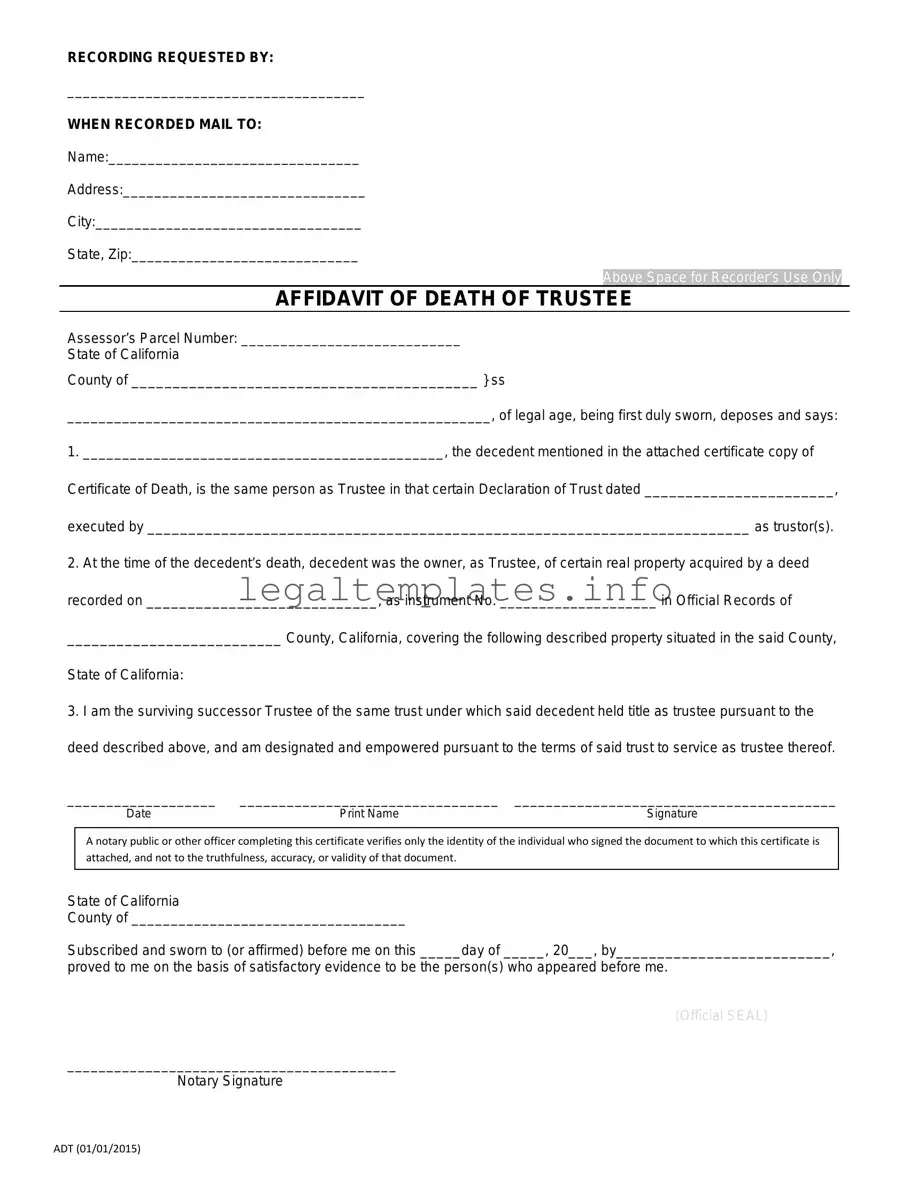

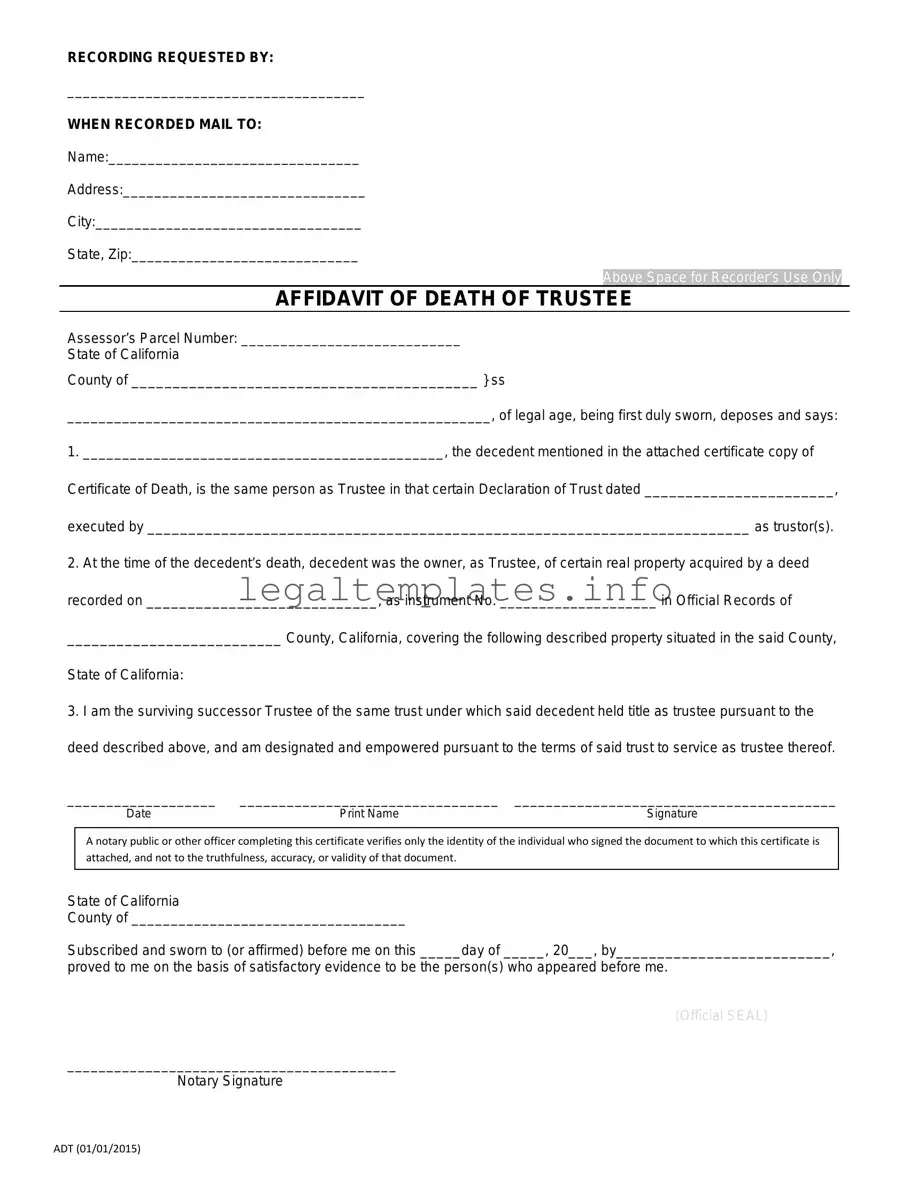

Fill a Valid California Affidavit of Death of a Trustee Form

The California Affidavit of Death of a Trustee form is a legal document used to officially declare the death of a trustee overseeing a trust. This form plays a critical role in the seamless transition of the management and control of trust assets following a trustee's death. For those looking to ensure the continued integrity of a trust, filling out this form accurately is a necessary step. Click the button below to get started on filling out your form.

Access California Affidavit of Death of a Trustee Online

Fill a Valid California Affidavit of Death of a Trustee Form

Access California Affidavit of Death of a Trustee Online

Access California Affidavit of Death of a Trustee Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete California Affidavit of Death of a Trustee online.