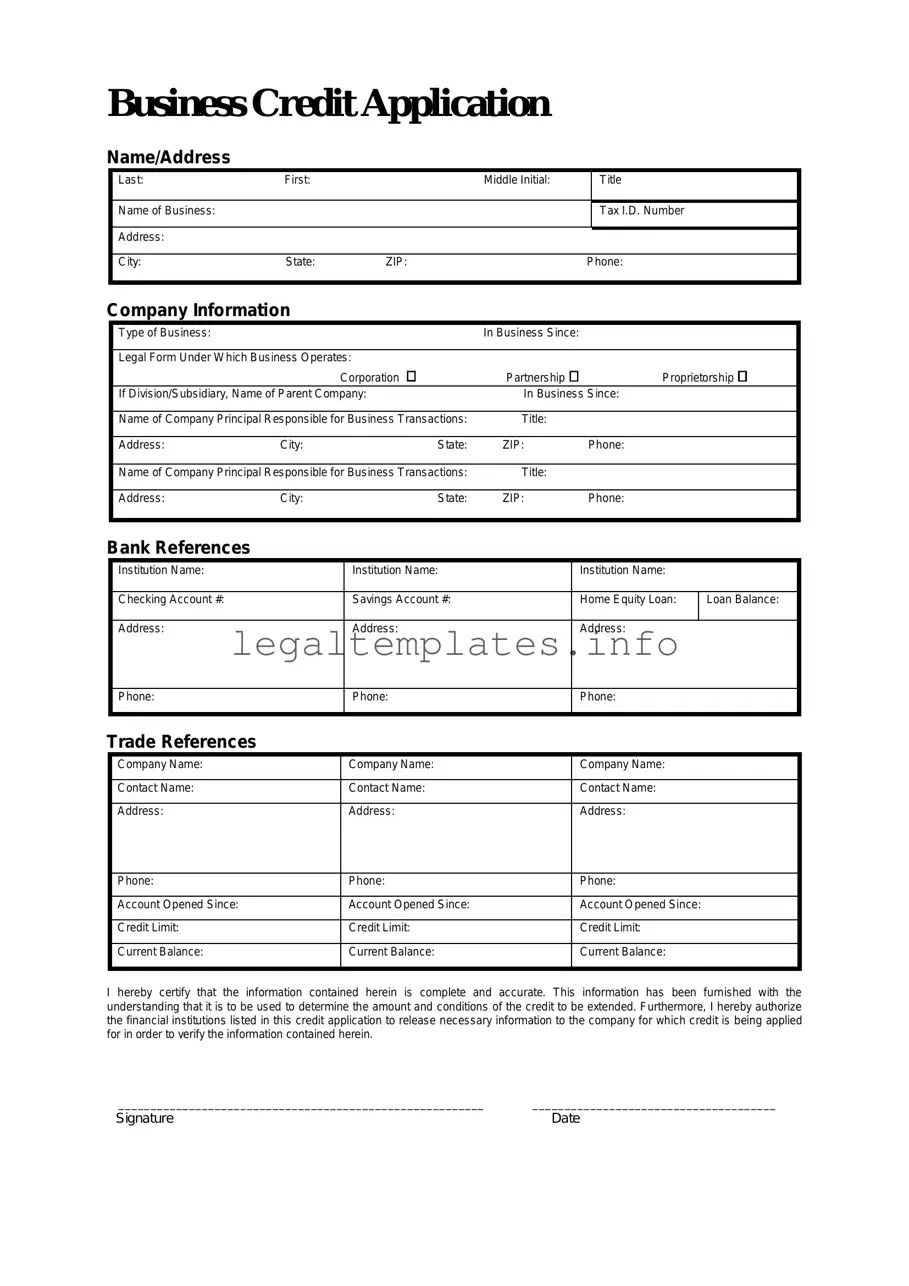

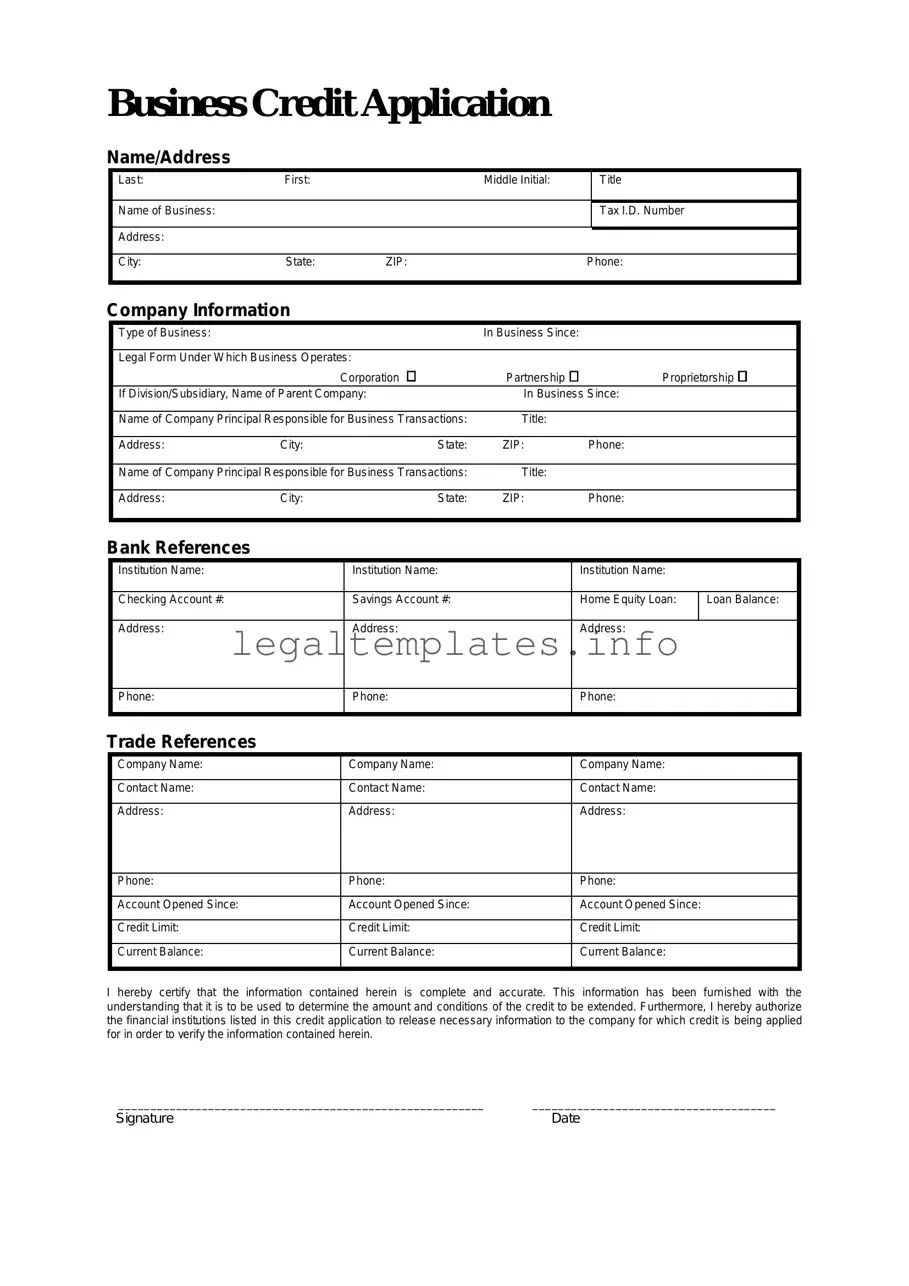

Filling out a Business Credit Application form is a common step for businesses seeking to establish a line of credit with suppliers or lenders. Unfortunately, mistakes in this process can lead to delays, a lack of trust from potential creditors, or even the denial of credit. One frequent error is the failure to provide complete information. Applicants often overlook sections or fields, thinking them irrelevant or unnecessary. This omission can signal a lack of attention to detail to the creditor.

Another common mistake is not double-checking the information for accuracy. Typographical errors, especially in critical details such as the business name, address, or tax identification numbers, can render the application invalid or cause significant delays. It's crucial to proofread every piece of information before submission.

Some businesses err by not thoroughly explaining the nature of their business or its financial health. Creditors rely on a clear understanding of what the business does and its financial stability to make informed lending decisions. Vague or incomplete descriptions can hamper the credit evaluation process.

A significant misstep is failing to provide the required financial documentation. Documents such as balance sheets, income statements, and cash flow statements provide a snapshot of the company's financial health. When businesses neglect to include these documents, or if they submit outdated or inaccurate financials, creditors might question the viability of the business.

Businesses often underestimate the importance of the personal credit history of the owner(s) in the credit application process. A common mistake is not authorizing the credit check or not disclosing relevant personal credit history information when required. This oversight can lead to an automatic rejection of the application.

Another oversight is not specifying the credit terms sought. Without this information, creditors cannot adequately assess the request's feasibility or align it with their lending capabilities. Leaving this section blank or being too vague can significantly impede the application's progress.

Ignoring the importance of references is another blunder. Suppliers or other commercial credit references can vouch for the business's creditworthiness and reliability. Failure to provide this information can leave the creditor with unanswered questions about the company's track record.

Not being upfront about previous credit rejections or financial issues is a serious mistake. Applicants might feel tempted to hide past financial struggles, but this can lead to problems later in the process. Full transparency is always the best policy.

Applicants sometimes wrongly believe that once the form is submitted, the process is out of their hands. They neglect to follow up with the creditor, which can be perceived as disinterest or lack of commitment. Proactive communication is key to facilitating the evaluation process.

Last but not least, businesses often treat the credit application as a mere formality and fail to understand its legal implications. Every piece of information provided must be accurate and honest, as discrepancies can lead to legal consequences or the termination of the credit agreement. An attentive and truthful approach to filling out the form is essential.