What is a Livestock Bill of Sale?

A Livestock Bill of Sale is a legal document that records the sale and transfer of ownership of livestock from one party to another. This form typically includes details about the animals being sold, such as their species, breed, and any identification numbers, along with the sale price and the names and signatures of both the seller and buyer. It provides both parties with proof of the transaction and serves as a crucial element in the legal transfer of ownership.

Why is a Livestock Bill of Sale important?

Having a Livestock Bill of Sale is important for several reasons. First, it officially documents the sale, serving as a receipt for the transaction. This can be vital for accounting and tax purposes. Second, it clarifies the specifics of the sale, reducing the risk of misunderstanding or disputes between the buyer and seller. Third, it can be required for registration purposes or when seeking financial loans, ensuring that the ownership transfer is legally recognized.

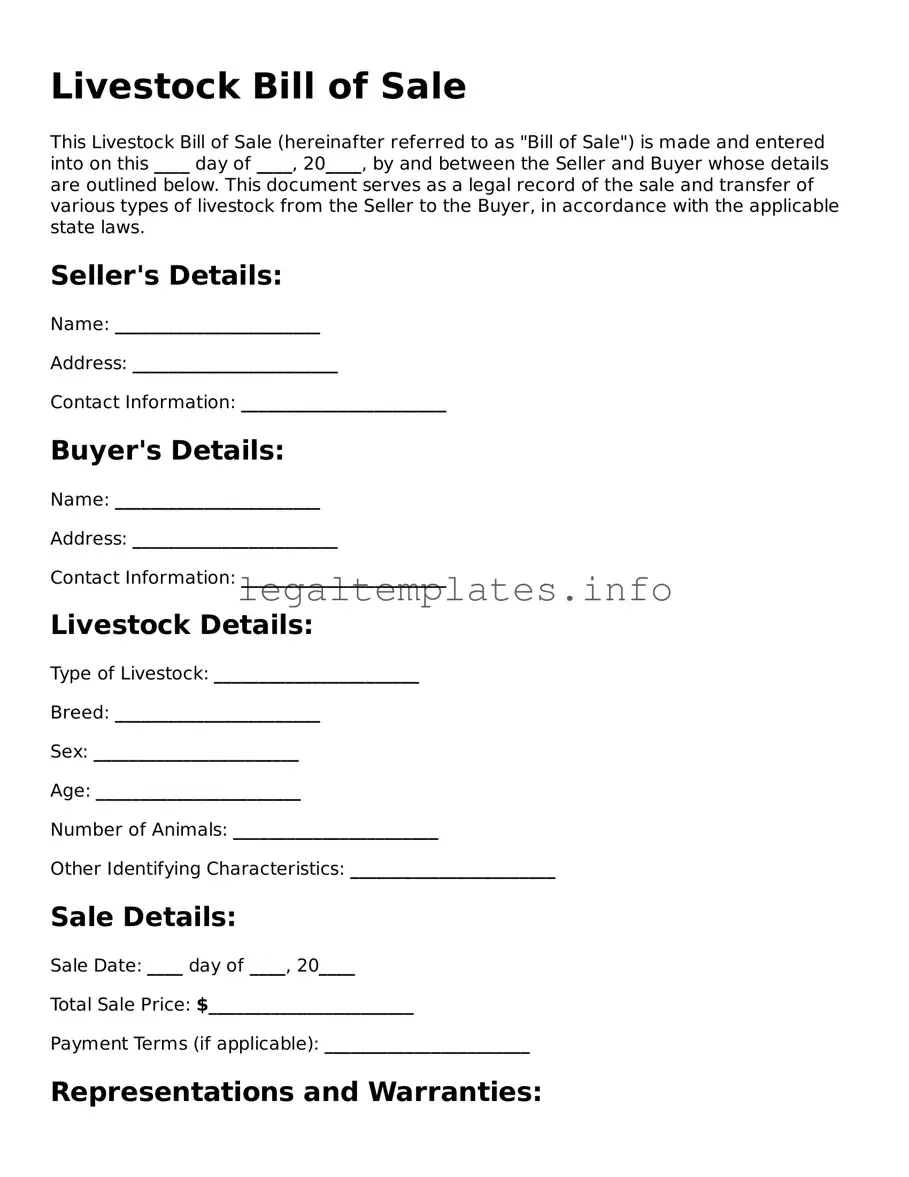

What should be included in a Livestock Bill of Sale?

A comprehensive Livestock Bill of Sale should include the date of the sale, detailed information about the livestock (such as species, breed, age, sex, and any unique identification marks or numbers), the sale price, and any terms or conditions of the sale. It should also contain the names and addresses of both the buyer and seller, and spaces for their signatures. Details about any warranties or guarantees provided by the seller can also be included.

Is a witness signature necessary on a Livestock Bill of Sale?

Whether a witness signature is necessary on a Livestock Bill of Sale can vary by jurisdiction. In some areas, having a witness sign the document or even having it notarized can add a layer of legal protection and authenticity to the document. However, in other areas, the signatures of the buyer and seller alone are sufficient. It’s advisable to consult local laws or a legal expert to understand the specific requirements in your area.

Can a Livestock Bill of Sale be modified after both parties sign it?

Once a Livestock Bill of Sale has been signed by both parties, modifications can only be made if both the buyer and seller agree to the changes. In such cases, the modifications should be documented in writing, and both parties should sign or initial near the changes to acknowledge them. For significant changes, drafting a new bill of sale might be more appropriate.

Do I need a lawyer to create a Livestock Bill of Sale?

While it is not strictly necessary to have a lawyer create a Livestock Bill of Sale, consulting with one can ensure that the document meets all legal requirements and adequately protects the interests of both parties. A lawyer can also help clarify any complex terms and conditions that might be included in the bill of sale.

How does the sale of livestock affect taxes?

The sale of livestock can have various tax implications for both the buyer and seller. For sellers, the money received from the sale may be considered income and subject to taxes. For buyers, the livestock may be considered an asset that can depreciate over time. Specific tax consequences can vary widely based on factors such as the scale of the operation, whether the livestock is for personal or business use, and current tax laws. It is advisable to consult with a tax professional to understand how a livestock sale might affect your tax situation.

What happens if a Livestock Bill of Sale is not used?

Not using a Livestock Bill of Sale can lead to several potential issues. Without this document, there may be no formal record of the transaction, making it difficult to prove ownership or settle disputes. This absence can lead to problems with registration, taxation, and even legal ownership disputes. For the protection of both the buyer and seller, using a Livestock Bill of Sale is highly recommended.

Can a Livestock Bill of Sale be used for any type of animal?

While a Livestock Bill of Sale is typically used for the sale of farm animals such as cattle, sheep, pigs, goats, horses, and poultry, its format can potentially be adapted for other types of animals. However, when dealing with exotic or non-traditional livestock, special considerations and additional details might be necessary to ensure that the sale complies with local regulations and that the bill of sale adequately covers the specifics of the transaction.