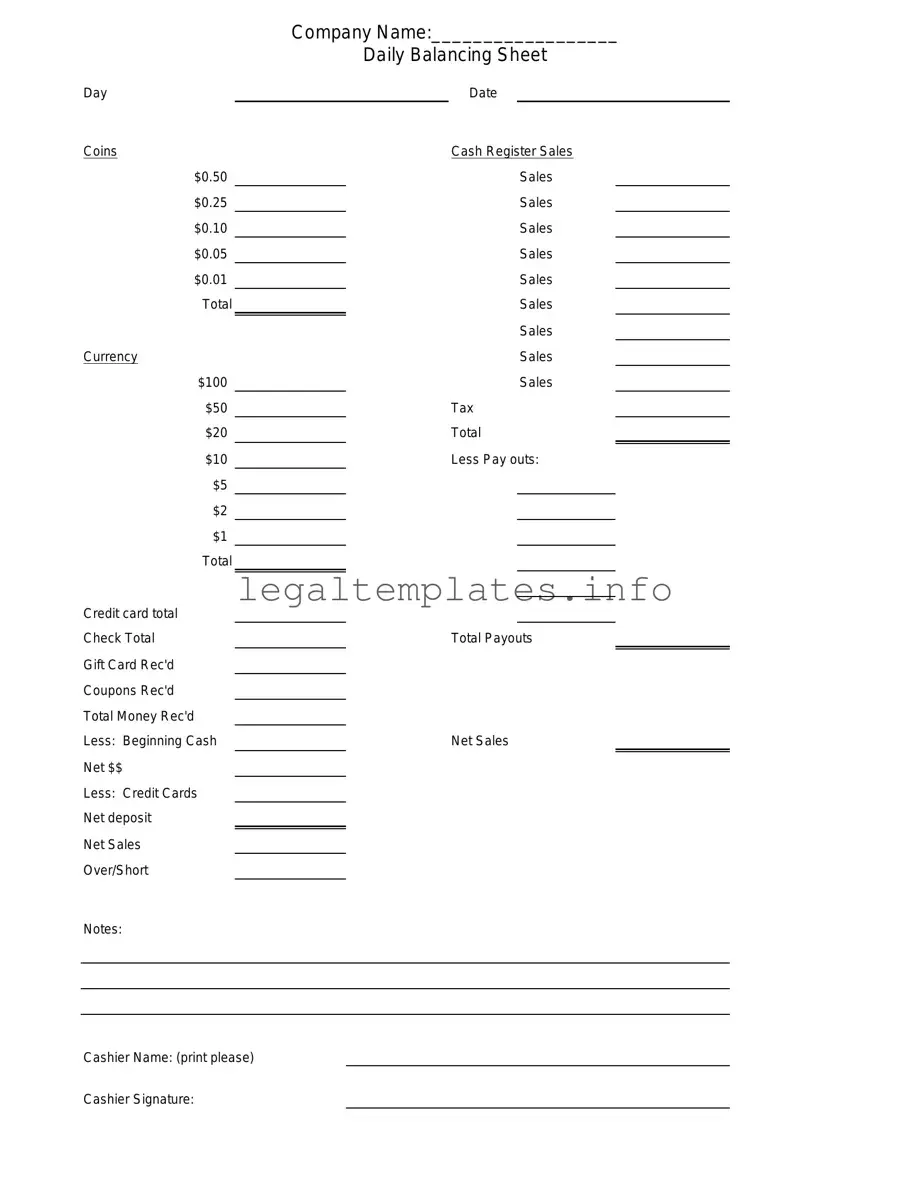

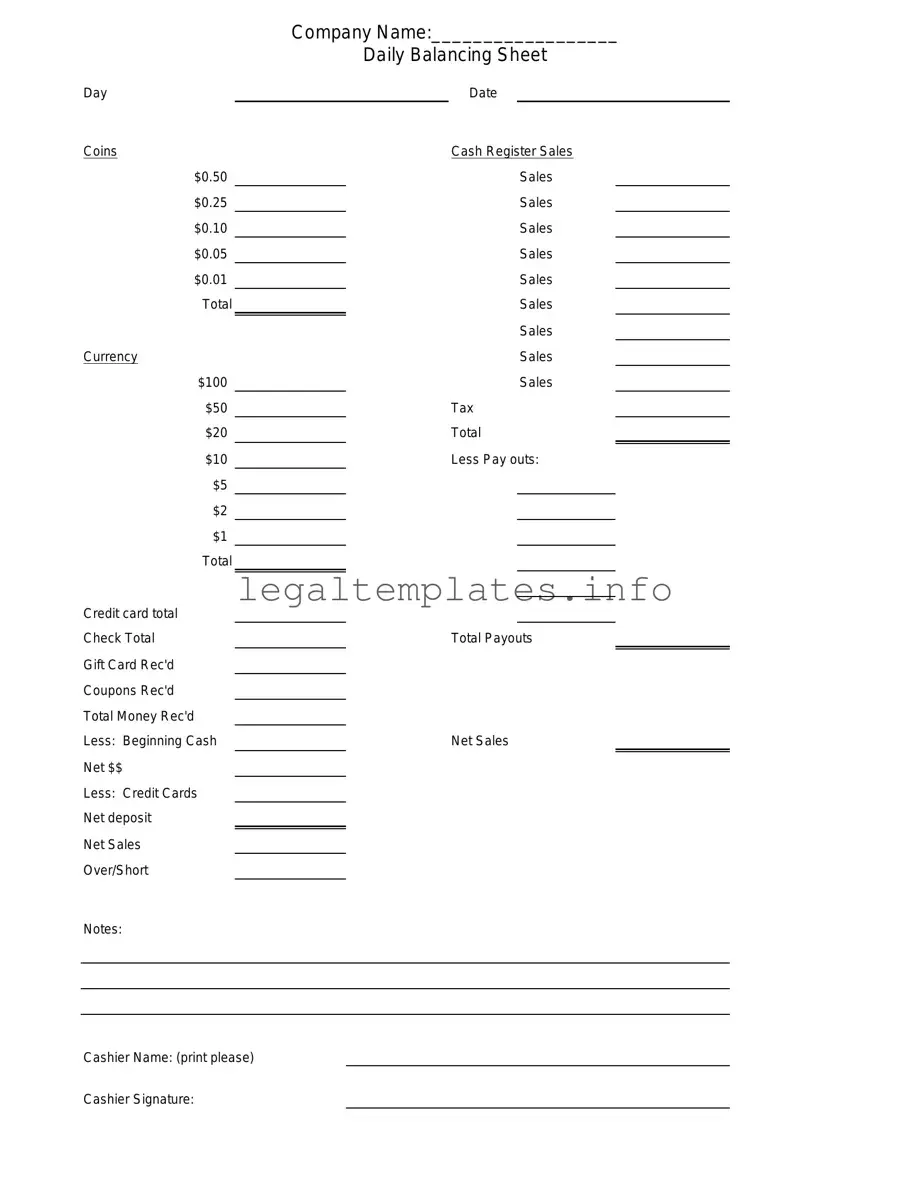

The Cash Drawer Count Sheet form is similar to a Daily Sales Report, as both documents are used by businesses to record financial transactions over a specific period. Whereas the Cash Drawer Count Sheet focuses on the cash transactions and the physical currency in the drawer, the Daily Sales Report encompasses all sales activities, including credit and debit transactions. Both serve as critical tools for reconciling cash flow and ensuring accurate financial records.

Another document similar to the Cash Drawer Count Sheet is the Petty Cash Log. Both are used to track the handling of cash within a business. The Petty Cash Log tracks small, incidental expenses paid out in cash, such as office supplies or staff reimbursements, providing a detailed record of minor disbursements. In contrast, the Cash Drawer Count Sheet monitors the cash transactions processed through the cash drawer.

The Bank Deposit Slip shares similarities with the Cash Drawer Count Sheet, as both involve the process of accounting for cash transactions. While the Cash Drawer Count Sheet is used to tally the cash at the end of a business day, a Bank Deposit Slip is used when depositing the day's earnings into a bank account. Both documents are essential for maintaining accurate financial records and ensuring that the physical cash matches the recorded sales.

The Inventory Reconciliation Sheet is akin to the Cash Drawer Count Sheet, with the primary difference being the type of assets tracked. While the Cash Drawer Count Sheet focuses on cash transactions, the Inventory Reconciliation Sheet is concerned with physical inventory levels. Both are crucial for ensuring that recorded amounts match the actual physical count, be it cash in the drawer or items in stock.

