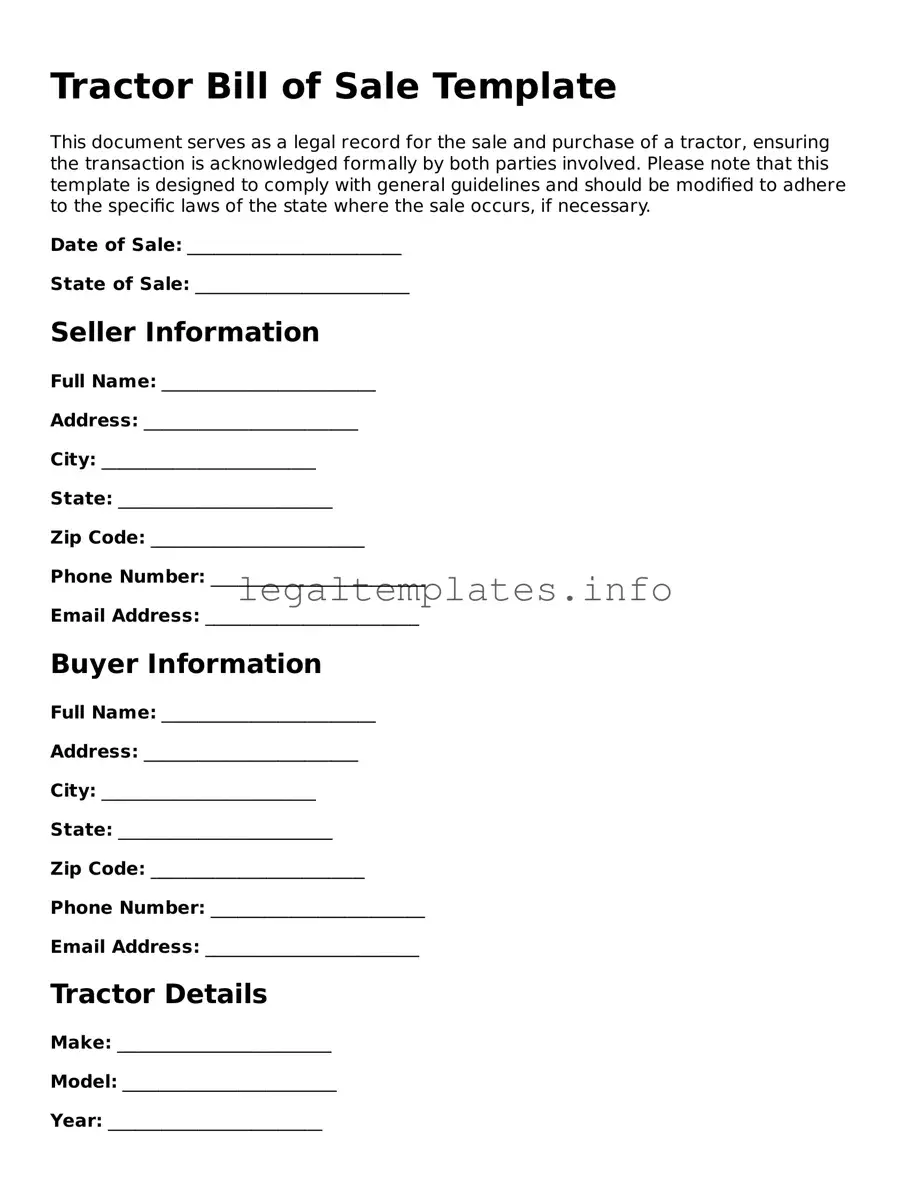

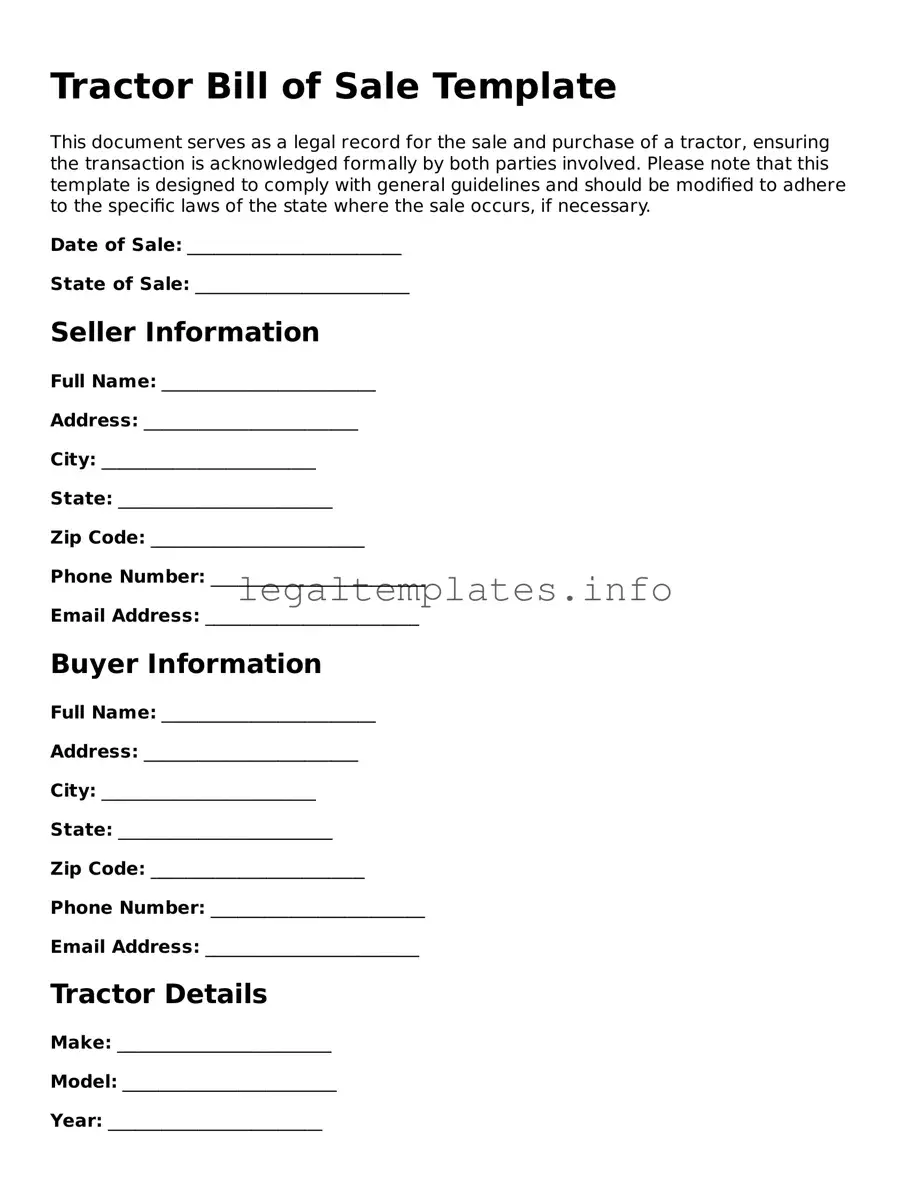

Fillable Tractor Bill of Sale Document

A Tractor Bill of Sale form serves as an official record that documents the transaction details between a seller and a buyer for a tractor purchase. This form not only proves the transfer of ownership but also provides vital information such as the tractor's condition, price, and identification details. For those looking to secure the sale or purchase of a tractor, completing this form accurately is a crucial step.

To streamline your tractor transaction, consider filling out the form by clicking the button below.

Access Tractor Bill of Sale Online

Fillable Tractor Bill of Sale Document

Access Tractor Bill of Sale Online

Access Tractor Bill of Sale Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete Tractor Bill of Sale online.