What is an Affidavit of Gift?

An Affidavit of Gift is a document used to legally declare that an individual (the donor) has voluntarily given a gift to another person (the recipient) without expecting any form of payment or compensation in return. This affidavit is often used to document the transfer of personal or real property, ensuring the transaction is recognized as a gift for legal and tax purposes.

Why do I need an Affidavit of Gift?

An Affidavit of Gift may be required for several reasons. Primarily, it serves to provide clear evidence of the donor's intention to gift the property, which can be important for tax purposes. It helps to prevent future disputes by recording the transaction details. Additionally, it can be necessary for the recipient to register or officially take ownership of the gift, especially in cases involving vehicles or real estate.

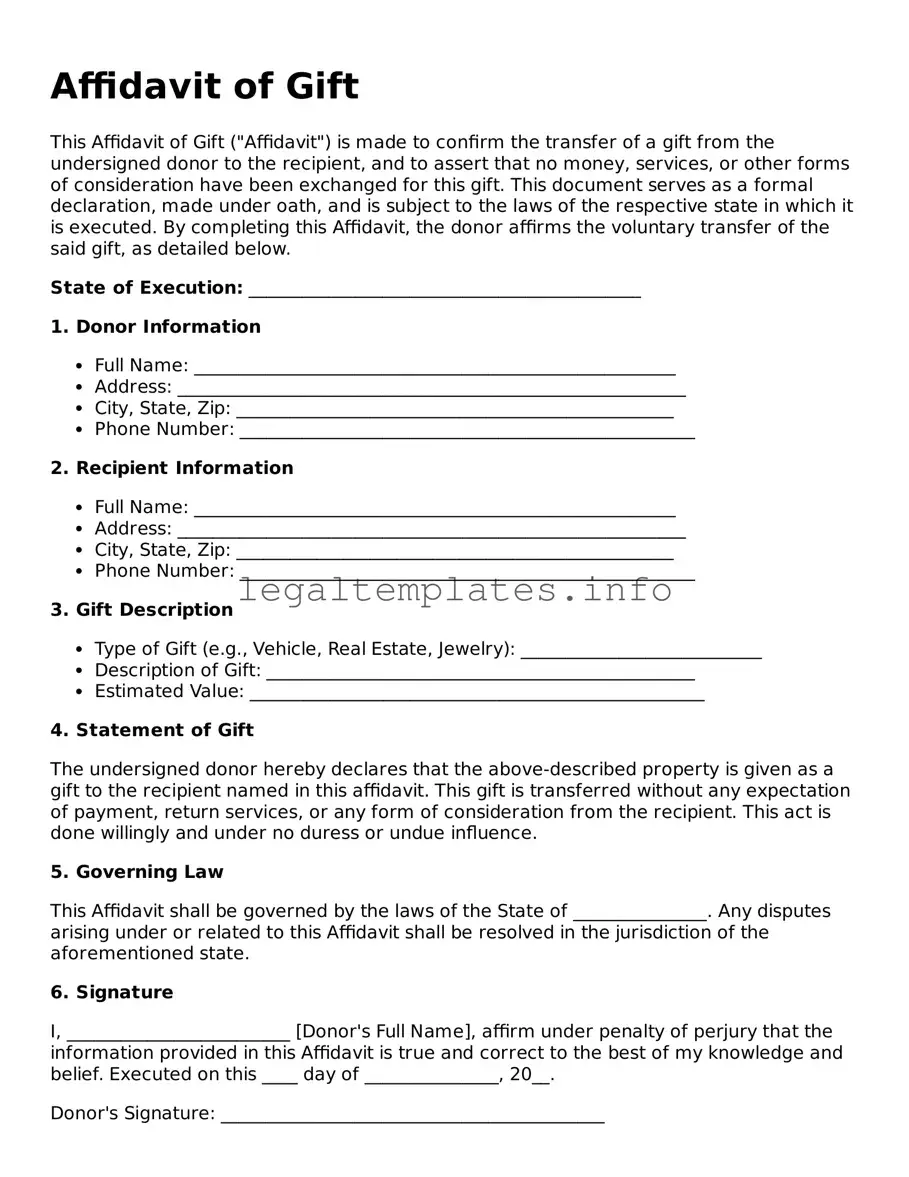

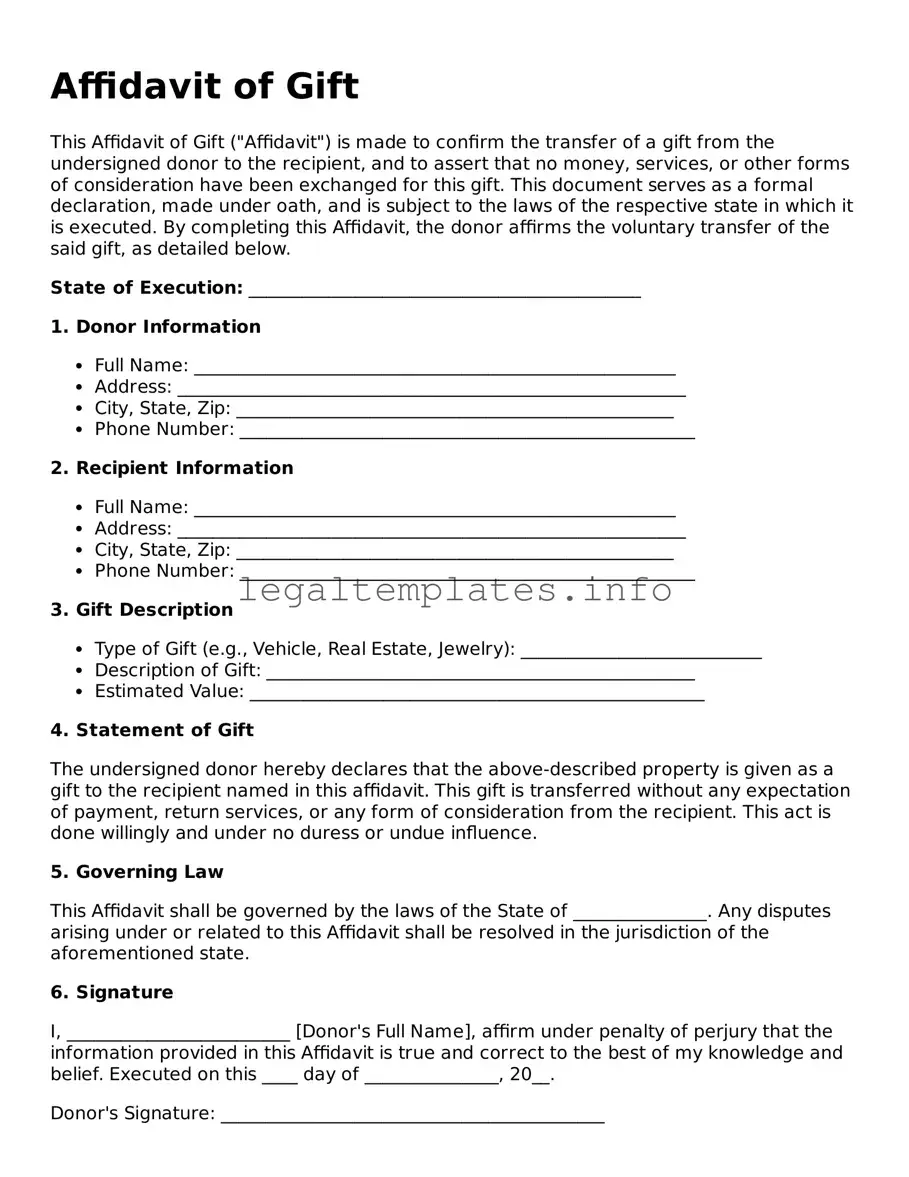

What information is included in an Affidavit of Gift?

The affidavit typically includes details such as the identities of the donor and recipient, a description of the gift, the date of the gift transfer, and a statement affirming that the gift is given freely without any conditions or expectations of payment. It also often contains a section for a notary public to sign, certifying that the donor's signature was made willingly and under no duress.

Is a notary required for an Affidavit of Gift?

Yes, in most cases, notarization is required for an Affidavit of Gift. A notary public must witness the signing of the document to certify that the donor acknowledged the document freely and voluntarily. This step adds a layer of legal validity and can help prevent questions of authenticity or coercion in the future.

