The Affidavit of No Florida Estate Tax Due (Form DR-312) shares similarities with other legal and tax documents that affirms or declares certain facts. One example is the Affidavit of Heirship, which is used primarily in estate proceedings to identify the heirs of a deceased person. This affidavit, like the DR-312, serves as a sworn statement regarding family relationships and helps to facilitate the transfer of property to heirs when there is no will.

Another similar document is the Small Estate Affidavit, a form that allows for the assets of the deceased to be distributed without formal probate. This document, akin to the DR-312, is typically used when the value of the estate falls below a certain threshold, thereby simplifying the legal process involved in distributing the deceased's property.

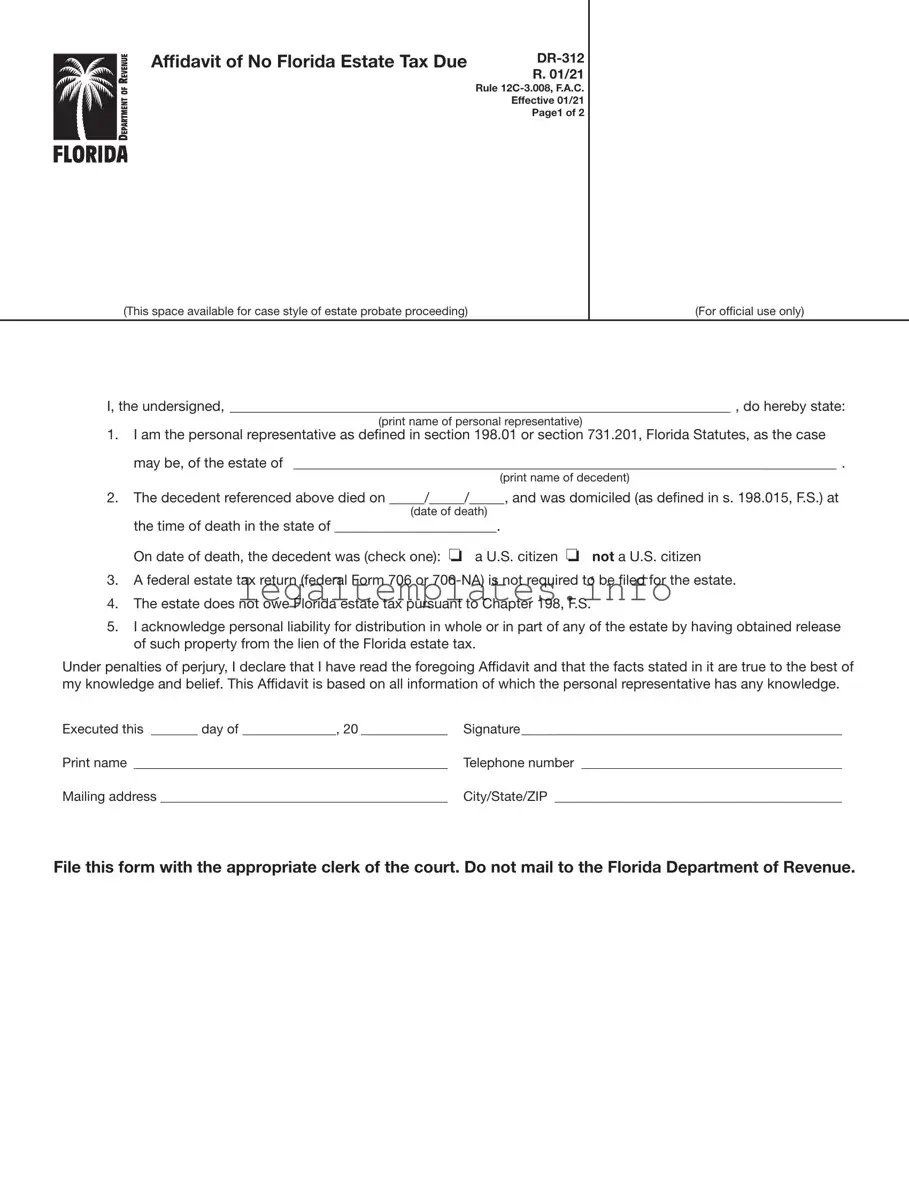

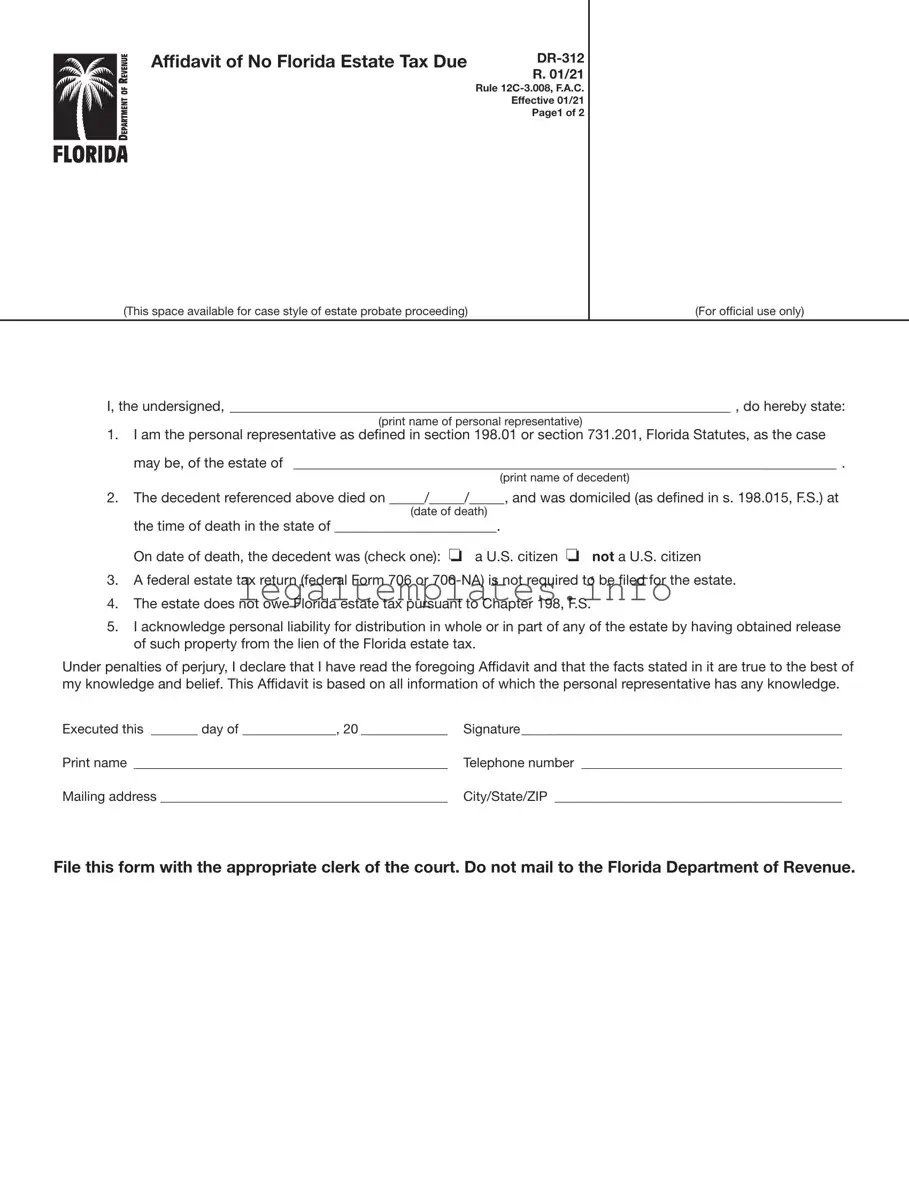

The Federal Tax Form 706, which is referred to in the DR-312 form, is another example. This form is for the United States Estate (and Generation-Skipping Transfer) Tax Return, required by the IRS when a deceased person's estate exceeds certain value thresholds. The DR-312 explicitly mentions Form 706 as part of its criteria, highlighting a connection in their use regarding estate tax responsibilities.

Additionally, the Transfer on Death (TOD) Deed or Affidavit is a document that allows individuals to name beneficiaries to receive property upon the death of the owner, bypassing probate. This document's purpose resonates with the DR-312's objective in facilitating smoother transfer of assets, though the DR-312 focuses on tax implications.

