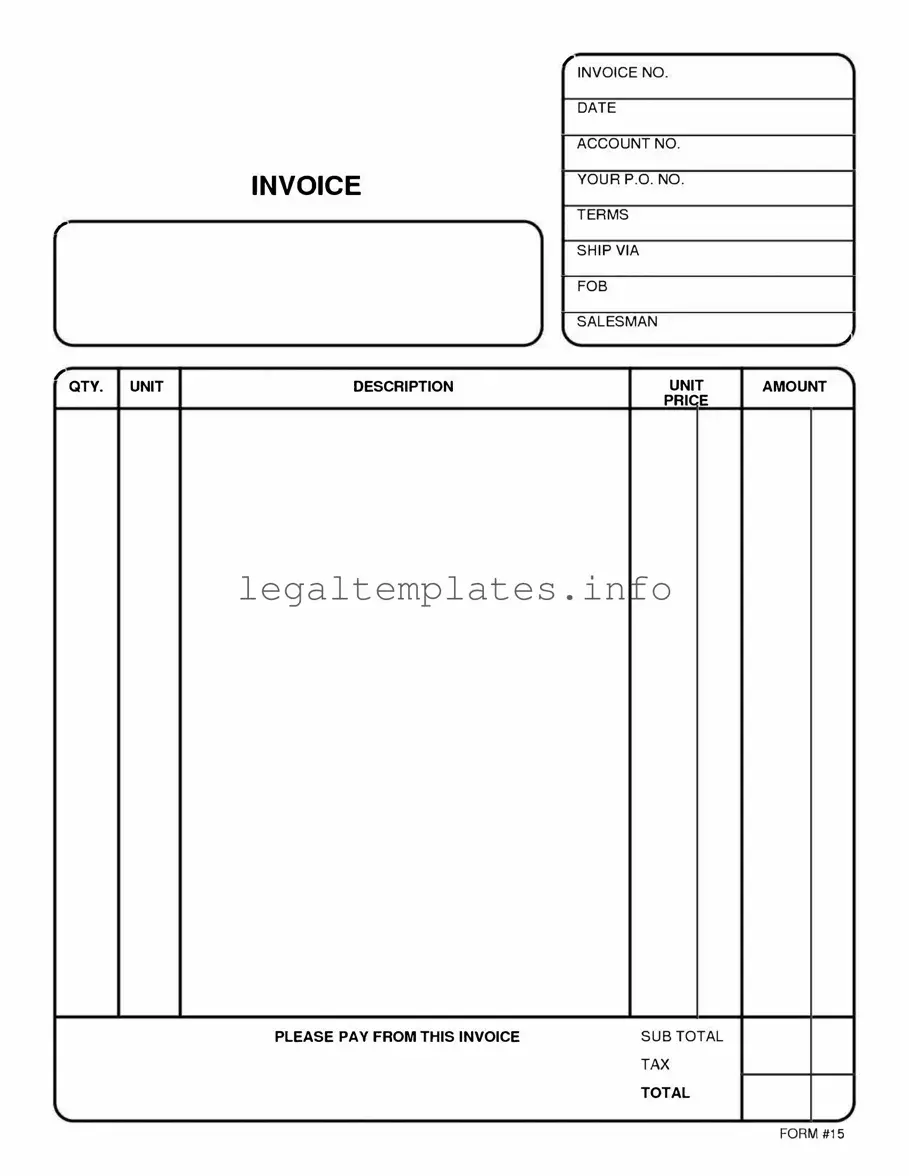

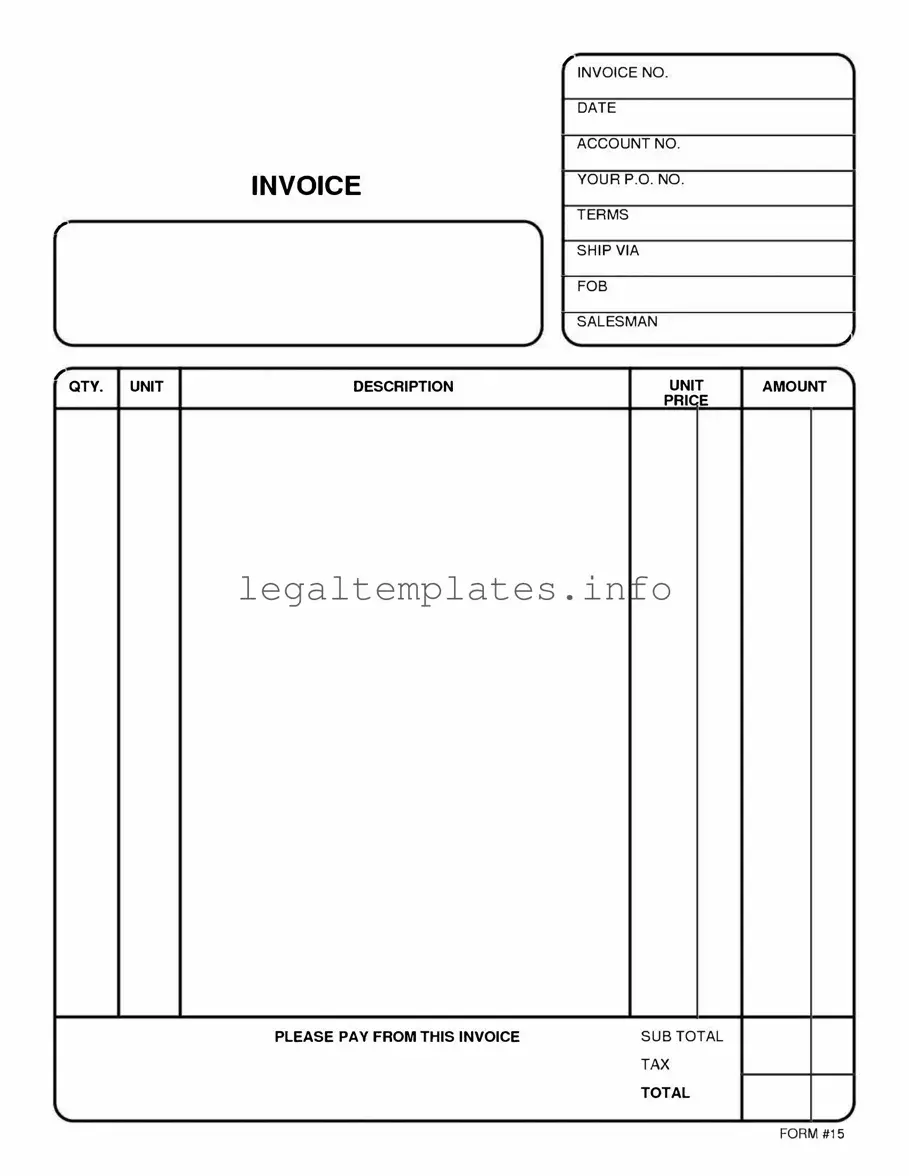

What is the Free And Invoice PDF form used for?

The Free And Invoice PDF form is designed for individuals and businesses to create, download, and send invoices easily. It is an efficient way to detail the goods or services provided, the quantity, price, and total cost, as well as payment terms. This tool aids in maintaining clear and professional financial records.

Can I customize the Free And Invoice PDF form to match my business branding?

Yes, the form is designed to be customizable. Users can add their business logo, contact information, and adjust the layout to suit their branding needs. This flexibility ensures that even though the form is standard, the final invoice can reflect your business identity.

Is the Free And Invoice PDF form suitable for use in all countries?

While the form is designed to be versatile, it's essential to check your local laws and regulations regarding invoicing. Some countries have specific requirements for what must be included on an invoice. However, the form provides a basic structure that can be adjusted to meet most regional requirements.

Do I need special software to use the Free And Invoice PDF form?

No special software is required. The form can be accessed and filled out using any standard PDF reader. Additionally, there are online platforms and tools that can open and edit PDF files, allowing for easy customization and use.

How can I share the completed invoice with my customers?

Once the invoice is completed and saved, it can be shared with customers through email, cloud storage links, or printed and mailed. The versatile nature of a PDF makes it easy to distribute in whichever format is most convenient for you and your customers.

Is the Free And Invoice PDF form secure for handling sensitive information?

PDF files are inherently secure as they can be encrypted with passwords and digital signatures. However, when dealing with sensitive information, it's crucial to ensure that any digital platform used to fill out or send the invoice is secure and trusted.

Can I save a template of the Free And Invoice PDF form for future use?

Yes, once you've customized the form for your needs, you can save it as a template. This allows for quick and easy creation of new invoices, saving time and ensuring consistency in your invoicing process.

Is there a limit to how many times the Free And Invoice PDF form can be used?

No, there is no limit. The form can be used as many times as needed, making it an excellent tool for ongoing business transactions. This unlimited use ensures that businesses of any size can manage their invoicing efficiently without worrying about additional costs.