What is a Credit Check Authorization form?

A Credit Check Authorization form is a document that grants permission for an individual or entity to conduct a credit inquiry on another person. This form is often used by landlords, employers, and lending institutions to assess the creditworthiness of an individual for renting an apartment, employment decisions, or extending credit.

Why do I need to sign a Credit Check Authorization form?

Signing a Credit Check Authorization form is necessary to allow the requesting party to legally obtain your credit report from credit bureaus. Without your consent, accessing your credit information would violate privacy laws. The form demonstrates that you are aware of and agree to the credit check.

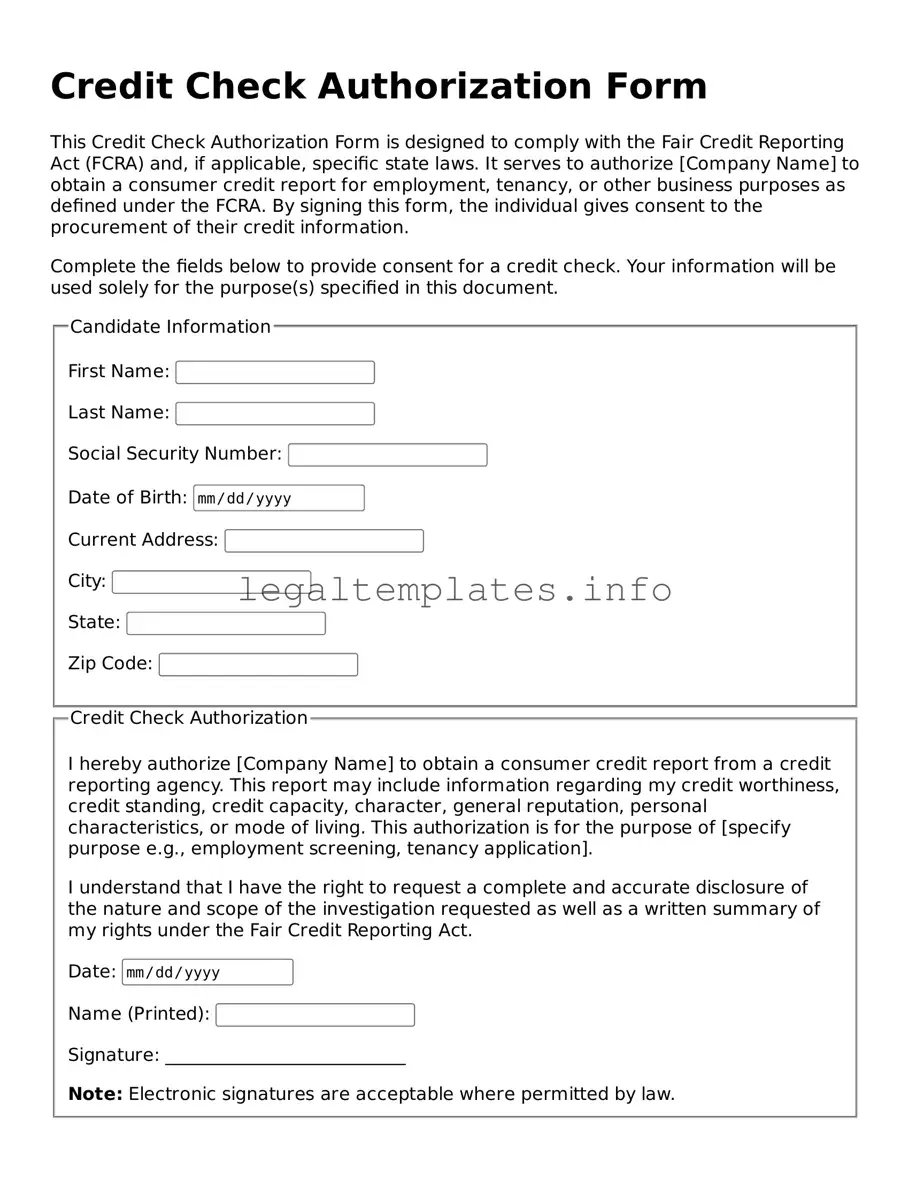

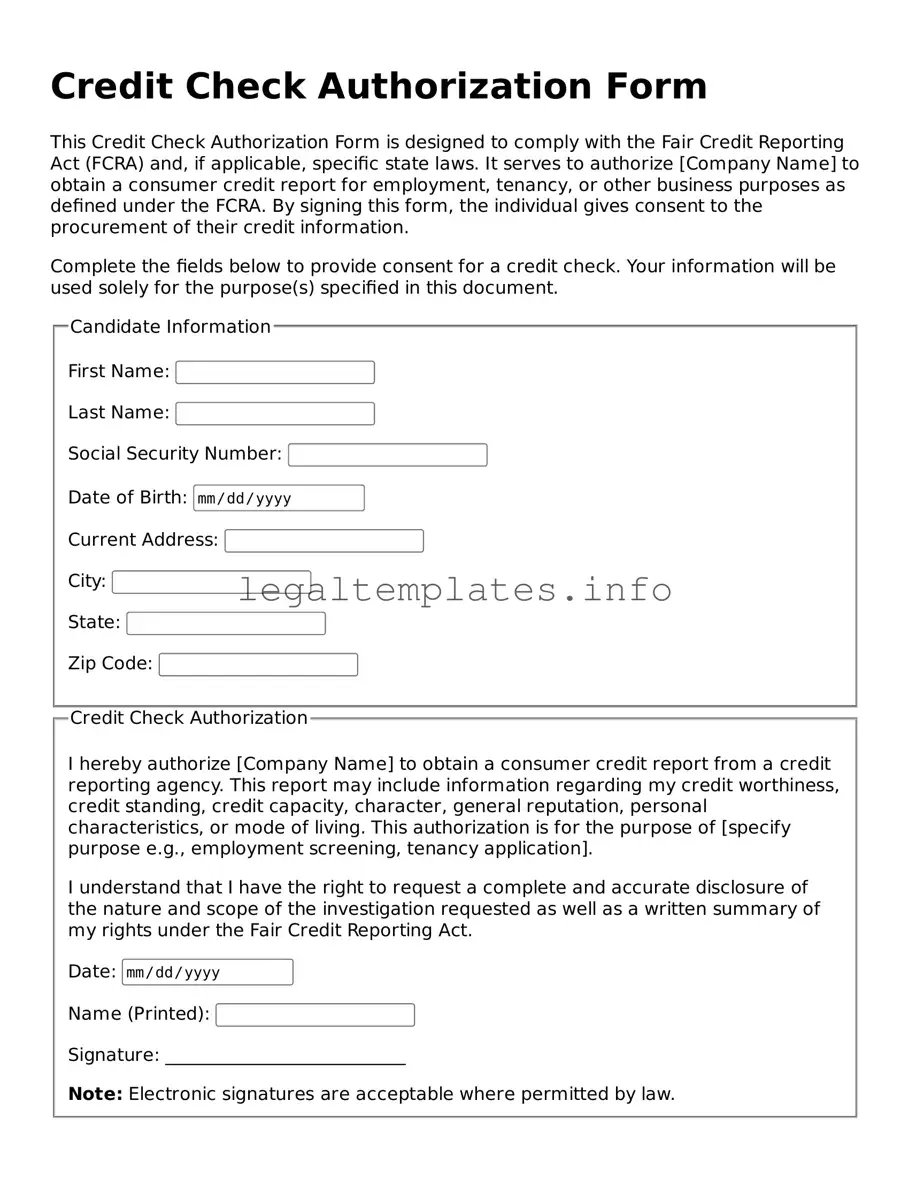

What information is typically included in the Credit Check Authorization form?

Typically, the form includes your full name, Social Security Number, date of birth, current address, and possibly your employment information. It will also have a section where you give your explicit consent for the credit inquiry and may outline the reason for the credit check.

Is my information safe when I sign a Credit Check Authorization form?

The party conducting the credit check is obligated to handle your information securely and in compliance with the Fair Credit Reporting Act (FCRA) and other applicable privacy laws. These entities must take reasonable steps to ensure that your data is protected against unauthorized access or use.

How long does the authorization to check my credit last once I sign the form?

