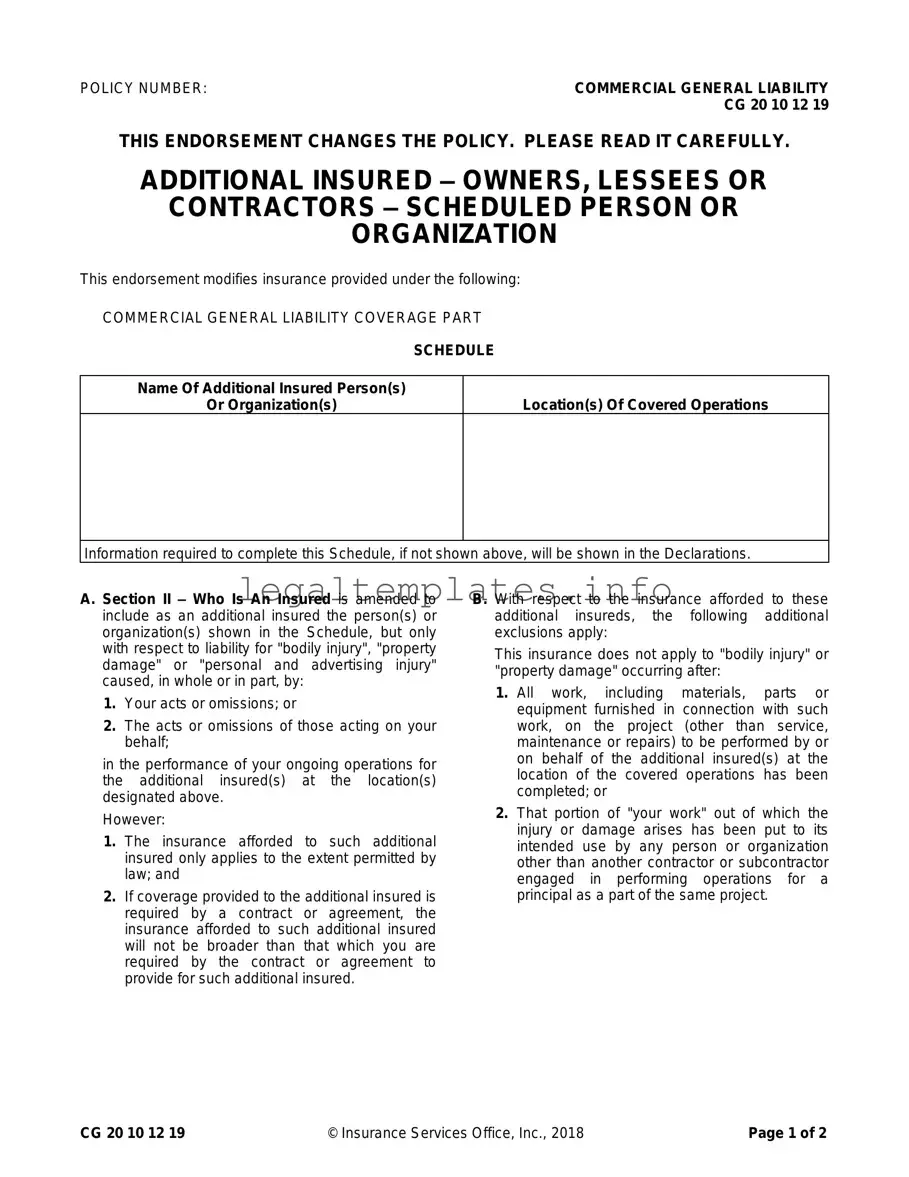

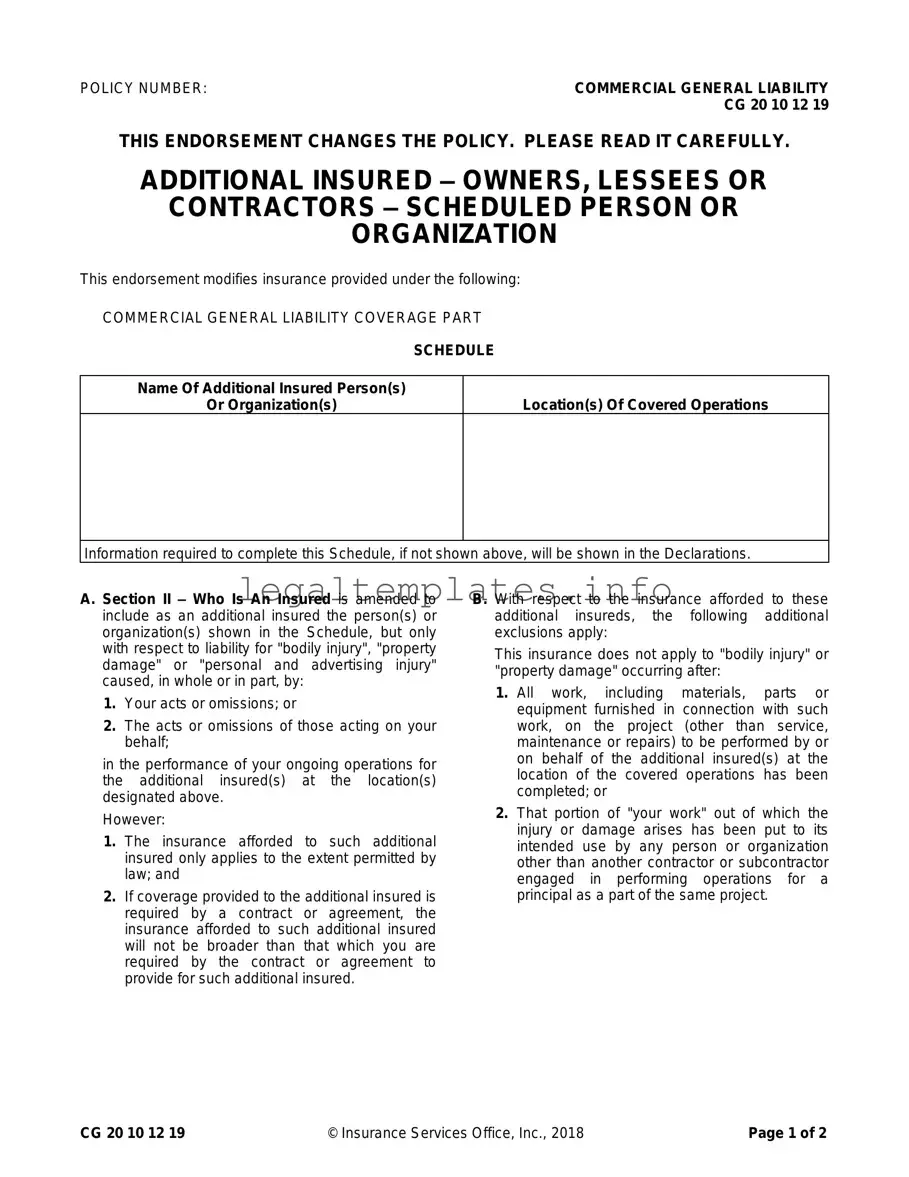

What is the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement form is a document used in commercial general liability insurance policies. It's designed to amend the policy by adding a person or organization as an additional insured. This modification typically applies to the liability arising from the acts or omissions of the policyholder or those acting on their behalf, specifically during ongoing operations for the additional insured at the designated locations.

Who can be added as an "additional insured" on this form?

Owners, lessees, or contractors can be added as an "additional insured" under this endorsement. The form requires specific information about the additional insured, including their name(s) and the location(s) of the covered operations, to be detailed either on the schedule of the form or in the declarations section of the policy.

In what circumstances does this endorsement provide coverage?

Coverage under this endorsement is extended to the additional insured but is specifically tied to liability for "bodily injury", "property damage", or "personal and advertising injury" caused, in whole or in part, by the policyholder's acts or those of individuals acting on the policyholder's behalf. This coverage is for the duration of the policyholder's ongoing operations for the additional insured at the specified locations.

Are there limitations on the coverage provided to the additional insured?

Yes, the coverage provided has certain limitations. Firstly, the insurance for the additional insured applies only to the extent permitted by law. Additionally, if the coverage is necessitated by a contract or agreement, it will not exceed what the policyholder is obligated to provide based on that agreement.

What are the additional exclusions to the coverage?

The endorsement specifies that insurance will not cover "bodily injury" or "property damage" that occurs after all work (except for service, maintenance, or repairs) on the project has been completed, or once the work or parts supplied have been put to use by someone other than another contractor or subcontractor working on the same project.

How does this endorsement affect the limits of insurance?

If coverage for an additional insured is mandated by a contract or agreement, the endorsement specifies that the maximum payment on their behalf will be the lesser of the amount required by the contract/agreement or the applicable limits of the insurance policy. Importantly, this endorsement does not increase the overall limits of insurance of the policy.

Can this endorsement be required by a contract?

Yes, often a contract or agreement will require one party to add the other as an additional insured on their liability policy. This endorsement is a common way to fulfill such contractual requirements, ensuring that the additional insured has coverage under the policyholder's commercial general liability insurance.

What does "ongoing operations" mean in the context of this endorsement?

"Ongoing operations" refers to the continuous, active work conducted by or on behalf of the policyholder for the additional insured at the specified locations. This work is within the scope of the policyholder's operations and is directly related to the liability coverage extended to the additional insured.

Is it possible to extend coverage after operations have been completed?

Under this specific endorsement, coverage for "bodily injury" and "property damage" is not extended after the completion of all work at the project site, barring service, maintenance, or repairs. However, other endorsements or additional policies might be needed to provide coverage beyond the completion of operations.

Where can one find the specific details needed to fill out the schedule of the endorsement?

The information required to complete the schedule of the CG 20 10 07 04 form, including the name and details of the additional insured, as well as the location of covered operations, is typically provided in the declarations section of the commercial general liability policy or can be determined through agreement between the insurer and the policyholder.