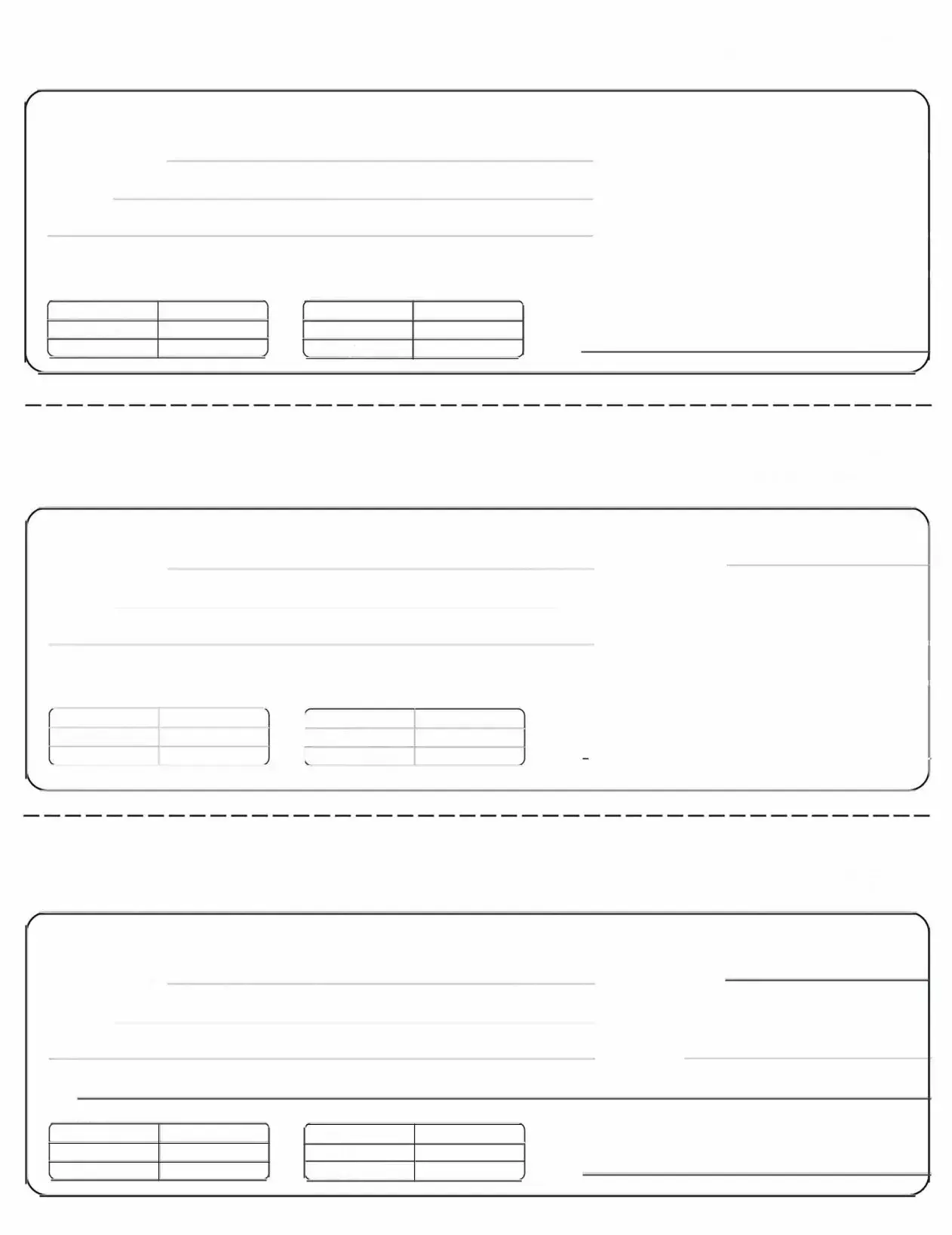

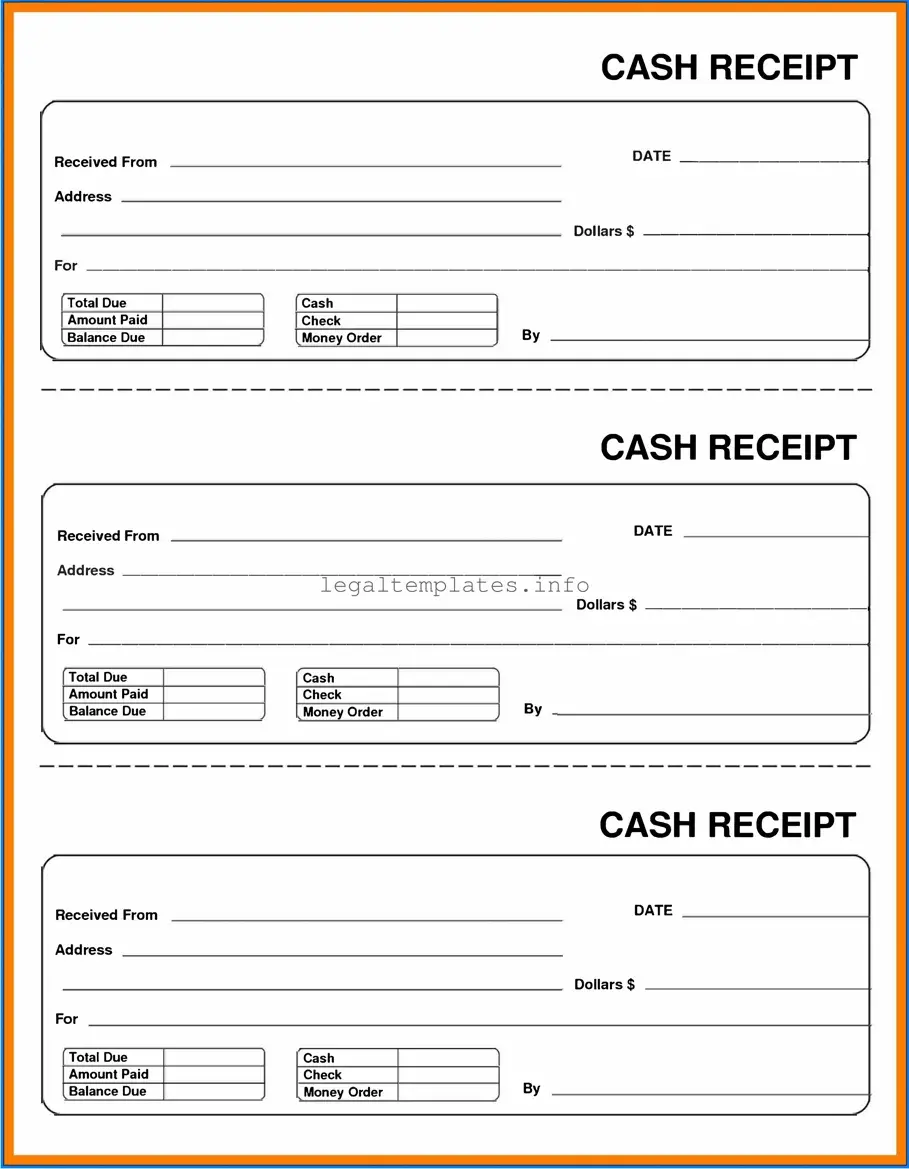

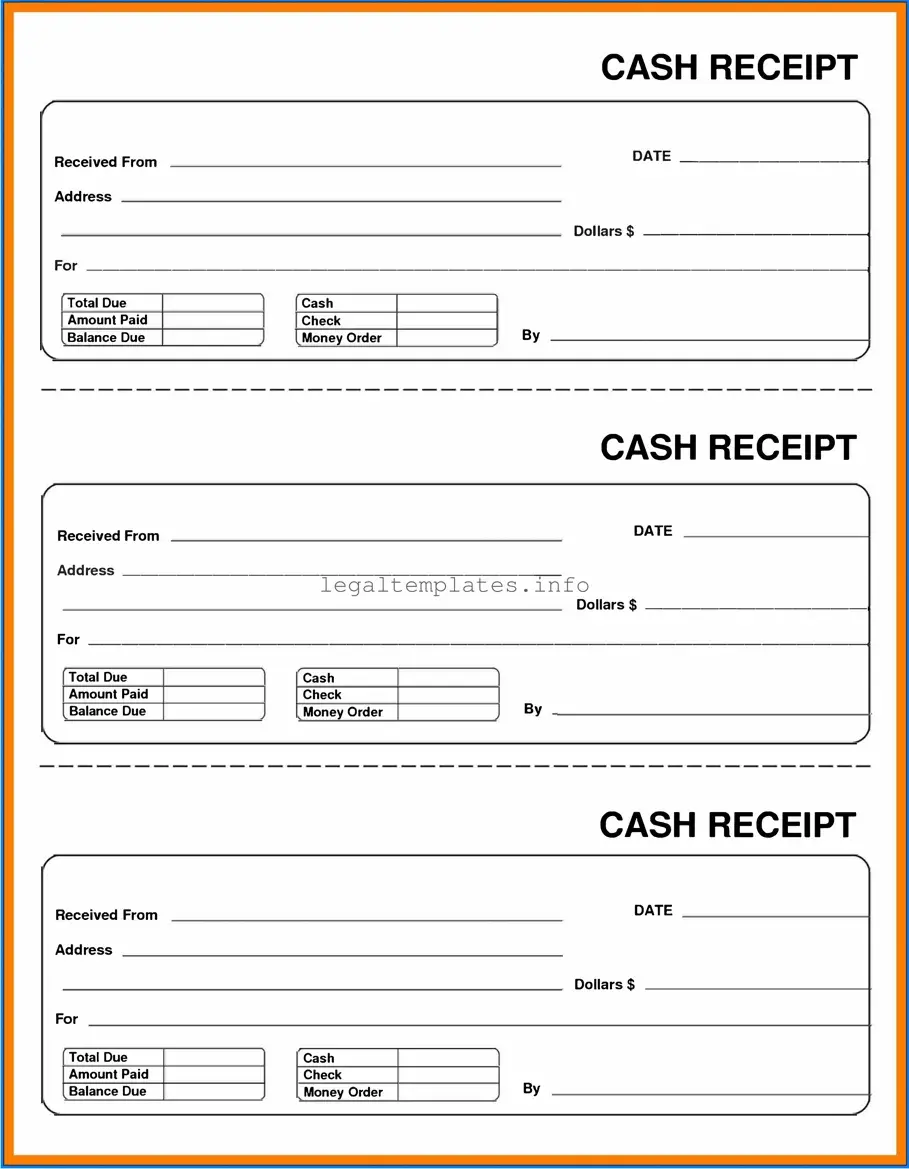

Fill a Valid Cash Receipt Form

A Cash Receipt form is a document used to record the details of a transaction whenever cash is received in exchange for goods or services. It serves as proof of payment, capturing essential information such as the amount received, date of transaction, and the parties involved. For those who need to provide or record payment in a tangible, reliable way, filling out a Cash Receipt form is a critical step. Click the button below to fill out your Cash Receipt form.

Access Cash Receipt Online

Fill a Valid Cash Receipt Form

Access Cash Receipt Online

Access Cash Receipt Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete Cash Receipt online.