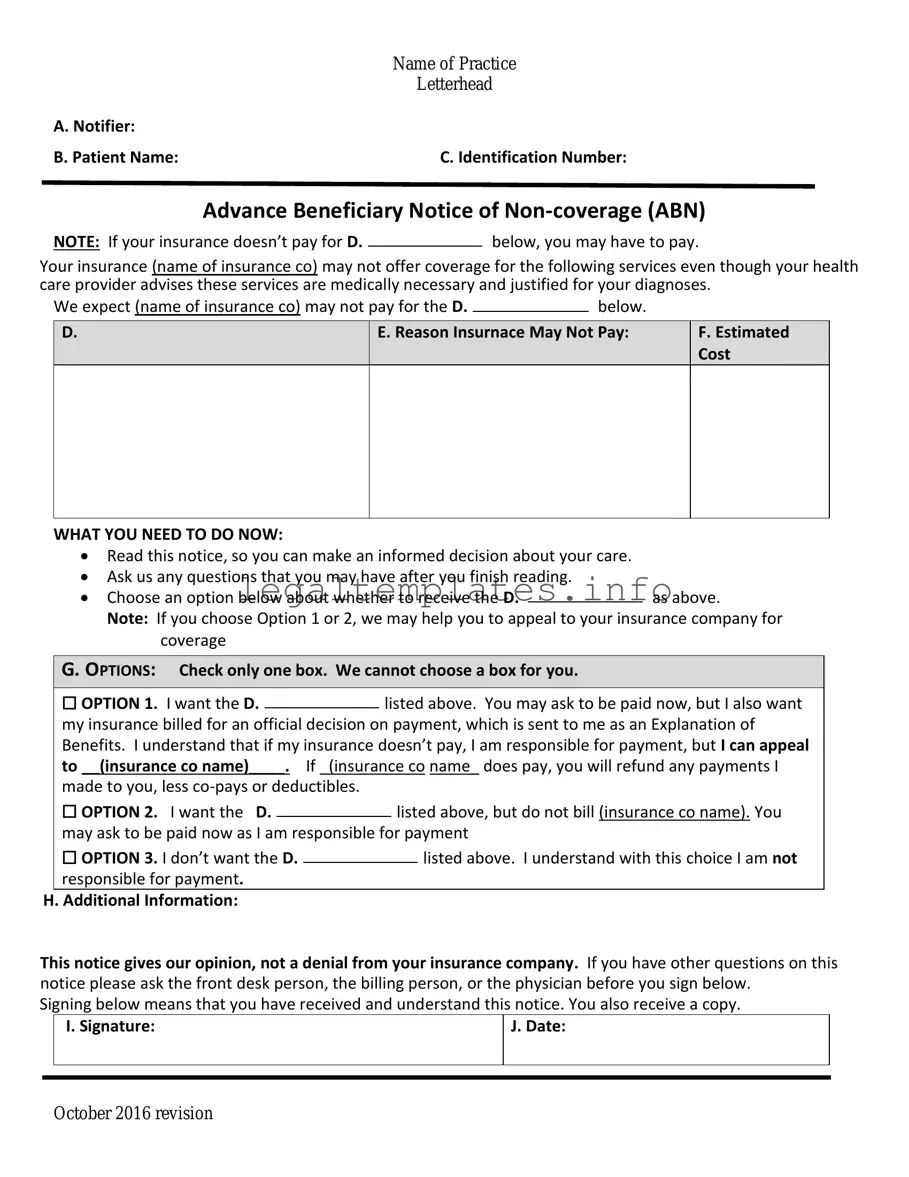

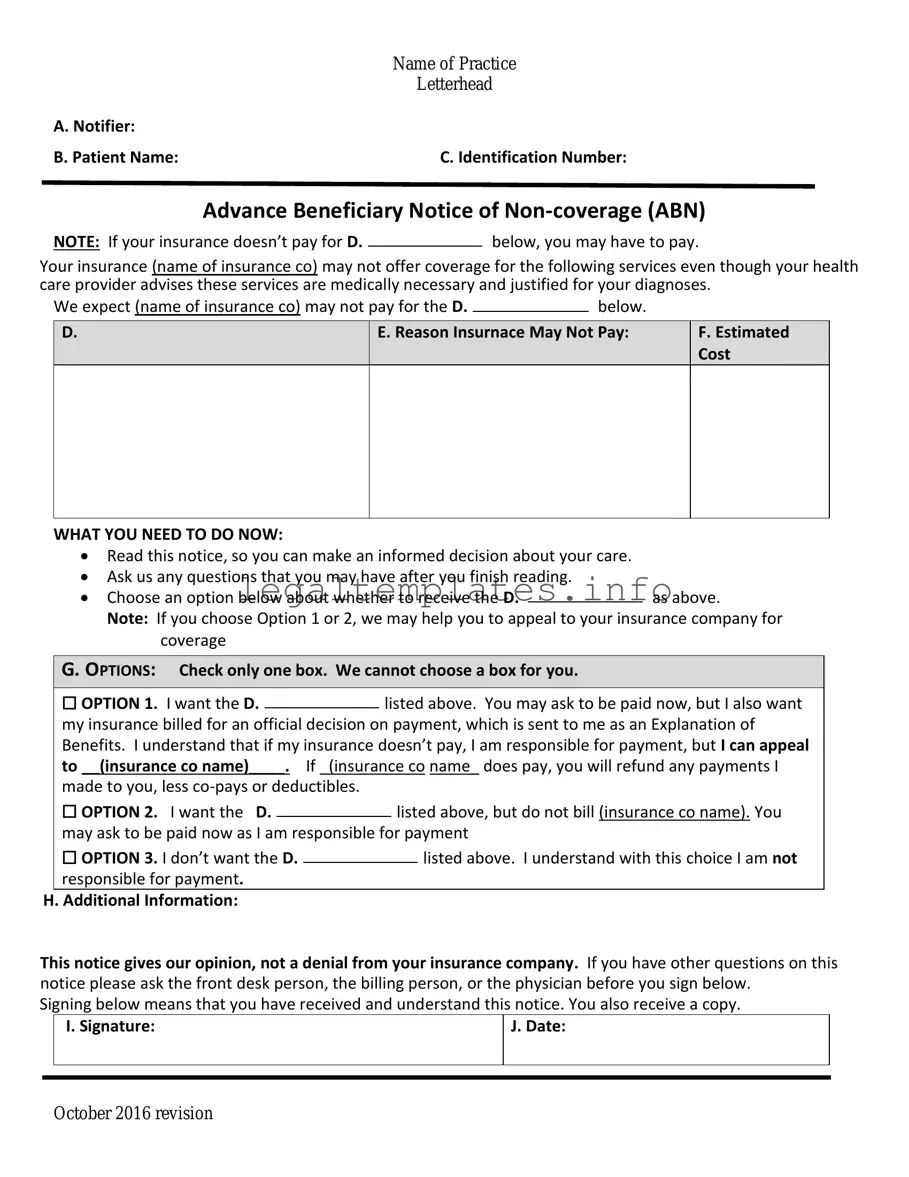

The Advance Beneficiary Notice of Non-coverage (ABN) form shares similarities with the Notice of Exclusion from Medicare Benefits (NEMB). Both serve the purpose of informing patients about services that Medicare does not cover. The NEMB is specifically used to notify patients before providing services or items that Medicare usually never covers, ensuring they understand their financial responsibilities. In contrast, the ABN is broader, covering services that could be covered under Medicare but might not be in a particular instance because they are considered not medically necessary or fall outside of Medicare's coverage policies.

Comparable to the ABN, the Consent to Release form is another document that deals with patient awareness and responsibilities. However, its primary focus is on authorizing healthcare providers to share the patient's medical information with third parties, such as insurance companies. While the ABN explicitly alerts patients to potential out-of-pocket costs for specific Medicare-uncovered services, the Consent to Release form is more about privacy and the management of personal medical information.

The Financial Responsibility Form that patients sign in medical offices closely resembles the ABN in its financial implications for the patient. This document typically outlines that the patient understands they will bear the cost of services not covered by insurance. Like the ABN, it is a proactive measure by healthcare providers to ensure patients are informed about potential charges for which they may be responsible, although it is not specific to Medicare and applies to all types of insurance coverages.

