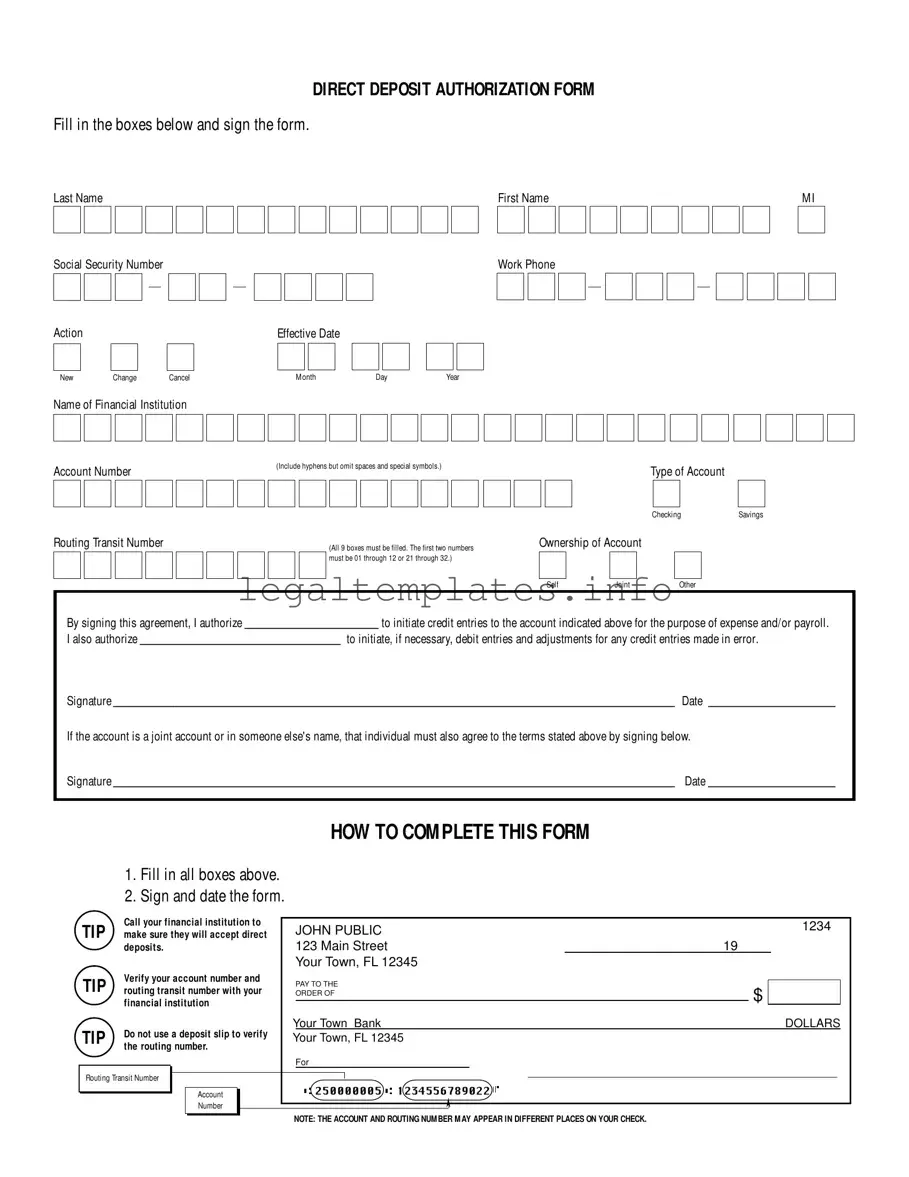

One common mistake observed when individuals fill out the Generic Direct Deposit form is not fully completing the personal information section. This includes leaving out the middle initial or inaccurately entering the social security number. Such omissions or mistakes can lead to delays in processing the form or even in the direct deposit setup.

Another frequent oversight involves incorrectly entering the action or effective date. Individuals often forget to select whether they are initiating a new direct deposit, changing an existing setup, or cancelling one. Additionally, the effective date is sometimes left blank or wrongly filled, which can cause confusion regarding when the changes should take effect.

Incorrectly entering the financial institution's information is a significant error that can disrupt the direct deposit process. In some cases, people mistakenly provide a branch name instead of the actual name of the bank. They might also enter incomplete or incorrect information for the financial institution, which complicates the bank's identification and the processing of the direct deposit authorization.

One critical error involves the account and routing numbers. Account numbers entered without including hyphens (as instructed on the form) or with spaces and special symbols may not be recognized by the bank's software, leading to transaction failures. Similarly, if the routing transit number isn't filled out completely or correctly—especially given its stringent requirement to start with specific numbers—this could prevent the direct deposit from being set up correctly.

Choosing the wrong type of account can also lead to issues, as direct deposits have different processing methods for savings and checking accounts. Some individuals accidentally check the wrong box or leave this section blank, leading to complications when the deposit is processed.

The ownership section of the account is often overlooked. The instructions specify that if the account is joint or held by another person, that individual must also agree to the terms by signing the form. Neglecting this step can invalidate the authorization if the bank requires consent from all account holders.

Regarding signatures, a common mistake is the absence of required signatures. The form clearly states that it needs to be signed and dated to authorize the direct deposit. However, it's not uncommon for individuals to fill out all other necessary information and then forget to sign and date the form, rendering it incomplete and delaying the setup process.

Lastly, failing to verify account and routing numbers with the financial institution before submission is a prevalent error. Even though the form suggests doing so as a tip, many skip this crucial step. As a result, if there's any discrepancy in the numbers provided, the setup of the direct deposit could be delayed or even rejected.

□

□