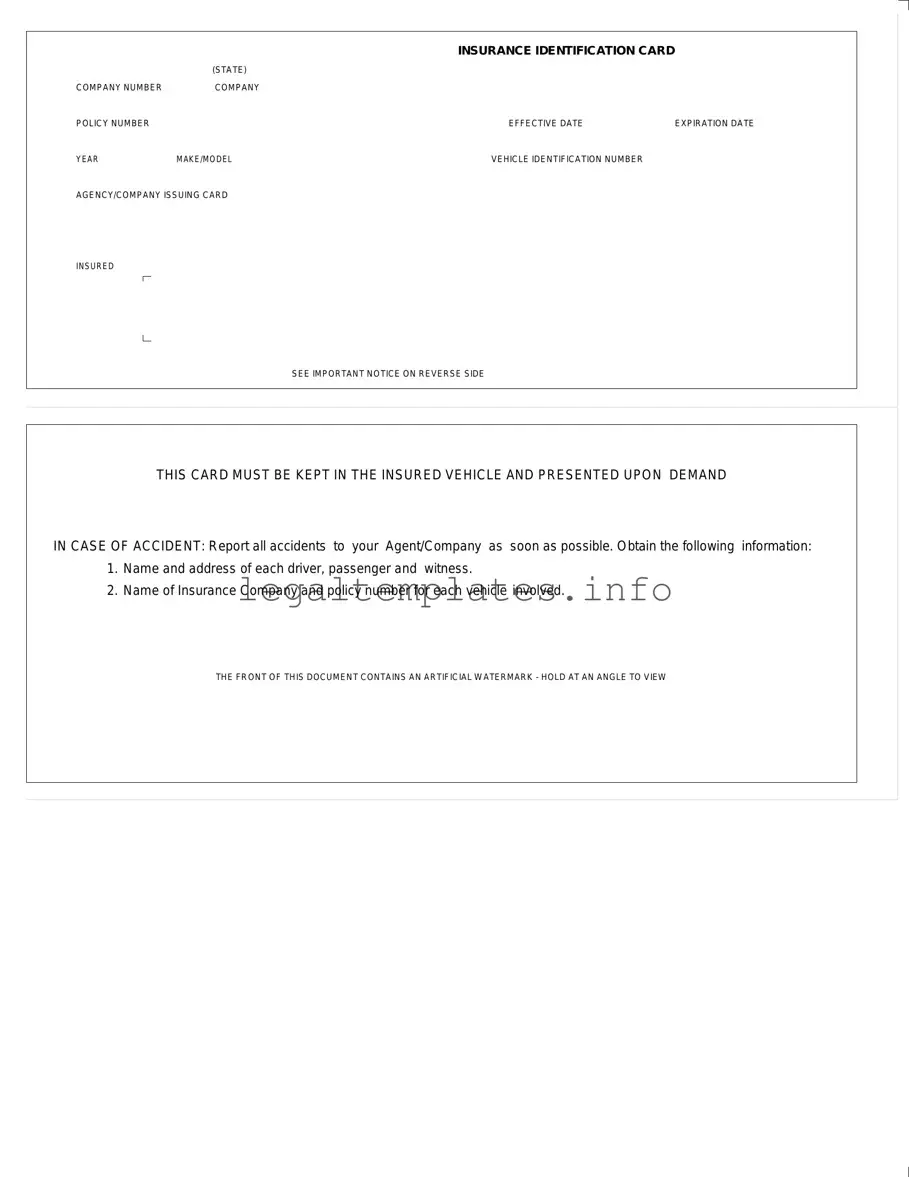

What is an Auto Insurance Card?

An Auto Insurance Card is a document that verifies you have automobile insurance. It typically includes your insurance company's name and contact details, your policy number, the effective and expiration dates of your policy, and information about your vehicle such as the year, make, model, and VIN (Vehicle Identification Number). It's a compact, comprehensive way to prove you're insured.

Why do I need to keep an Auto Insurance Card in my vehicle?

