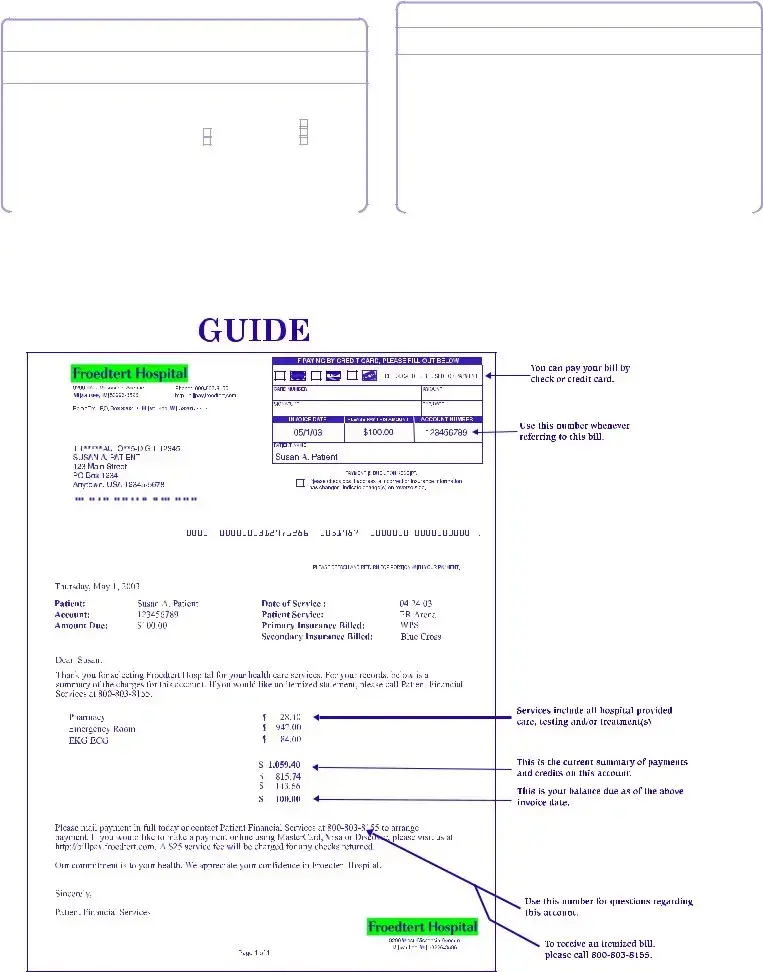

The hospital bill form closely resembles a utility bill in structure and purpose. Both documents list charges for services provided – in one case, health services, and in the other, utilities like electricity, water, or gas. Each document includes the service dates, total charges, payments already made, and the balance due. Additionally, they provide instructions for payment, including the method of payment (like by check or credit card), and the address or online portal where payments should be sent. Just as the hospital bill may detail charges for specific services such as emergency room use or pharmacy charges, a utility bill might break down usage costs across different services or time frames.

Similar to an insurance premium statement, the hospital bill informs the receiver about the amount due for services rendered, reflecting any adjustments or payments already applied, much like an insurance bill outlines premiums due while accounting for any previous payments or adjustments. Both documents often request payment upon receipt and provide specific details on how to pay, including online options or via mail. They also contain detailed contact information for questions or disputes and may indicate a due date by which payment should be received to avoid additional fees or service interruption.

An invoice for freelance services shares similarities with the hospital bill, as both itemize the services provided and their respective costs. They both list an account or invoice number, detail payments or adjustments already accounted for, and clearly state the balance that remains due. Just as a hospital bill might include instructions for disputing charges or requesting more information, a freelance invoice often provides terms and conditions, including payment timelines, late payment policies, and contact information for queries. Moreover, both documents serve as a formal request for payment, aiming to settle financial transactions for services rendered.

The hospital bill form also mirrors a credit card statement in several ways. Both documents list transactions (or services) provided over a given period, showing past payments, current charges, and the total amount owed. They also provide detailed information on how to make a payment, whether online, over the phone, or through the mail. Credit card statements and hospital bills may include sections dedicated to important messages or notices about the account, such as changes in terms or advice on how to seek assistance with billing issues. Additionally, both types of documents emphasize the importance of prompt payment to avoid late fees or other penalties.

A mortgage statement is another document with notable parallels to a hospital bill. Each outlines important account details at the top—such as account number, date, and customer information—followed by a breakdown of charges or payments due. In a hospital bill, this might include individual service charges, adjustments, and the total due, while a mortgage statement would detail the principal, interest, escrow payments if applicable, and the total monthly payment. Both encourage the holder to review their personal information for accuracy and update any changes. They also explain how to make a payment and might provide information on how to get help if the person is unable to pay.