Another related document is the Durable Power of Attorney for Healthcare (DPOA-HC). While fundamentally different in purpose from the ABN, which informs about Medicare coverage limits, the DPOA-HC involves preparing for situations where the patient might not be able to make healthcare decisions themselves. Both documents necessitate discussions about healthcare preferences and potential financial ramifications, yet the DPOA-HC focuses primarily on legal authority in decision-making rather than coverage notices.

The Patient Agreement and Acknowledgment of Receipt of Information form is also similar to the ABN in certain aspects. It is used to confirm that the patient has received and understands specific information about their treatment plan, risks, and rights. While its scope is broader and not limited to insurance coverage, like the ABN, it plays a critical role in ensuring informed consent and understanding of financial liabilities related to healthcare services.

The Medicare Secondary Payer (MSP) Questionnaire is akin to the ABN, with both involving Medicare's coverage rules. The MSP Questionnaire is used to determine whether Medicare is the primary or secondary payer for a beneficiary's medical claims. Although its primary function is for billing purposes and to prevent erroneous Medicare payments when another insurer should pay first, it similarly involves understanding the nuances of Medicare coverage and ensuring that beneficiaries are informed about where responsibility for payment lies.

Lastly, the Private Contract between a Medicare beneficiary and a physician who has opted out of Medicare is reminiscent of the ABN's theme of patient responsibility for payment. This private contract signifies that the patient acknowledges paying for healthcare services out-of-pocket because the physician does not participate in the Medicare program. It is a direct agreement between patient and provider regarding payment responsibility, similar to how the ABN warns patients of specific instances where Medicare will not cover services, leaving the patient financially liable.