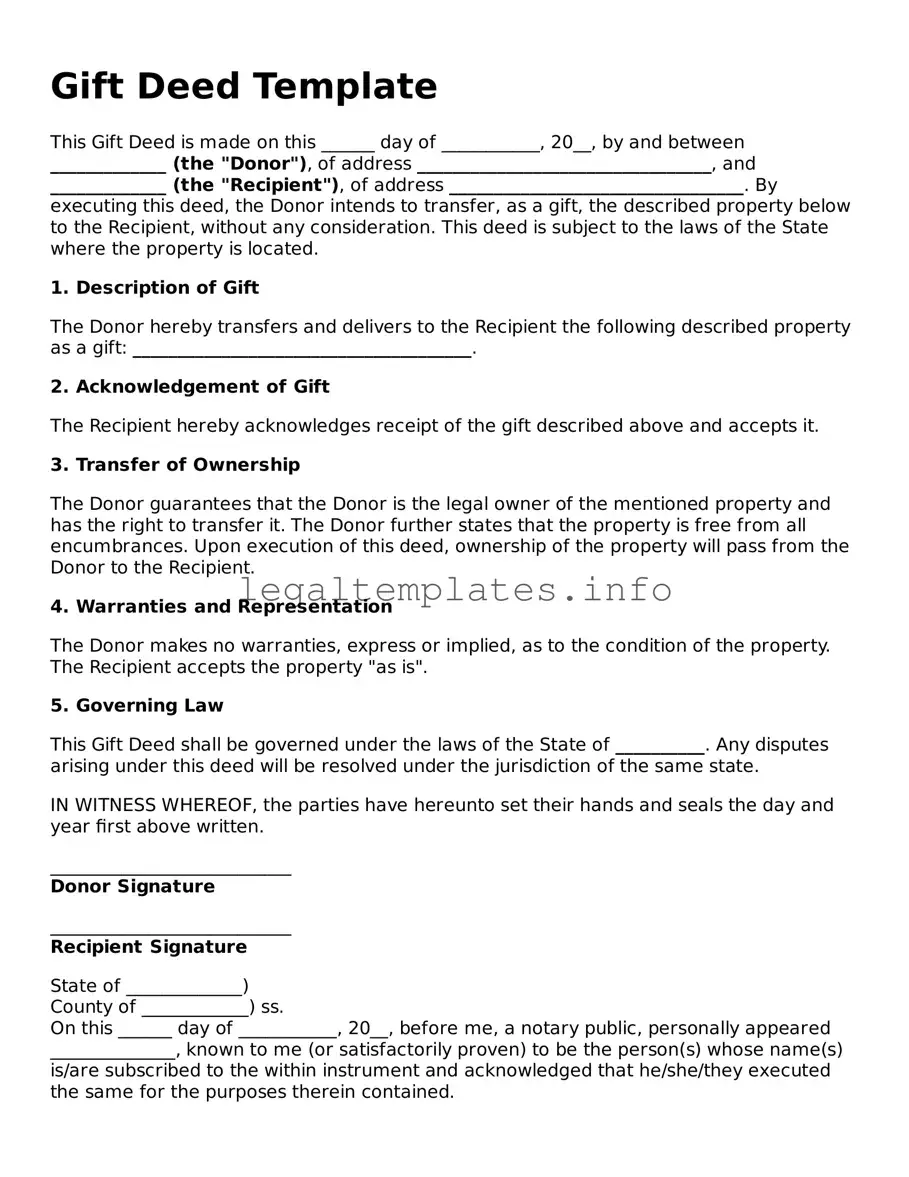

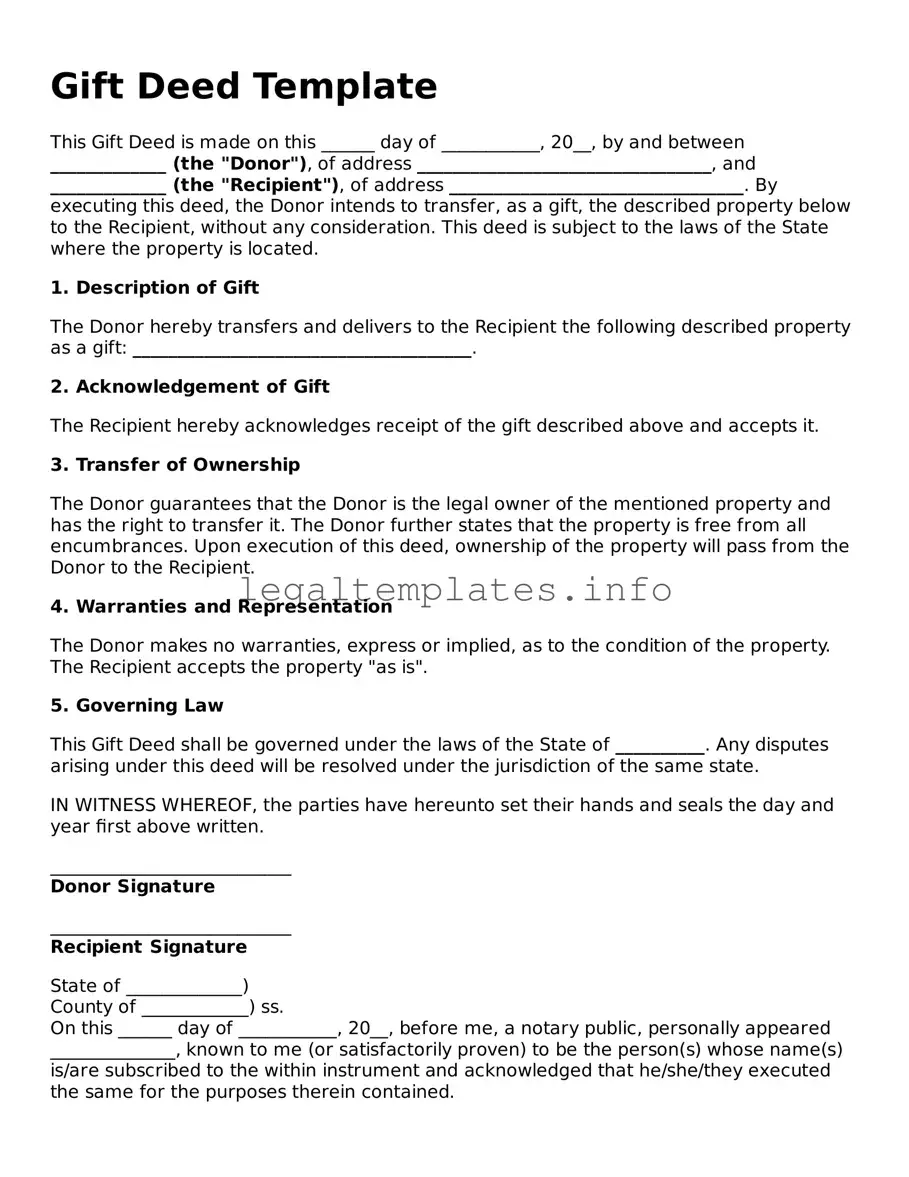

Fillable Gift Deed Document

A Gift Deed form is a legal document that facilitates the voluntary transfer of property from a donor to a donee, without any exchange of compensation. This formal instrument, underpinned by the intention of the donor, legally documents the act of giving, ensuring both clarity and the rights of all parties involved. To make a generous gesture legally binding and safeguarded, consider filling out the Gift Deed form by clicking the button below.

Access Gift Deed Online

Fillable Gift Deed Document

Access Gift Deed Online

Access Gift Deed Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete Gift Deed online.