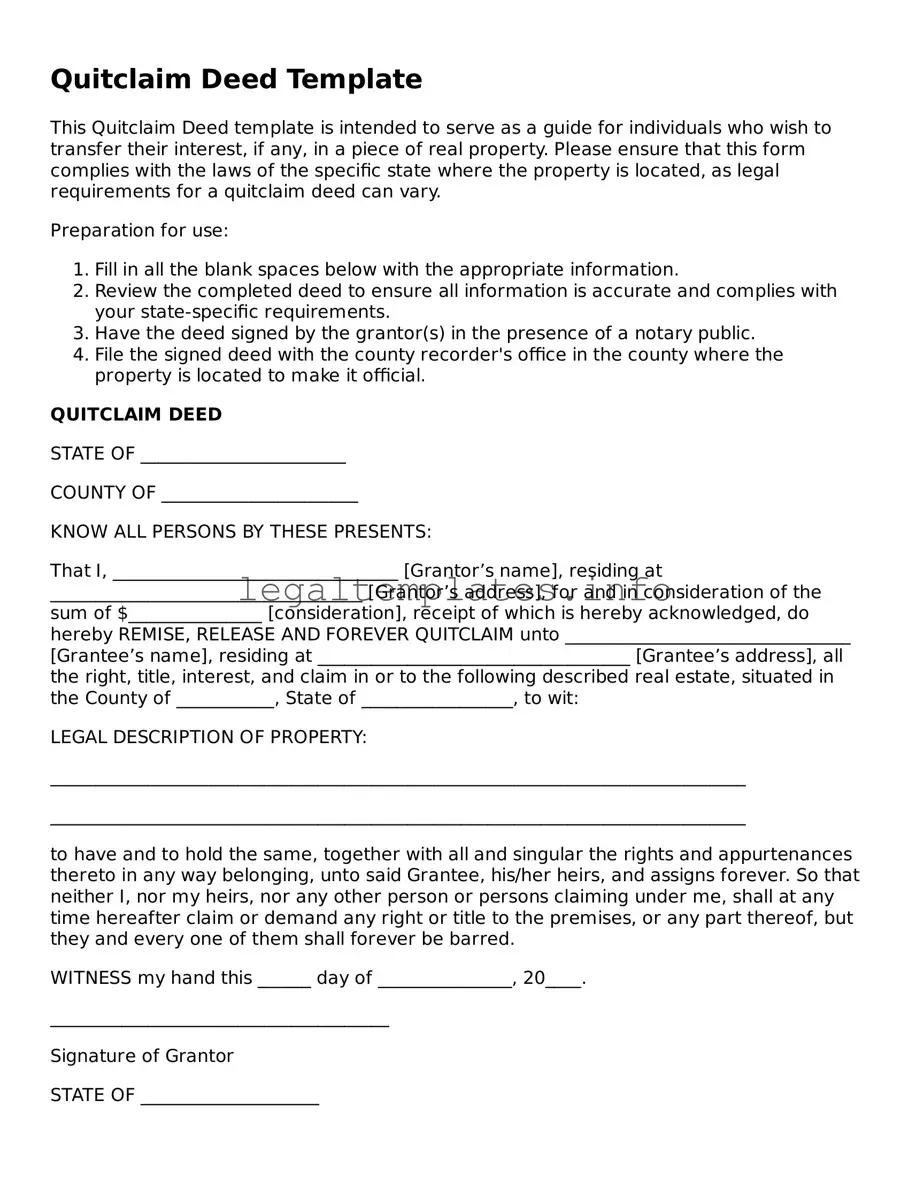

Quitclaim Deed Template

This Quitclaim Deed template is intended to serve as a guide for individuals who wish to transfer their interest, if any, in a piece of real property. Please ensure that this form complies with the laws of the specific state where the property is located, as legal requirements for a quitclaim deed can vary.

Preparation for use:

- Fill in all the blank spaces below with the appropriate information.

- Review the completed deed to ensure all information is accurate and complies with your state-specific requirements.

- Have the deed signed by the grantor(s) in the presence of a notary public.

- File the signed deed with the county recorder's office in the county where the property is located to make it official.