Once signed, the authorization typically remains valid for a specific time frame mentioned in the form, often not exceeding a year. However, some forms may not specify a duration, in which case the authorization might be considered valid for a reasonable period necessary to accomplish the purpose of the credit check.

Can I refuse to sign a Credit Check Authorization form?

Yes, you have the right to refuse to sign a Credit Check Authorization form. However, doing so may prevent you from proceeding further with the application process for a rental, loan, or job, as the requester may require this information to make an informed decision.

What happens if I find inaccuracies in my credit report after a check?

If inaccuracies are found in your credit report, you have the right to dispute the incorrect information with the credit bureau that supplied the report. Each credit bureau has its own procedures for disputing errors, and they are required by law to investigate your dispute, typically within 30 days.

Who can request a credit check with my authorization?

With your authorization, various entities can request a credit check, including landlords, employers, lenders, and any other party with a legitimate need to assess your creditworthiness. Your explicit consent ensures that such checks are conducted legally and ethically.

Will signing a Credit Check Authorization form affect my credit score?

Signing the form itself does not affect your credit score. However, the resulting credit inquiry may impact your score, depending on the type of inquiry. A "soft" inquiry, like those often conducted by employers, typically does not affect your score. A "hard" inquiry, such as those by lenders for loan considerations, may have a minor, temporary impact on your score.