An Employee Expense Reimbursement Form is quite similar to the Employee Advance form, as both deal with finances related to work activities. The Expense Reimbursement Form is typically used after an expense has occurred, allowing employees to request reimbursement for out-of-pocket expenses. This parallels the advance form, which provides funds before expenses are incurred, yet both are centered on managing work-related expenditures.

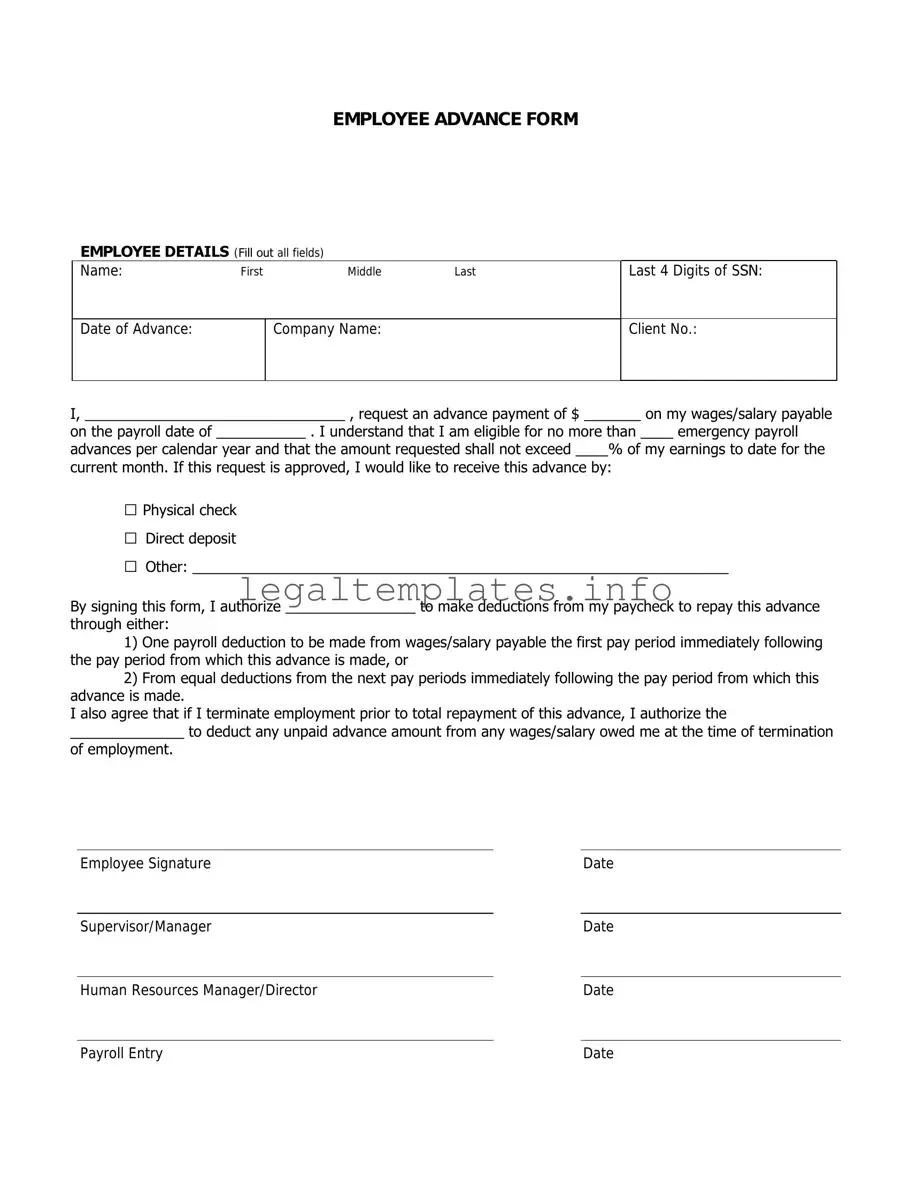

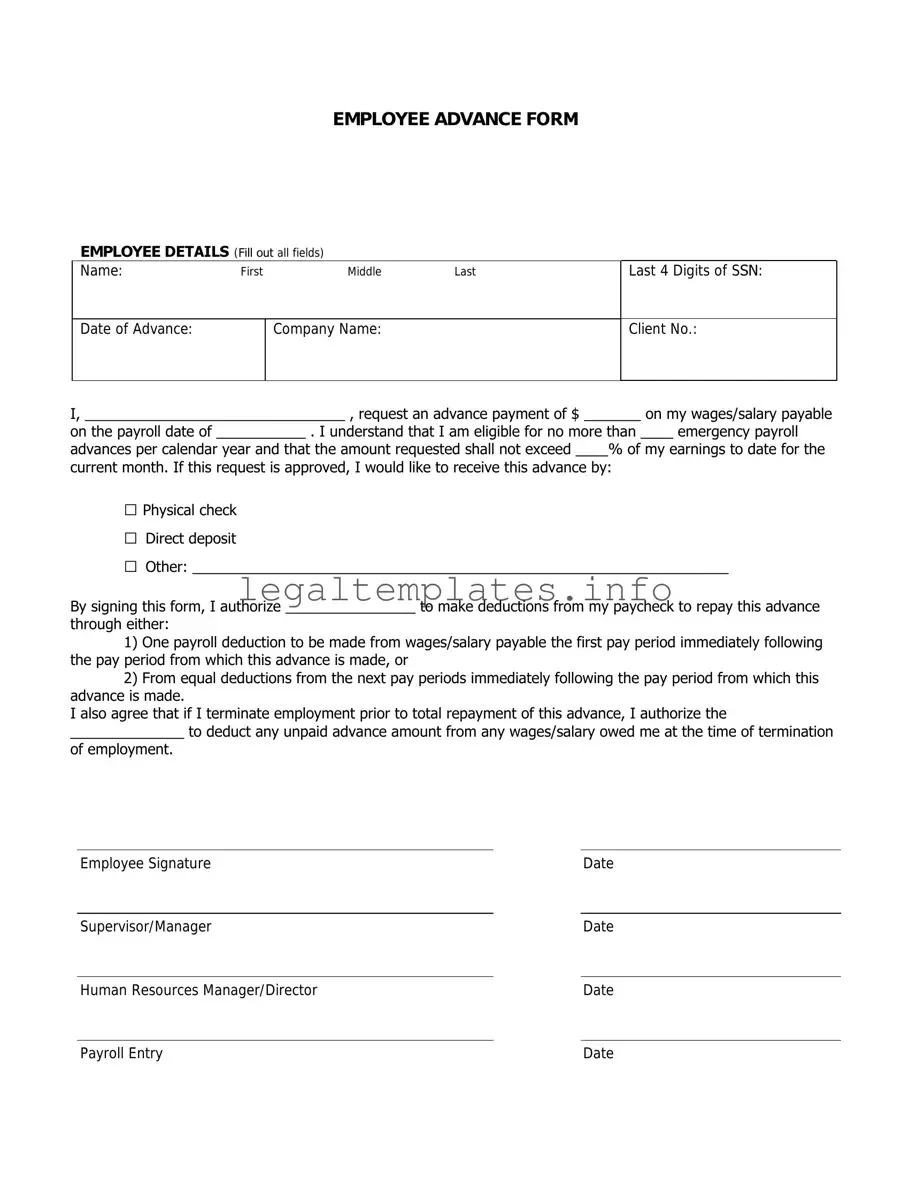

A Payroll Deduction Authorization form shares core attributes with an Employee Advance form, in that it involves the management of an employee's earnings, albeit in different contexts. While the Payroll Deduction Authorization allows for deductions from an employee's future paychecks for various reasons, including benefits, charities, or repayments, the Employee Advance form specifically deals with the early disbursement of earnings that are expected to be repaid usually through deductions from future wages.

The Loan Agreement Form is akin to the Employee Advance form because both establish an agreement regarding the borrowing of funds that need to be repaid. However, the Loan Agreement Form can be used in a broader context outside of the employer-employee relationship and often involves more detailed terms regarding interest, repayment schedule, and consequences of default.

The Timesheet Form is another document related to the Employee Advance form since timesheets are often used to justify the need for an advance. Timesheets document the hours worked by an employee, which can be crucial in determining the amount of an advance, especially if it is intended to cover expected earnings from overtime or special projects.

A Direct Deposit Authorization Form intersects with the Employee Advance form through the method of payment. Both forms may require the employee to provide bank account information to facilitate a transaction directly into their account, whether it's for depositing regular wages or an advance on those wages.

