What is a Citibank Direct Deposit form used for?

The Citibank Direct Deposit form is a document that allows you to set up automatic deposits into your Citibank account. This could be your salary, pension, Social Security benefits, or any other regular payments. It's designed to make the process of receiving funds simpler and faster, directly depositing them into your account without the need for a physical check.

How do I fill out the Citibank Direct Deposit form?

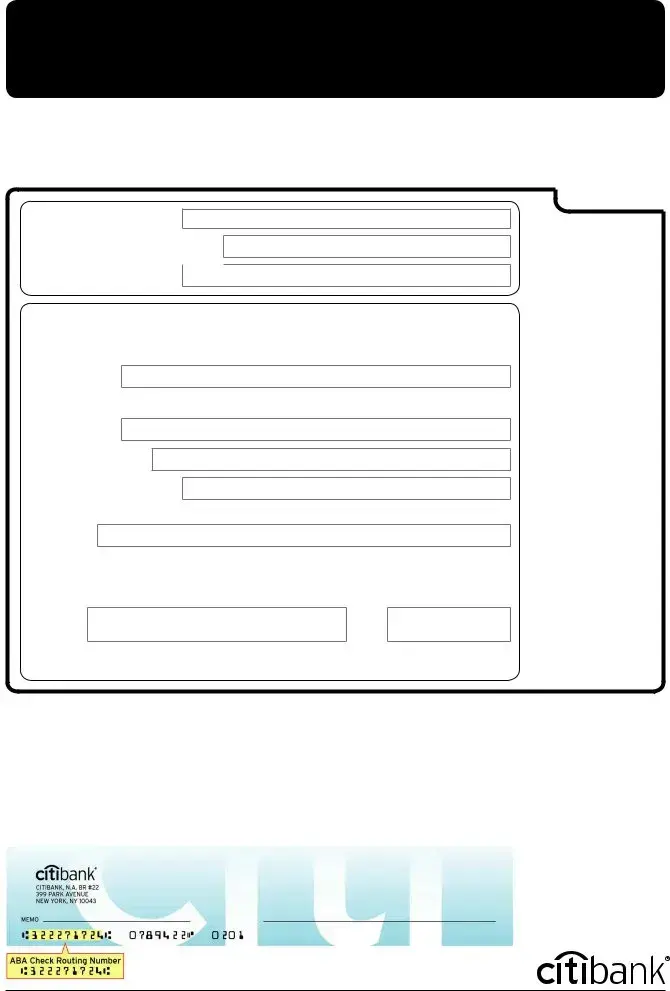

Start by providing your personal information, such as your name, Citibank account number, and the routing number for your branch. Then, specify the type of account you're directing the funds to (checking or savings). You'll also need the details of the deposit, including the payer's name and the amount, if known. Make sure everything is accurate to avoid any delays in receiving your funds.

Where do I find my Citibank routing number?

Your Citibank routing number is a 9-digit code that identifies the location where your account was opened. You can find it on your checks, within your online banking account, or by contacting Citibank customer service directly. This number is crucial for setting up your direct deposit correctly.

Can I set up direct deposits to both my checking and savings accounts?

Yes, you can distribute your direct deposits between your Citibank checking and savings accounts. You must specify the amounts or percentages you wish to allocate to each account on the form. This flexibility helps you manage your money more efficiently.

Is there a fee to set up direct deposit with Citibank?

No, Citibank does not charge a fee to set up direct deposit. It's a free service they provide to make banking more convenient for their customers.

How long does it take for my direct deposit to be active?

After submitting your completed Citibank Direct Deposit form, it generally takes one to two pay cycles for your direct deposit to become active. The exact timing can vary depending on your employer's processing time and Citibank's system updates.

What should I do if my direct deposit is not showing up in my account?

First, verify that your employer has initiated the deposit and the processing time has passed. If everything appears to be in order, contact Citibank customer service for assistance. They can help identify any issues with the direct deposit setup or processing.

Can I change or cancel my direct deposit arrangement?

Yes, you can change or cancel your direct deposit at any time. To make changes, simply complete a new Direct Deposit form with your updated information and submit it to your employer. To cancel, inform your employer and Citibank as soon as possible to avoid any payment errors.

SIGNATURE:

SIGNATURE: