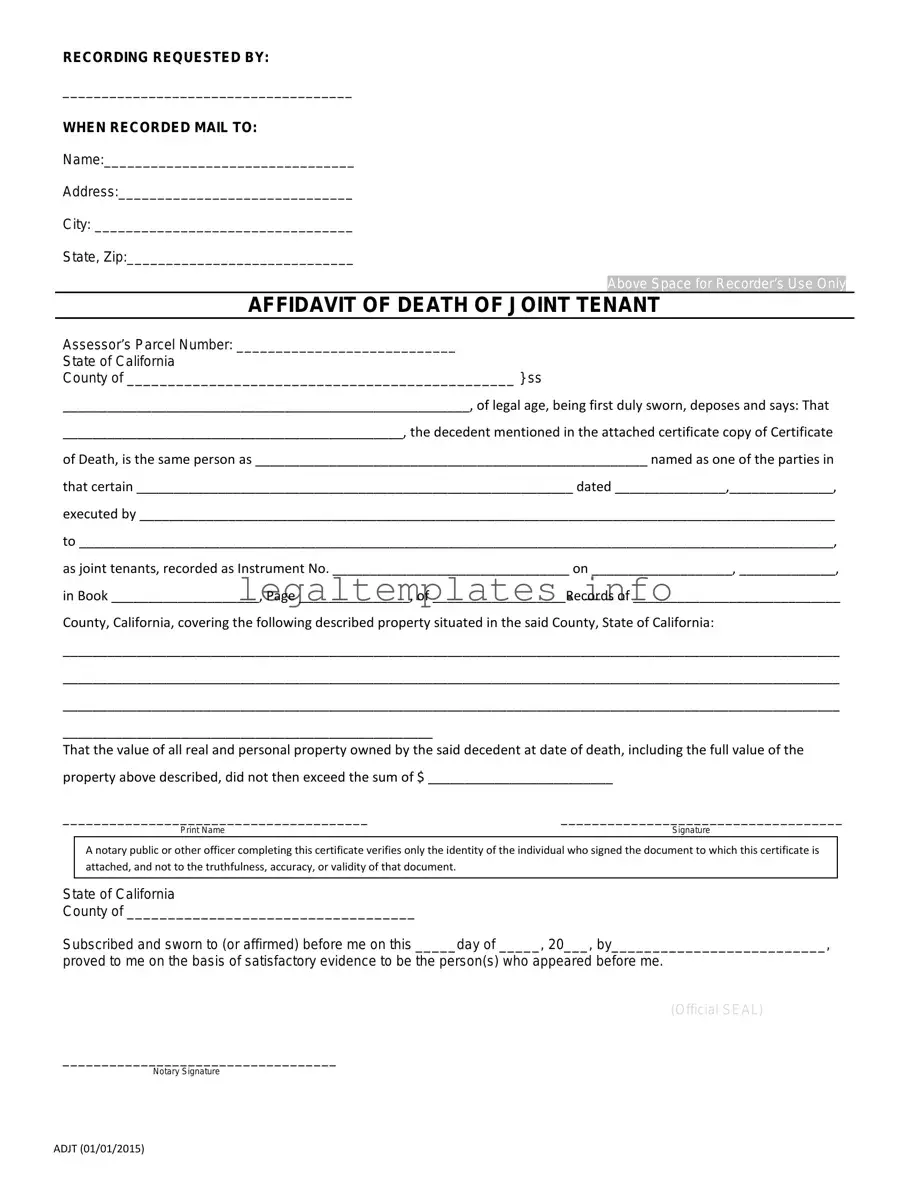

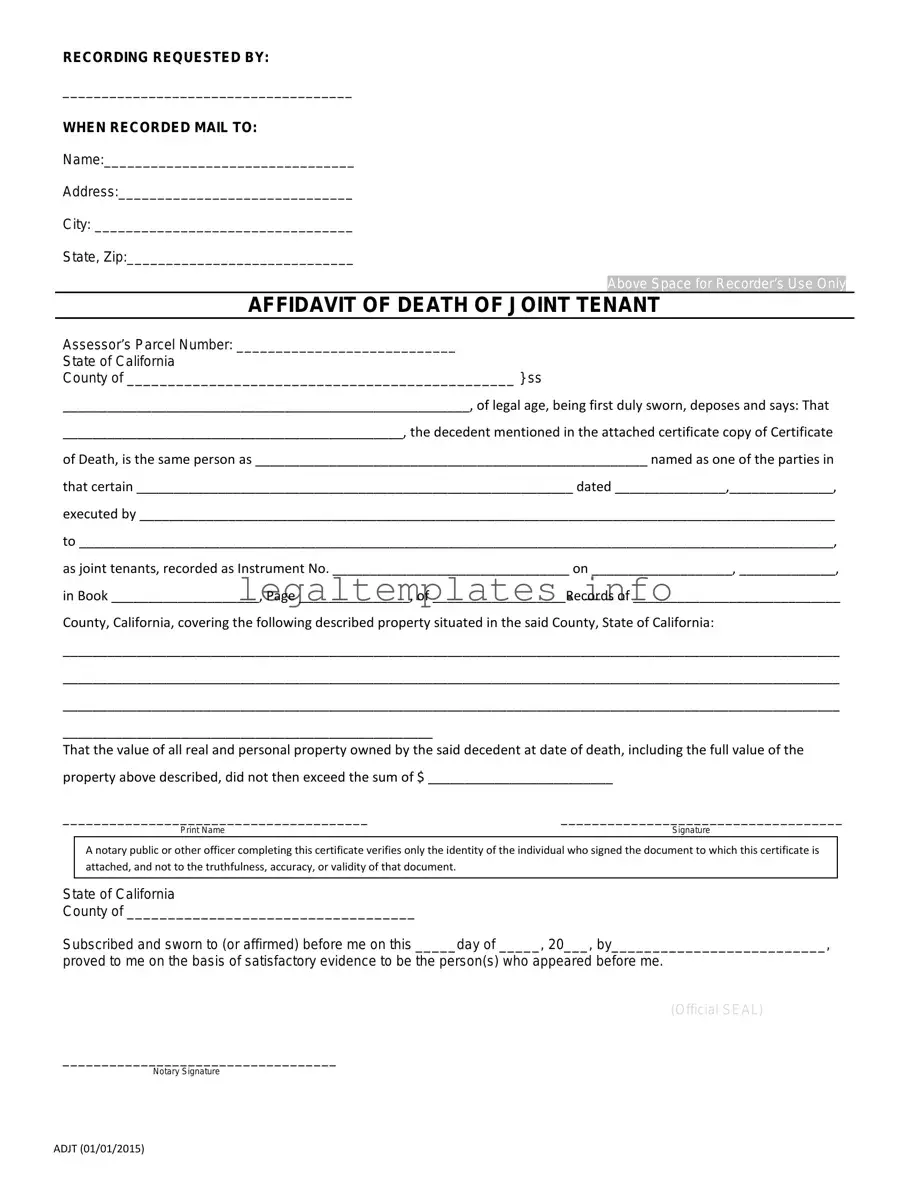

Fill a Valid California Death of a Joint Tenant Affidavit Form

The California Death of a Joint Tenant Affidavit form is a crucial document used when one owner of property held in joint tenancy passes away. It allows the surviving owner(s) to formally remove the deceased's name from the property title, effectively transferring full ownership to them. For those navigating this transition, understanding how to properly fill out and file this form is essential. Click this button to start filling out the form now.

Access California Death of a Joint Tenant Affidavit Online

Fill a Valid California Death of a Joint Tenant Affidavit Form

Access California Death of a Joint Tenant Affidavit Online

Access California Death of a Joint Tenant Affidavit Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete California Death of a Joint Tenant Affidavit online.