An Employee Recognition Form, while primarily focused on acknowledging and rewarding employee performance, can sometimes tie into financial benefits that might necessitate an advance. For instance, an award or bonus detailed in a recognition form could lead to an employee seeking an advance against this anticipated extra income.

The Employee Termination Checklist might indirectly relate to an Employee Advance form, especially in cases where an outstanding advance needs to be settled upon termination. This checklist includes various steps to be completed when an employee leaves the company, and ensuring that any advances are repaid can be one of these essential steps.

Performance Review Forms share a connection with Employee Advance forms in scenarios where the outcome of a review could affect an employee's financial status. Specifically, if a performance review leads to a wage increase or bonus, an employee might seek an advance against this anticipated raise in income. This scenario ties the two forms together through the theme of compensation based on assessment.

Employee Onboarding Checklist forms are linked to Employee Advance forms since they both play critical roles at different stages of employment. The Onboarding Checklist ensures a smooth transition into the company by outlining necessary steps and paperwork, while an Advance form might come into play later as the employee requires financial assistance before their regular pay cycle.

Finally, the Job Application Form, though primarily used at the start of the employment process, shares a basic connection with the Employee Advance form as they both deal with potential financial implications of employment. While the application form marks the beginning of this process, leading to potential earnings, the Employee Advance form relates to the financial management of these earnings during employment.