Similarly, a Release of Lien document, used in various contexts including tax liens, mortgage liens, and mechanic's liens, shares the goal of the DR-312 in removing a specific lien – in this case, the lien of the Florida estate tax on the property of the deceased.

The trust certification or affidavit of trust may also be considered akin to the DR-312. This legal document verifies the existence of a trust and the trustee's authority without revealing the full details of the trust. Like the DR-312, it is used to simplify and confirm legal authority in financial and legal transactions.

The Nonresident Alien's Estate Tax Return (Form 706-NA) is another specific form that has similarities with the DR-312 for estates belonging to deceased nonresidents not citizens of the United States. While Form 706-NA is used to declare estate values for tax purposes on a federal level, the DR-312 is used at the state level in Florida to affirm that no estate tax is due.

A Declaration Under Probate Code, another common affidavit used in estate planning and settlement, affirms various facts under the probate code, similar to the DR-312’s function of affirming no estate tax liability under Florida law.

Lastly, the Executor’s/ Administrator’s Deed mirrors the intent behind Form DR-312 by facilitating the transfer of property from an estate under an executor's or administrator’s authority. While the DR-312 helps clear the way for such transfers by confirming that no estate tax is due, the Executor’s/Administrator’s Deed is the mechanism by which the property is legally transferred.