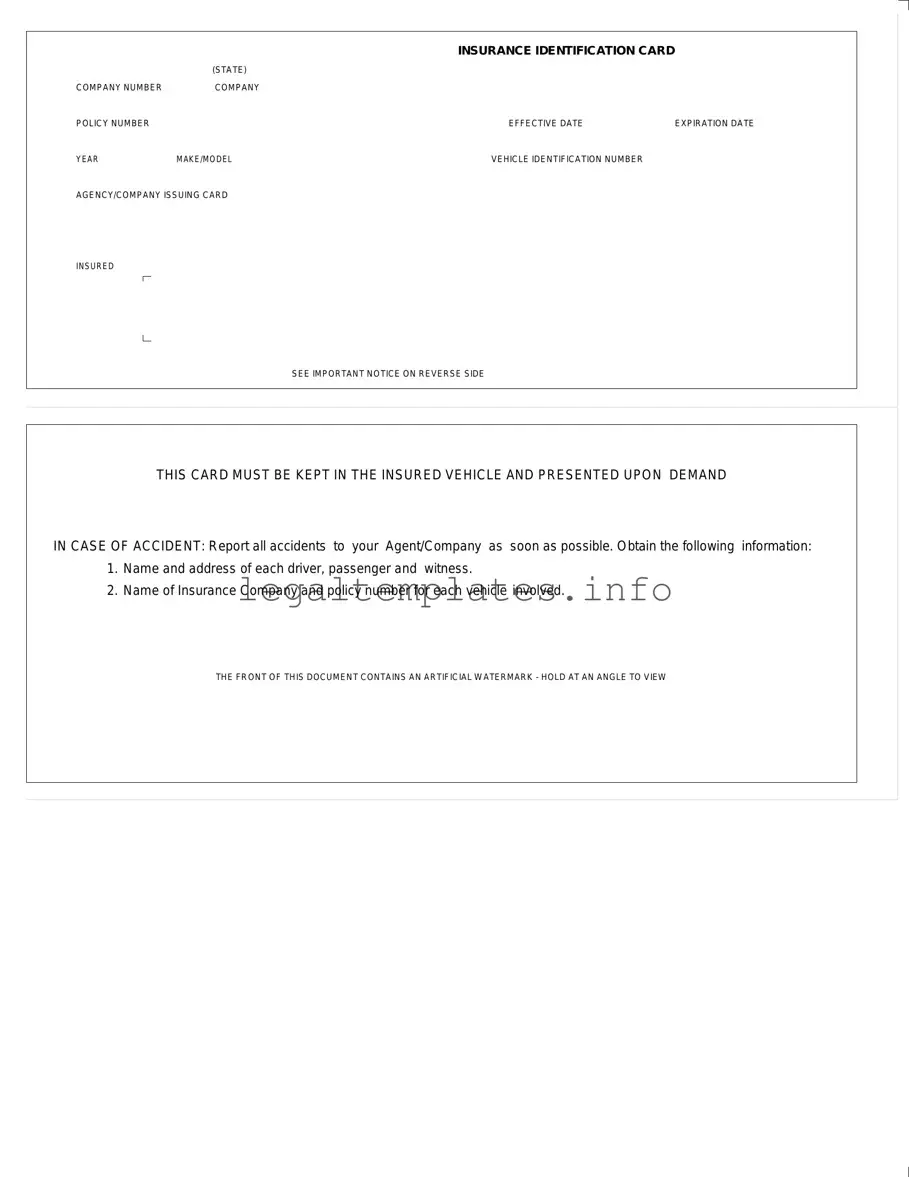

Most states require drivers to carry proof of insurance in their vehicles at all times. The card serves as this proof, and if you're stopped by law enforcement or involved in an accident, you'll need to show it to demonstrate that you have the required insurance coverage. Not having it can lead to fines or other penalties.

What does the "EFFECTIVE DATE" and "EXPIRATION DATE" mean on the Auto Insurance Card?

The "EFFECTIVE DATE" is the day your insurance coverage starts, and the "EXPIRATION DATE" is the day it ends. Between these dates, your insurance policy is active, and you are covered according to the terms of your policy. After the expiration date, you will need to renew your policy to continue being insured.

How can I obtain an Auto Insurance Card?

When you purchase or renew an auto insurance policy, your insurance company will provide you with an Auto Insurance Card. You might receive it by mail or, in many cases, you can download it directly from your insurer's website or through their mobile app.

What is the importance of the "VEHICLE IDENTIFICATION NUMBER" on the card?

The Vehicle Identification Number (VIN) is like a car's fingerprint, unique to that particular vehicle. Including it on your Auto Insurance Card helps identify the exact vehicle covered under the policy. This is especially useful in situations like accidents or traffic stops, ensuring the insurance information matches the vehicle in question.

What should I do if my Auto Insurance Card is lost or damaged?

If your card is lost or damaged, contact your insurance company as soon as possible to request a replacement. Most insurers can provide a digital copy immediately via email or their app, with a physical card sent by mail if needed.

Is there a digital version of the Auto Insurance Card?

Yes, many insurance companies offer digital versions of the Auto Insurance Card that can be accessed through their website or mobile app. These digital cards are accepted as proof of insurance in many states, but it's important to check your state's regulations to ensure they are considered valid.

What is the "IMPORTANT NOTICE ON REVERSE SIDE" referring to?

The "IMPORTANT NOTICE ON REVERSE SIDE" typically includes legal information and helpful instructions in case of an accident, such as the steps to follow immediately after the incident and how to report a claim. It's there to provide you with guidance on what to do in a situation where you might need to make use of your insurance policy.