The Sales Tax Liability Report is another document that shares elements with the Cash Drawer Count Sheet. It focuses on calculating the sales tax collected from customers over a specific period. While the Cash Drawer Count Sheet tracks all cash received, including sales and possibly sales tax, the Sales Tax Liability Report specifically segregates and totals the tax collected, which is critical for tax reporting and compliance.

The Employee Time Sheet, although primarily focused on tracking employee hours worked, shares a common purpose with the Cash Drawer Count Sheet in terms of record-keeping and verification. The Time Sheet ensures that the hours worked by employees are accurately recorded for payroll purposes, similar to how the Cash Drawer Count Sheet ensures that cash transactions are accurately recorded for financial accounting.

The Expense Report is related to the Cash Drawer Count Sheet in that it documents specific expenditures. While the Cash Drawer Count Sheet records cash transactions made through sales, the Expense Report details funds spent on business-related purchases or services, often including those paid for with cash. Both are integral to financial management and budgeting within a business.

The Profit and Loss Statement, or income statement, is a broader financial document that encompasses the data found in a Cash Drawer Count Sheet. The Profit and Loss Statement offers a comprehensive overview of a business's revenues, costs, and expenses over a period, including the net profit or loss. The Cash Drawer Count Sheet contributes to the accuracy of this document by ensuring that cash sales are precisely accounted for.

Lastly, the Balance Sheet shares a connection with the Cash Drawer Count Sheet through their role in financial reporting. The Balance Sheet provides a snapshot of a company’s financial condition at a specific point in time, detailing assets, liabilities, and equity. The accuracy of the cash amounts listed on the Balance Sheet relies on the meticulous tracking of cash transactions, as recorded daily by the Cash Drawer Count Sheet.