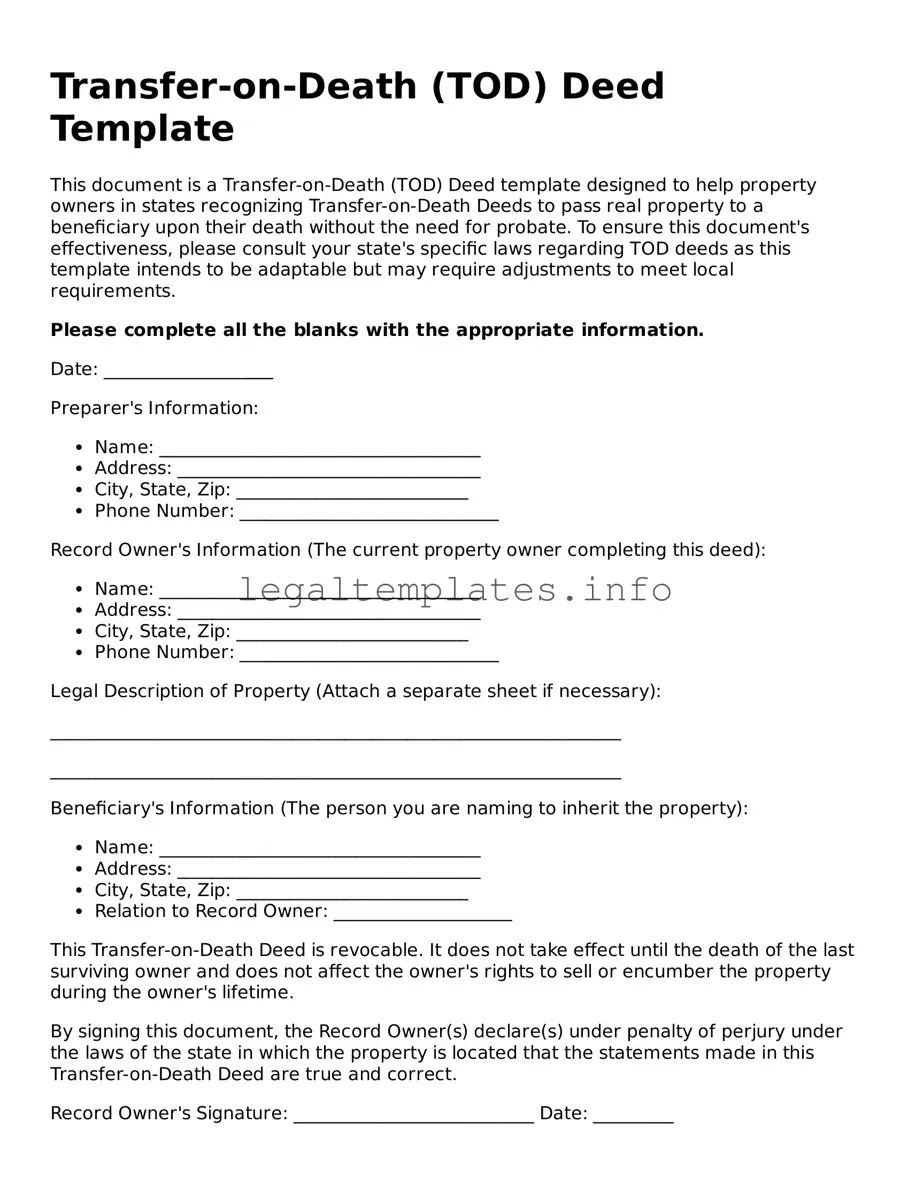

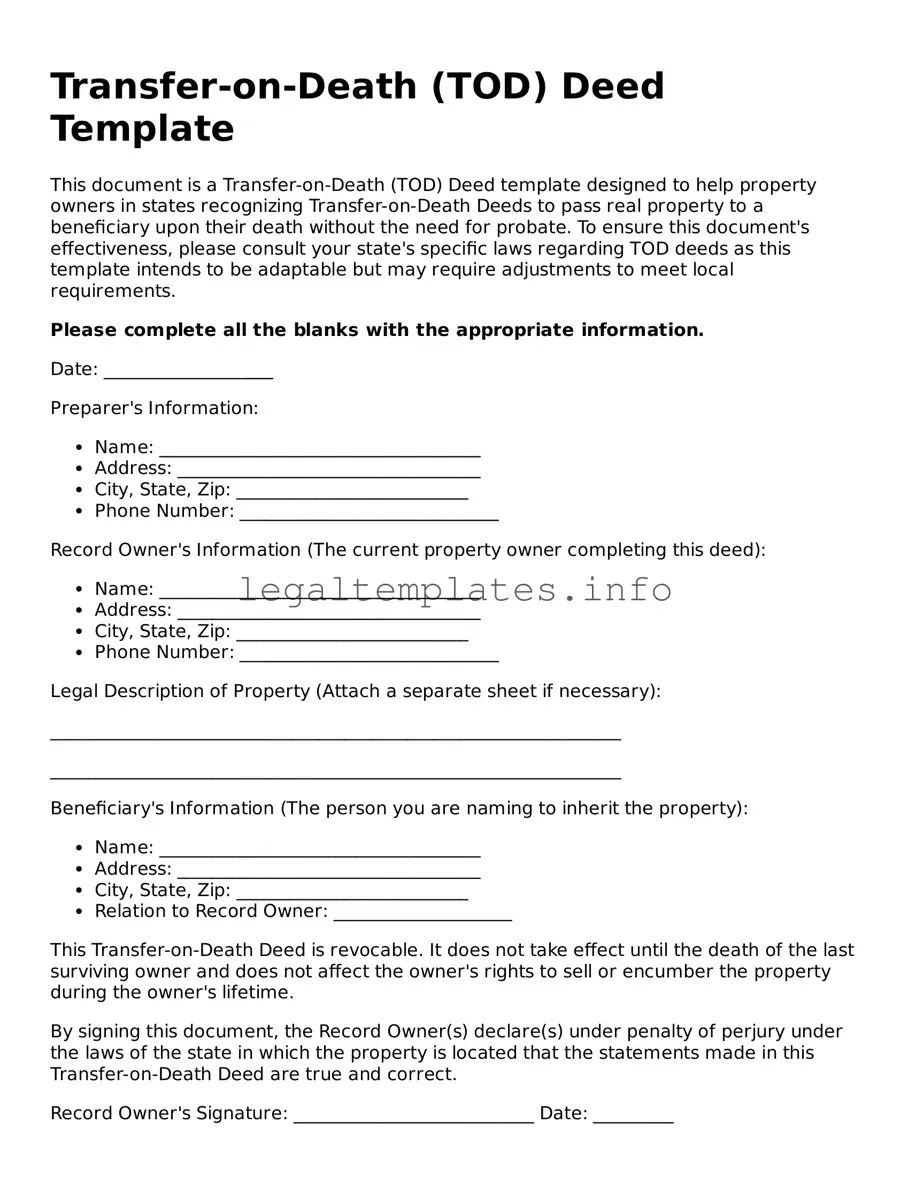

Transfer-on-Death (TOD) Deed Template

This document is a Transfer-on-Death (TOD) Deed template designed to help property owners in states recognizing Transfer-on-Death Deeds to pass real property to a beneficiary upon their death without the need for probate. To ensure this document's effectiveness, please consult your state's specific laws regarding TOD deeds as this template intends to be adaptable but may require adjustments to meet local requirements.

Please complete all the blanks with the appropriate information.

Date: ___________________

Preparer's Information:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip: __________________________

- Phone Number: _____________________________

Record Owner's Information (The current property owner completing this deed):

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip: __________________________

- Phone Number: _____________________________

Legal Description of Property (Attach a separate sheet if necessary):

________________________________________________________________

________________________________________________________________

Beneficiary's Information (The person you are naming to inherit the property):

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip: __________________________

- Relation to Record Owner: ____________________

This Transfer-on-Death Deed is revocable. It does not take effect until the death of the last surviving owner and does not affect the owner's rights to sell or encumber the property during the owner's lifetime.

By signing this document, the Record Owner(s) declare(s) under penalty of perjury under the laws of the state in which the property is located that the statements made in this Transfer-on-Death Deed are true and correct.

Record Owner's Signature: ___________________________ Date: _________

State of _______________

County of ______________

Subscribed and affirmed before me on this ___ day of ___________, 20___ by ________________________________ (Record Owner's Name).

Notary Public's Signature: ___________________________

My commission expires: ____________________

Instructions for Record Owner:

- Review and complete this template accurately.

- If necessary, attach a detailed legal description of the property.

- Ensure all signatures are done in the presence of a notary public.

- File this deed with the appropriate county recorder's office as per state requirements.

It is recommended to consult with a real estate attorney or a legal advisor to ensure that this Transfer-on-Death Deed complies with current state laws and regulations and adequately reflects your intentions.

*This template is provided as a courtesy and is intended for informational purposes only. It should not be considered legal advice.