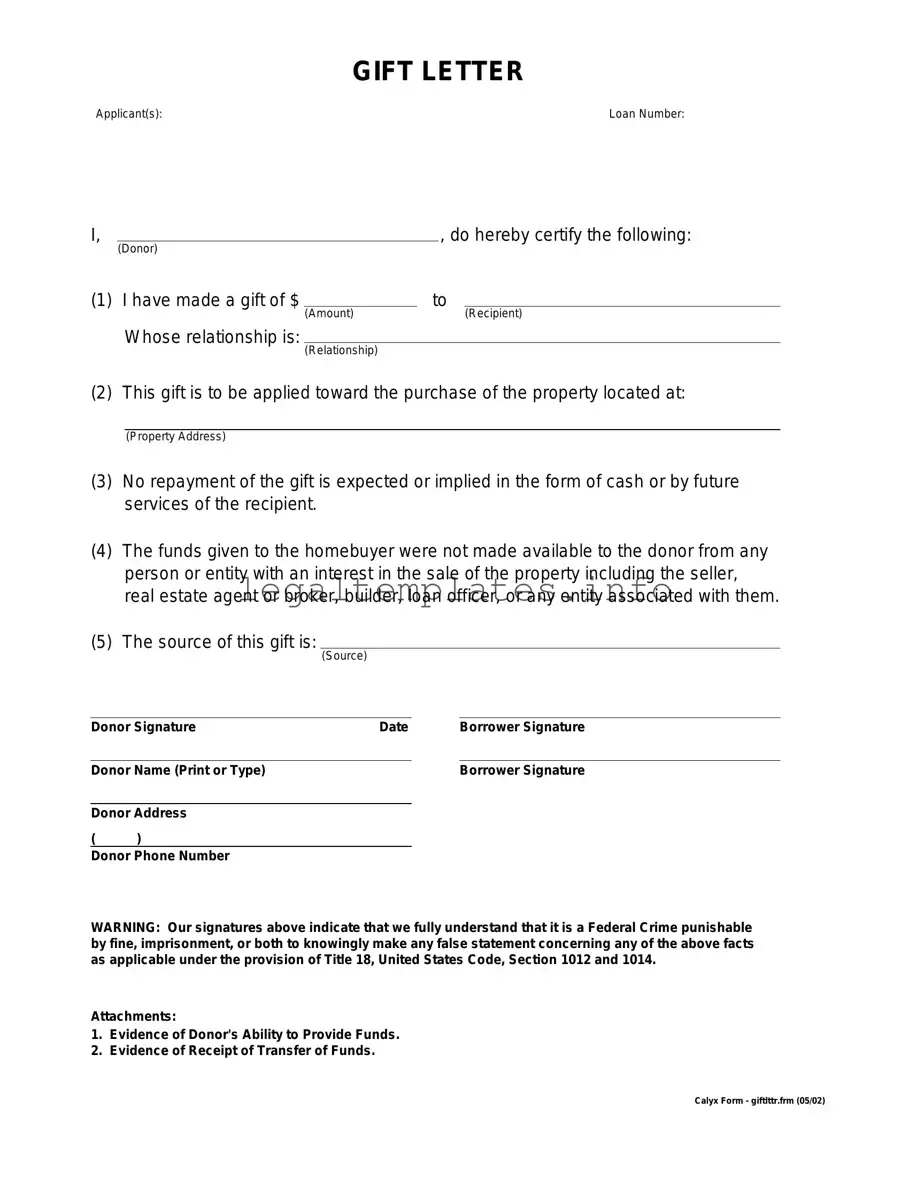

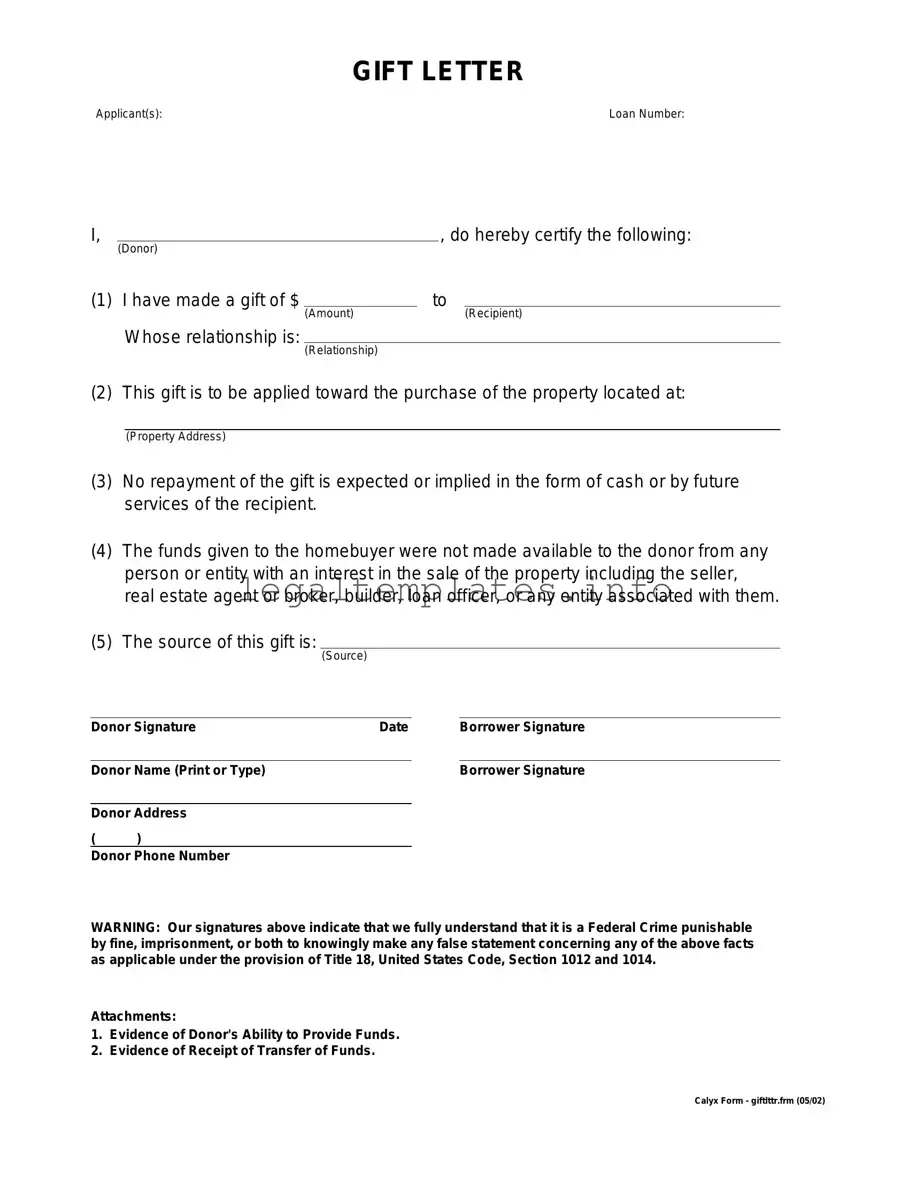

What is a Gift Letter?

A Gift Letter is a document that clearly states that money given by one person to another is a gift, meaning it does not have to be repaid. This form is often used when a family member gives money towards the purchase of a home, ensuring that the lender understands the funds are not an additional loan.

When do I need a Gift Letter?

You might need a Gift Letter during the mortgage application process. If you're receiving financial help towards your down payment or closing costs from someone, your lender will likely require this letter to prove that the assistance is not a loan.

Who can provide a gift according to the Gift Letter?

Typically, gifts can be provided by family members, such as parents, grandparents, siblings, or close relatives. Some lenders may also accept gifts from non-relatives under certain conditions. It's important to check with your lender for their specific requirements.

What information should be included in a Gift Letter?

A Gift Letter should clearly identify the donor and recipient, the relationship between them, the exact amount of the gift, a statement that no repayment is expected or required, and the purpose of the gift. It should also include the signatures of both the donor and recipient.

Is there a specific format for a Gift Letter?

While there's no one mandatory format, a Gift Letter should be clear and contain all necessary information to satisfy lender requirements. Many lenders have their own form or preferred format, so it's wise to check with them first.

Can a Gift Letter affect my taxes?

For the donor, large gifts may have implications for gift taxes. The recipient usually does not have to worry about taxes, as gifts are not considered taxable income. However, it's a good idea to consult with a tax professional to understand any potential tax implications.

Does the donor need to prove the source of the gift funds?

Yes, lenders often require donors to provide evidence of where the gift money came from. This can include bank statements or other financial documents. It helps lenders ensure the money is indeed a gift and not a loan in disguise.

How does a Gift Letter protect the recipient?

A Gift Letter helps assure the lender that the recipient has the financial support needed to complete the home purchase without risking additional debt. It's a safeguard that clarifies the nature of the support as a gift, not a loan.

Can a Gift Letter be rescinded?

Once a gift is given and the letter is signed, it's typically not possible to rescind the gift, given it’s supposed to indicate the transfer of funds with no expectation of repayment. Any change of heart or circumstances would involve legal aspects beyond the scope of a simple Gift Letter.