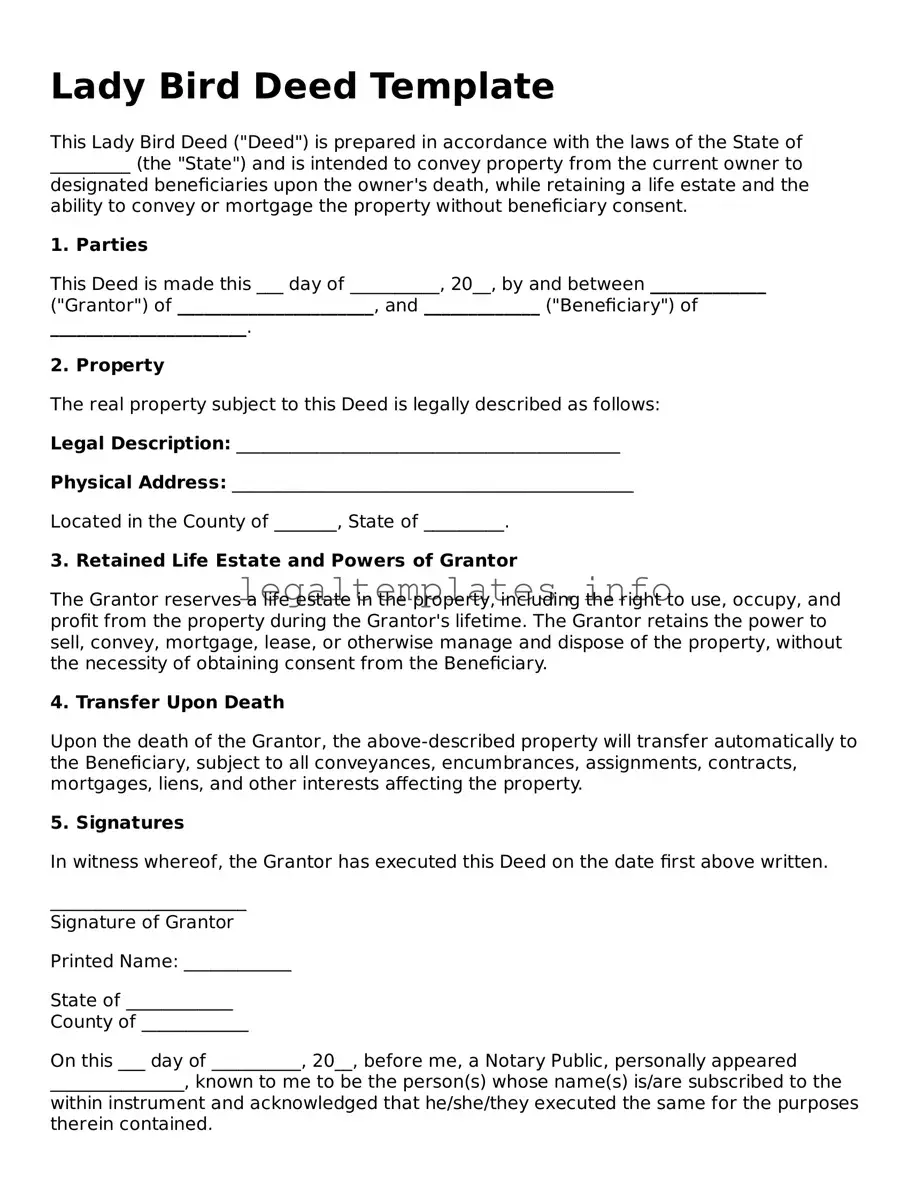

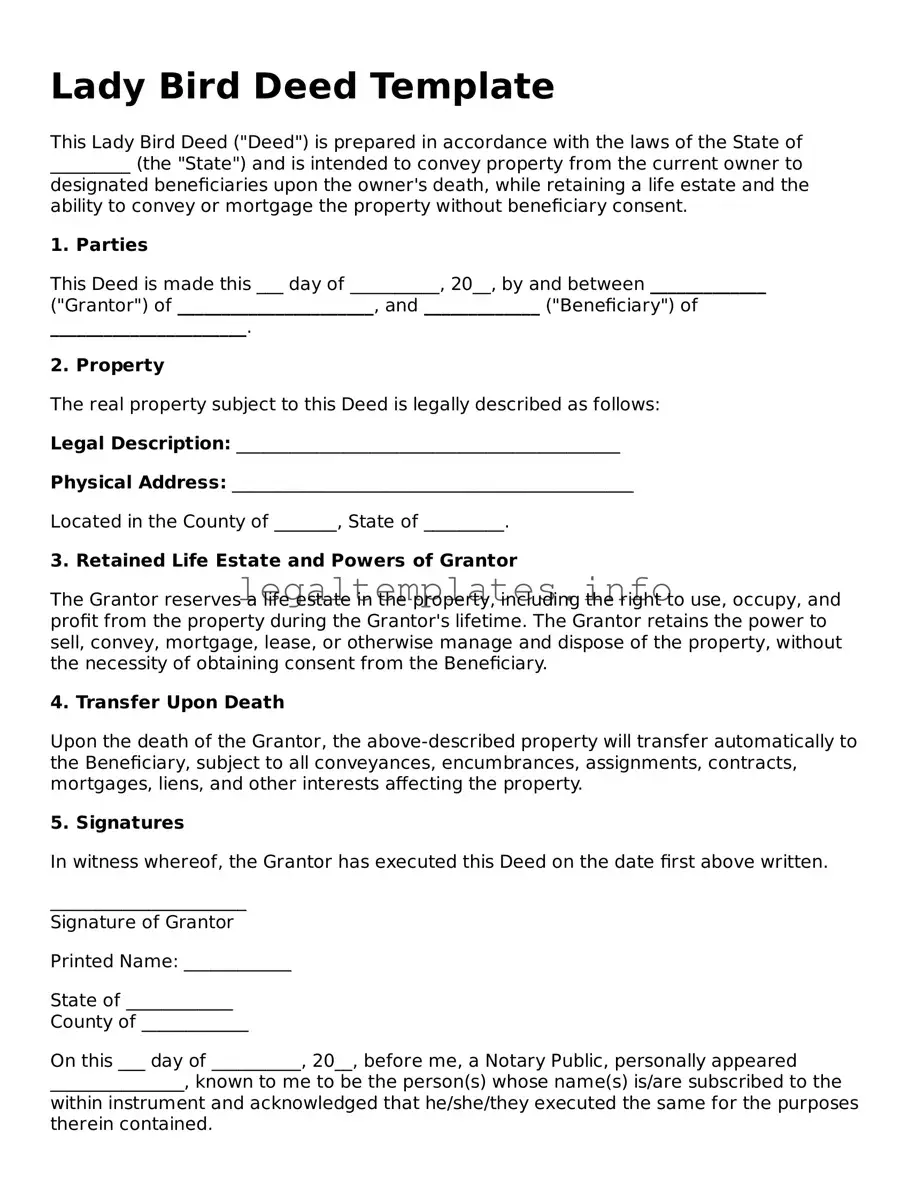

Fillable Lady Bird Deed Document

A Lady Bird Deed is a legal document that enables property owners to transfer their real estate to beneficiaries upon their death without the need for probate. This form of deed offers a simple and effective way to manage estate planning, ensuring that property is passed along according to the owner's wishes. For those interested in utilizing this estate planning tool, ensure completeness and accuracy when filling out the form by clicking the button below.

Access Lady Bird Deed Online

Fillable Lady Bird Deed Document

Access Lady Bird Deed Online

Access Lady Bird Deed Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete Lady Bird Deed online.