QUITCLAIM DEED

STATE OF _______________________

COUNTY OF ______________________

KNOW ALL PERSONS BY THESE PRESENTS:

That I, ________________________________ [Grantor’s name], residing at ___________________________________ [Grantor’s address], for and in consideration of the sum of $_______________ [consideration], receipt of which is hereby acknowledged, do hereby REMISE, RELEASE AND FOREVER QUITCLAIM unto ________________________________ [Grantee’s name], residing at ___________________________________ [Grantee’s address], all the right, title, interest, and claim in or to the following described real estate, situated in the County of ___________, State of _________________, to wit:

LEGAL DESCRIPTION OF PROPERTY:

______________________________________________________________________________

______________________________________________________________________________

to have and to hold the same, together with all and singular the rights and appurtenances thereto in any way belonging, unto said Grantee, his/her heirs, and assigns forever. So that neither I, nor my heirs, nor any other person or persons claiming under me, shall at any time hereafter claim or demand any right or title to the premises, or any part thereof, but they and every one of them shall forever be barred.

WITNESS my hand this ______ day of _______________, 20____.

______________________________________

Signature of Grantor

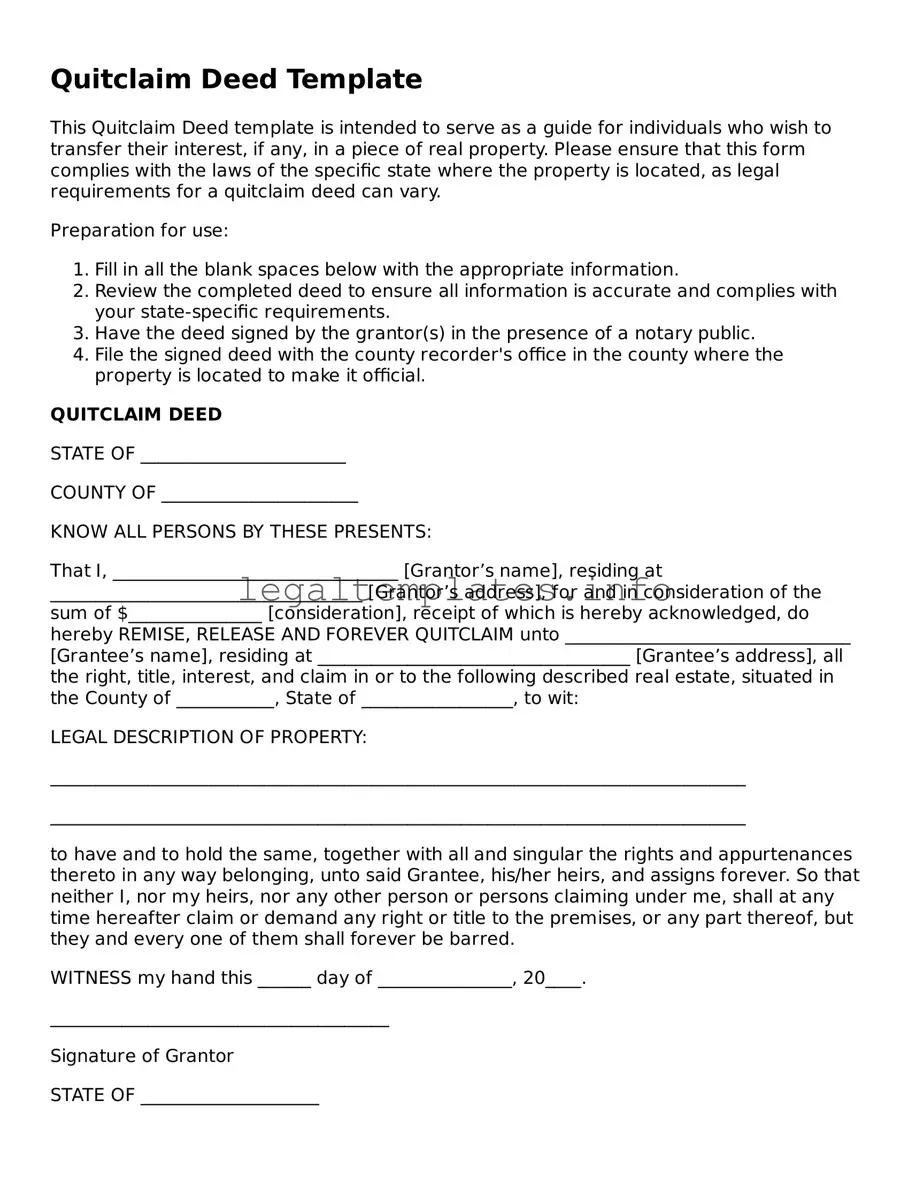

STATE OF ____________________

COUNTY OF __________________

On this ______ day of ___________, 20____, before me, the undersigned, a Notary Public in and for said State, personally appeared ______________________________ [Grantor’s name], known to me (or satisfactorily proven) to be the person whose name is subscribed to the foregoing instrument, and acknowledged that he/she executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I have hereunto set my hand and official seal.

______________________________________

(SEAL) Notary Public

My Commission Expires: _______________