What is the difference between an Affidavit of Gift and a Gift Letter?

While both documents are used to declare that a transfer of property is a gift, an Affidavit of Gift is a sworn statement that requires notarization, making it a more formal document. In contrast, a Gift Letter may not require notarization but still outlines the gift's details. Affidavits offer stronger legal proof of the gifting process and intent than a simple gift letter.

How does an Affidavit of Gift affect taxes?

An Affidavit of Gift can significantly impact tax obligations. For the donor, the affidavit is crucial in demonstrating that a transfer of property was indeed a gift, potentially subject to gift tax rules instead of income tax. For the recipient, it provides evidence that they received the property as a gift, which typically means they are not responsible for income tax on the gift's value. However, it's essential to consult with a tax professional to understand the specific implications.

Can I write an Affidavit of Gift myself?

While it is possible to draft an Affidavit of Gift on your own, it's crucial to ensure that all required elements are correctly included and that the document complies with relevant state laws. Using a template or seeking the assistance of a legal professional can help avoid mistakes that could invalidate the affidavit or create future disputes.

What happens if I don’t use an Affidavit of Gift?

Without an Affidavit of Gift, proving the transfer of property was a true gift can be challenging. This might complicate matters related to taxes, ownership registration, and could expose both the donor and recipient to legal disputes. An affidavit provides a clear, legally recognized record of the gift, minimizing potential problems and misunderstandings down the line.