What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided by Goodwill to donors following a donation. It serves as proof of the donation made and can be used for tax deduction purposes, subject to IRS rules.

How can I obtain a Goodwill donation receipt form?

You can obtain a Goodwill donation receipt form at the time of your donation. Goodwill staff will provide you with a receipt when you drop off your items. Alternatively, for mailed donations or special cases, you may contact your local Goodwill to request a receipt.

Is it necessary to fill out the entire donation receipt form?

Yes, it is recommended to fill out the form completely. Providing all requested details ensures the receipt can be properly used for tax deduction purposes and helps in maintaining accurate records of your donation.

Can I claim a tax deduction without a Goodwill donation receipt?

No, the IRS requires donors to have a documented record, such as a donation receipt, to claim a tax deduction for any non-cash items donated. Therefore, securing a receipt is crucial if you plan to deduct your donation on your tax return.

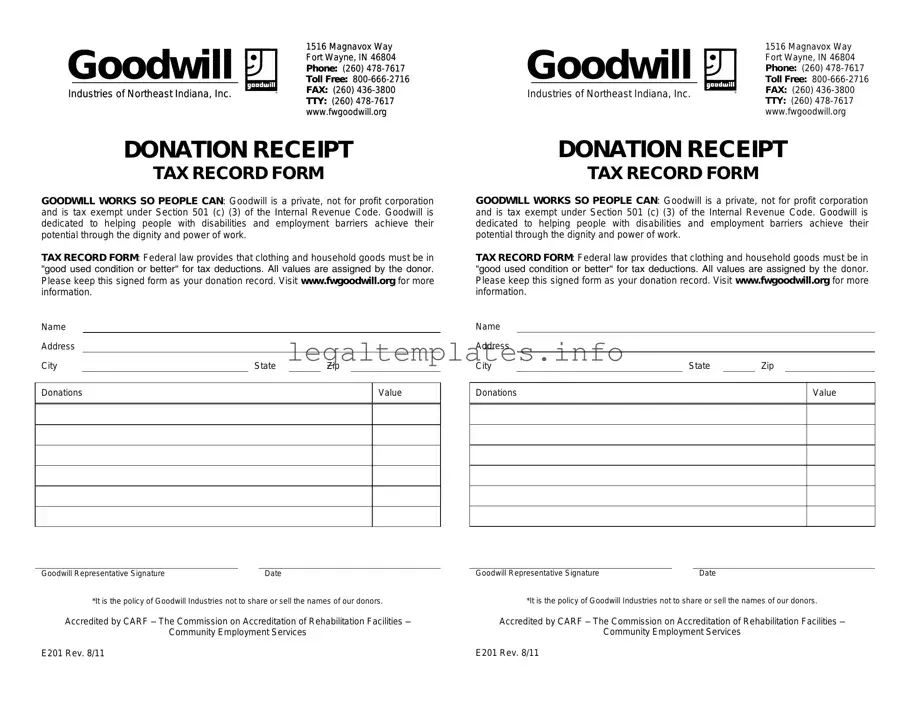

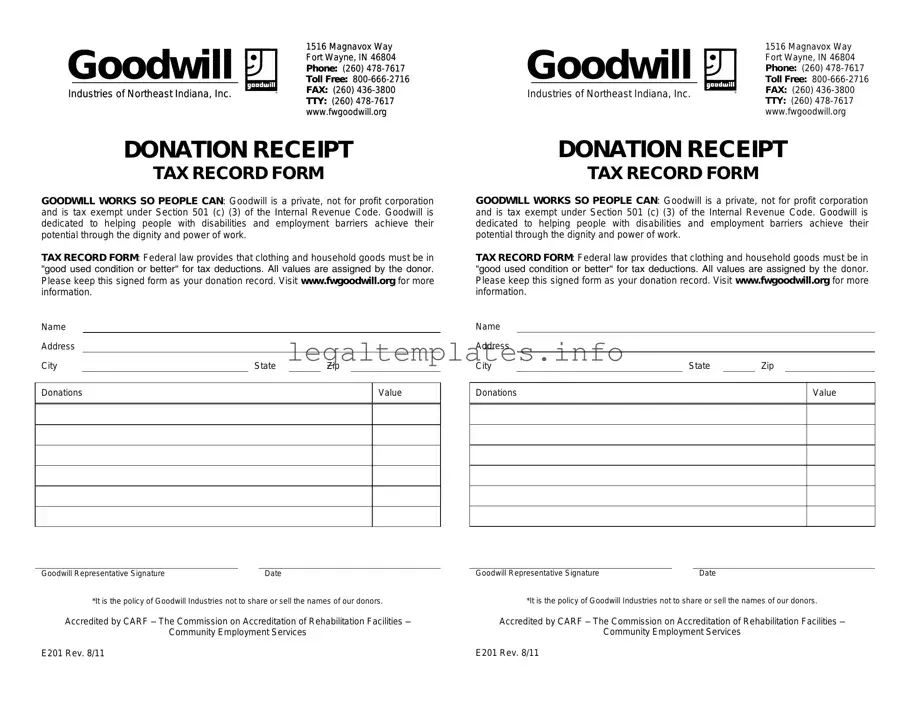

What information is included on a Goodwill donation receipt form?

The form typically includes the donor's name, the date of the donation, a detailed list of items donated, and the location of the Goodwill store or donation center. Some forms may also have a section for the Goodwill employee’s signature or the donor’s signature.

How should I value my donated items for the receipt?

It is the donor's responsibility to determine the value of the items donated. Fair Market Value (FMV) is the standard, which is the price items would sell for in an open market. Goodwill provides donation valuation guides on their website to assist donors.

Can I get a donation receipt for a monetary donation?

Yes, Goodwill provides receipts for monetary donations as well. You should receive a receipt showing the amount of your monetary contribution. For online donations, a receipt is typically sent via email.

What if I lose my Goodwill donation receipt?

If you lose your receipt, contact the Goodwill location where you made your donation as soon as possible. They may be able to issue a duplicate receipt based on their records of your donation.

Are there any limitations on what can be included in a donation receipt?

The receipt only includes items that Goodwill accepts as donations. Goodwill does not accept certain items, such as hazardous materials or severely damaged goods. It's important to check with Goodwill's accepted items list before donating.

How long should I keep my Goodwill donation receipts?

It's advisable to keep your donation receipts for at least three years from the date of filing the tax return that includes the charitable contribution deduction. In case of an IRS audit, these receipts will serve as necessary documentation of your donations.