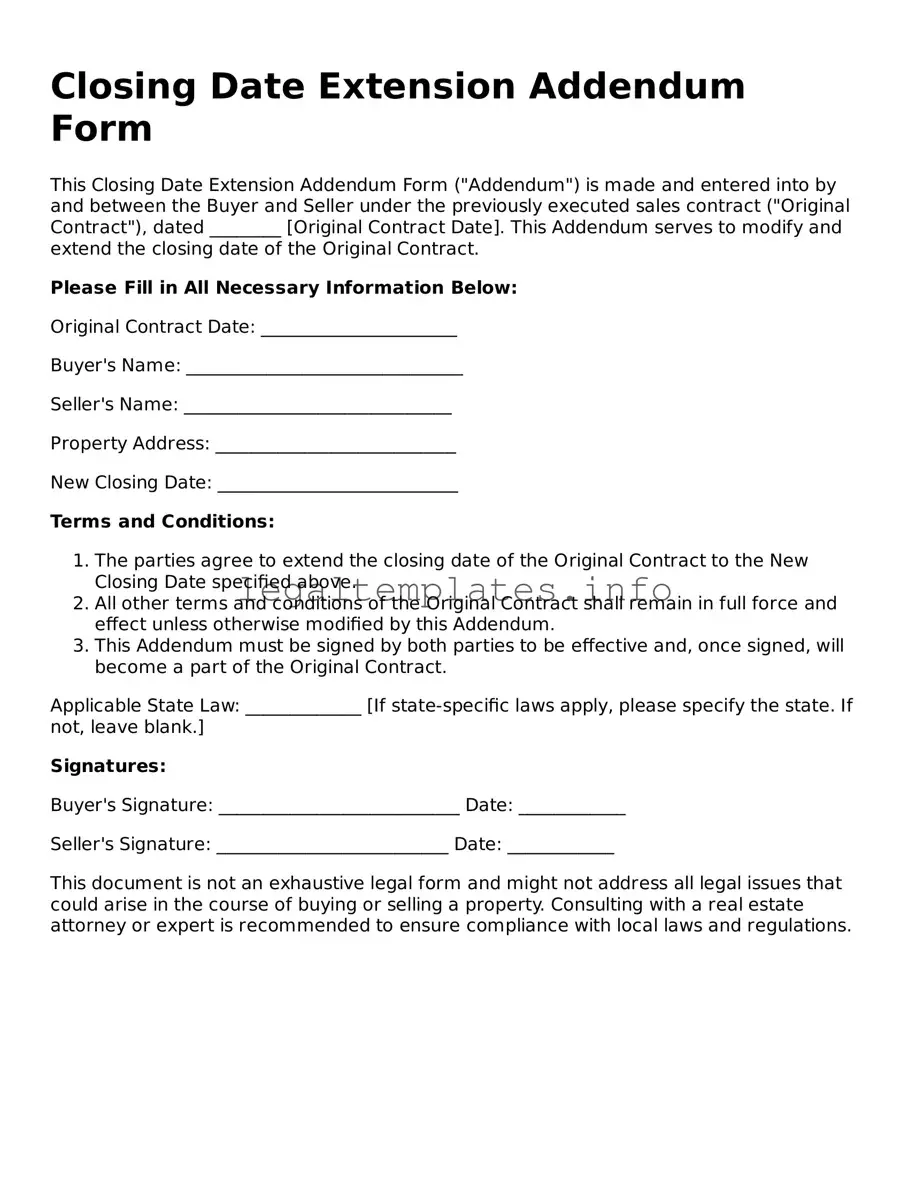

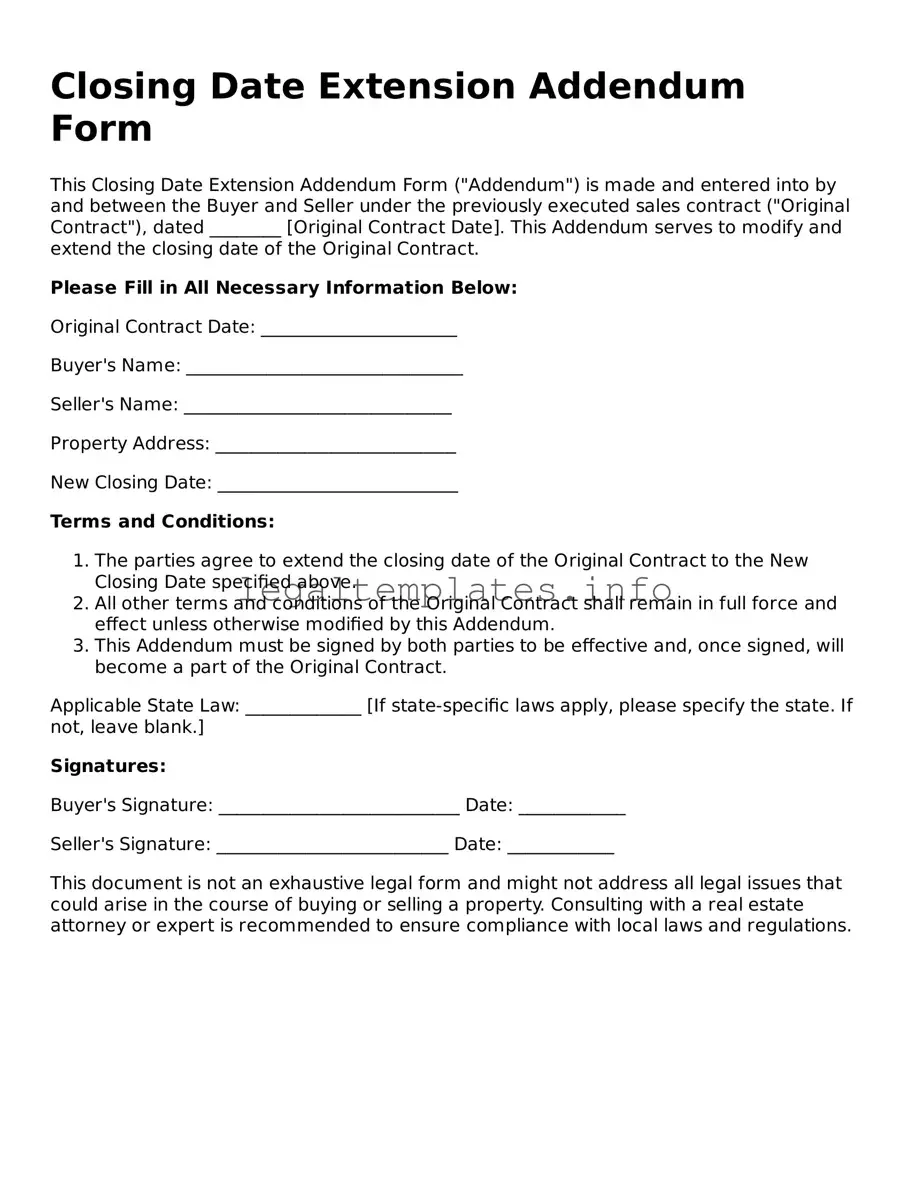

Fillable Closing Date Extension Addendum Form Document

The Closing Date Extension Addendum Form is a legal document used to formally extend the closing date of a real estate transaction. This document is critical when parties involved need more time to fulfill their obligations under the original agreement. For those requiring a modification to their closing timeline, click the button below to fill out the form.

Access Closing Date Extension Addendum Form Online

Fillable Closing Date Extension Addendum Form Document

Access Closing Date Extension Addendum Form Online

Access Closing Date Extension Addendum Form Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete Closing Date Extension Addendum Form online.