What is a Childcare Receipt Form and why is it necessary?

A Childcare Receipt Form is an official document that recognizes the payment made for childcare services. This form serves as proof of payment, detailing the amount, date, and recipient of the childcare service. It is necessary for maintaining transparent records for both providers and parents, aiding in tax preparation, and potentially qualifying for tax benefits or employer-based childcare reimbursement programs.

Who should issue a Childcare Receipt?

The childcare provider, whether it’s an individual babysitter, nanny, or a formal childcare center, should issue a Childcare Receipt. The receipt acts as a formal acknowledgment of the payment received for caring for the child(ren) within a specified period.

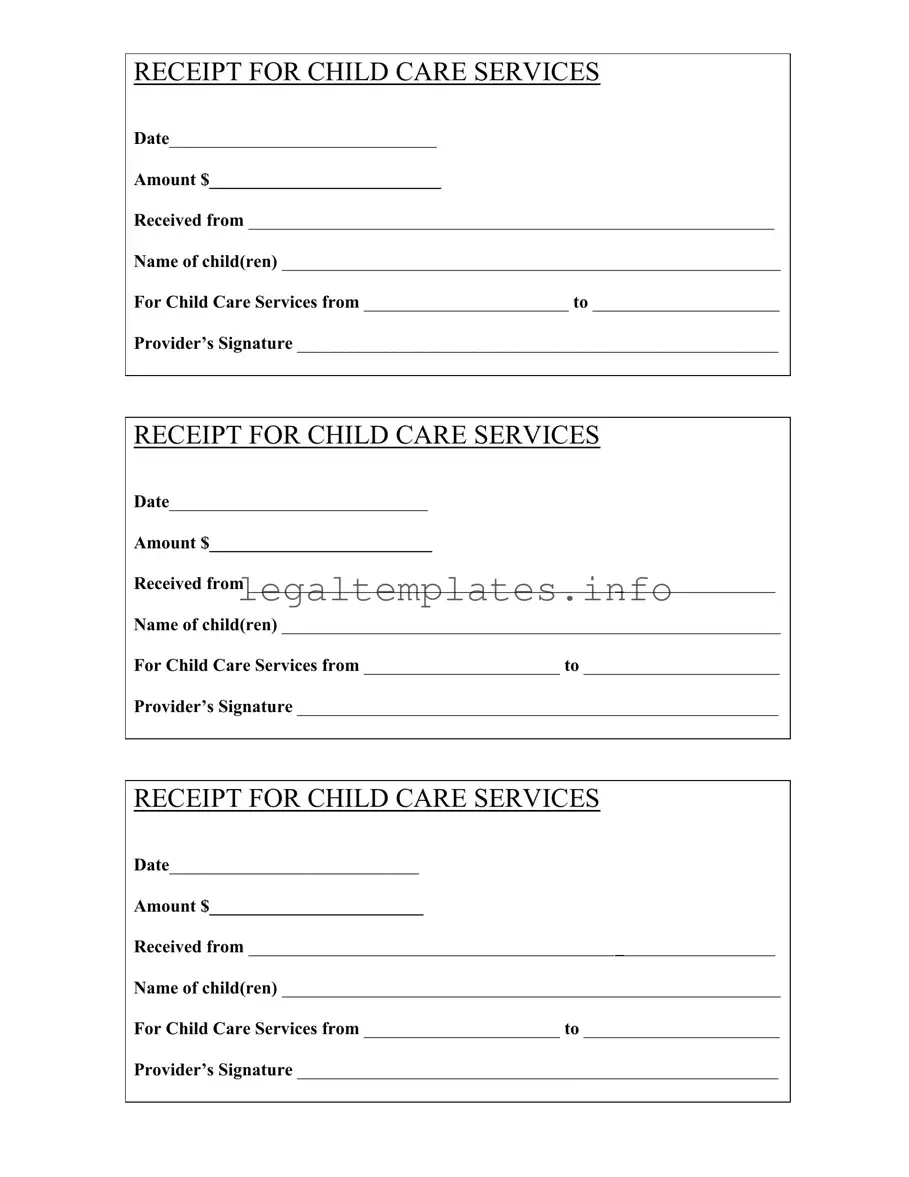

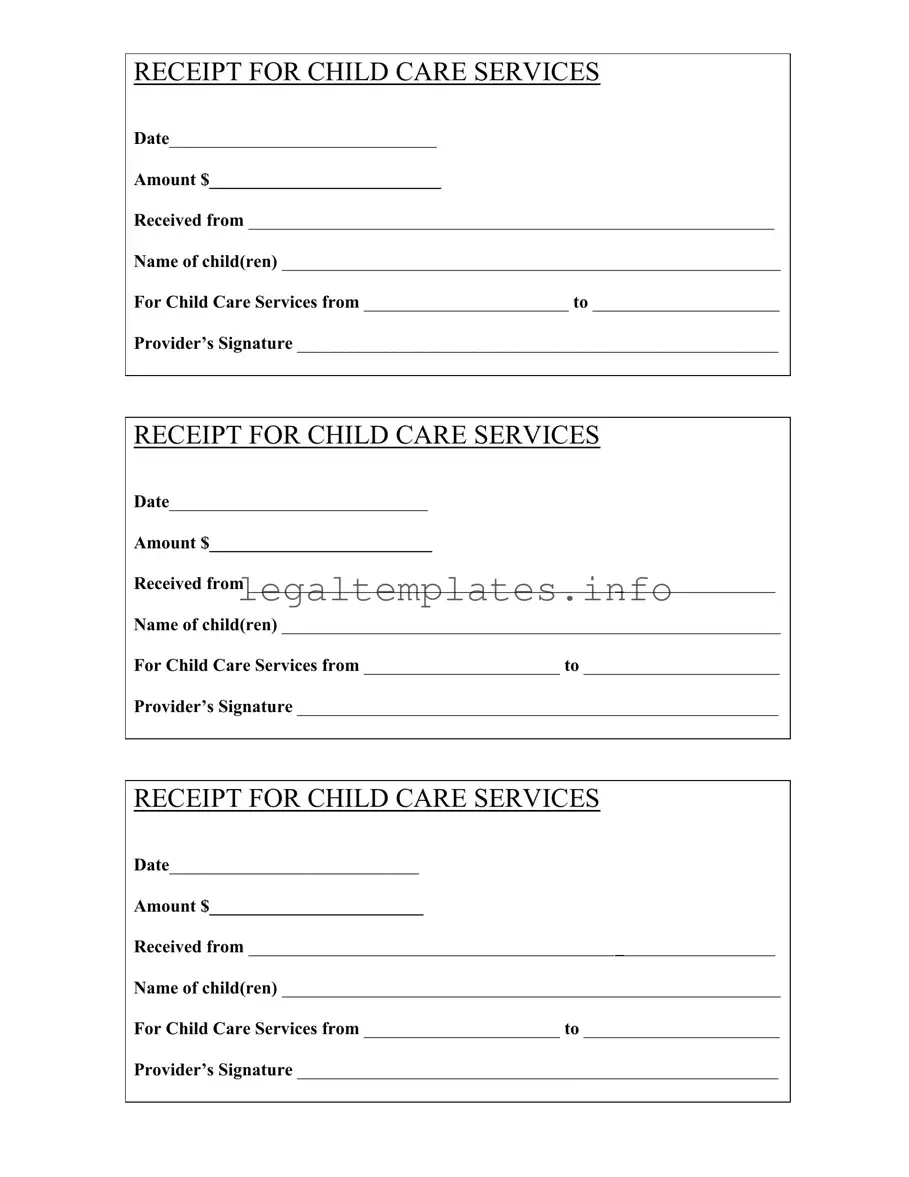

What are the essential elements that must be included on a Childcare Receipt?

Essential elements of a Childcare Receipt include the date the payment was made, the amount paid, the name of the person who made the payment, the name(s) of the child(ren) receiving care, the period during which care was provided, and the provider's signature. All these details contribute to the validity and comprehensiveness of the receipt.

How often should Childcare Receipts be issued?

Childcare Receipts should be issued each time a payment is made. Whether payments are made weekly, bi-weekly, monthly, or on another schedule, a receipt should accompany each payment to create an ongoing, accurate record of financial transactions related to childcare services.

Can a Childcare Receipt be handwritten?

Yes, a Childcare Receipt can be handwritten as long as it includes all necessary information and is legible. Whether handwritten or typed, the importance lies in the details contained within the receipt and its clarity, not the means by which it is produced.

Is a signature mandatory on a Childcare Receipt?

A signature is mandatory on a Childcare Receipt as it validates the document. The provider’s signature confirms that they acknowledge receiving the stated amount for services rendered during the specified period. Without a signature, the receipt may not be considered a legally binding proof of payment.

What should parents do with Childcare Receipts after receiving them?

Parents should safely store all Childcare Receipts received. These receipts are crucial for financial record-keeping, preparing for tax season, and potentially qualifying for childcare-related deductions or reimbursements. Organizing receipts and keeping a running log can save time and ensure accuracy in financial management and tax preparation.

In case of a dispute, how important is a Childcare Receipt?

In case of a dispute, a Childcare Receipt is incredibly important. It serves as a piece of evidence documenting the financial transaction between the childcare provider and the parent. The detailed information on the receipt can help resolve misunderstandings related to payment dates, amounts, and the period of service, making it an essential document in conflict resolution.