What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that details the payment an independent contractor receives from a company for services rendered. It typically includes information such as the amount paid, any taxes withheld, and a breakdown of hours or services provided. Although independent contractors do not receive a traditional paycheck like employees, this document serves as a record of payment.

Why do independent contractors need a Pay Stub?

Independent contractors may need a Pay Stub for various reasons such as personal record-keeping, income verification for loan or mortgage applications, and tax purposes. It provides a detailed summary of their earnings from each client, which is essential for managing finances and fulfilling tax obligations.

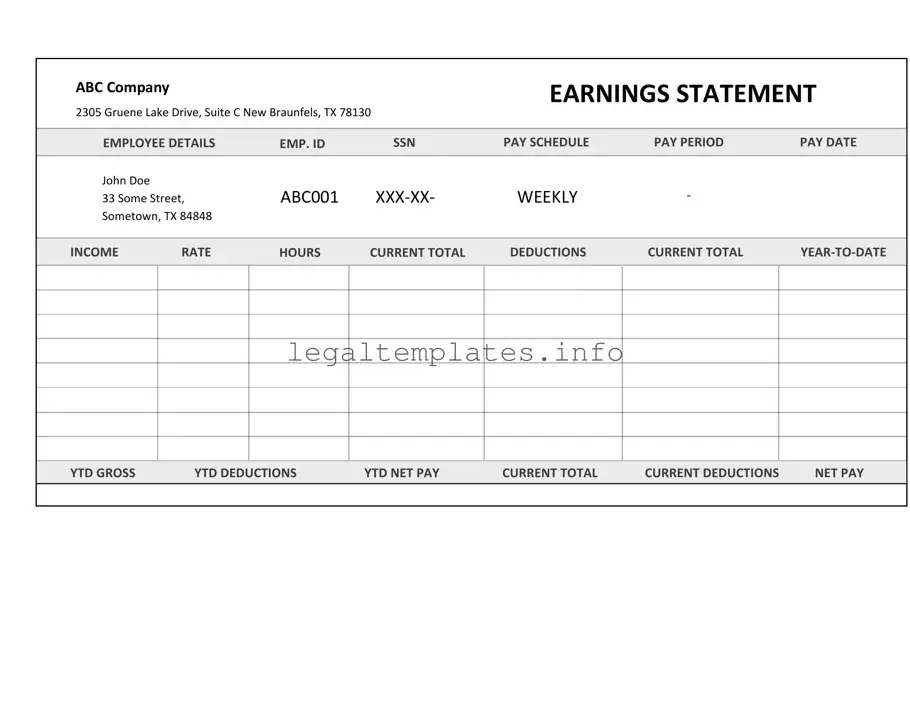

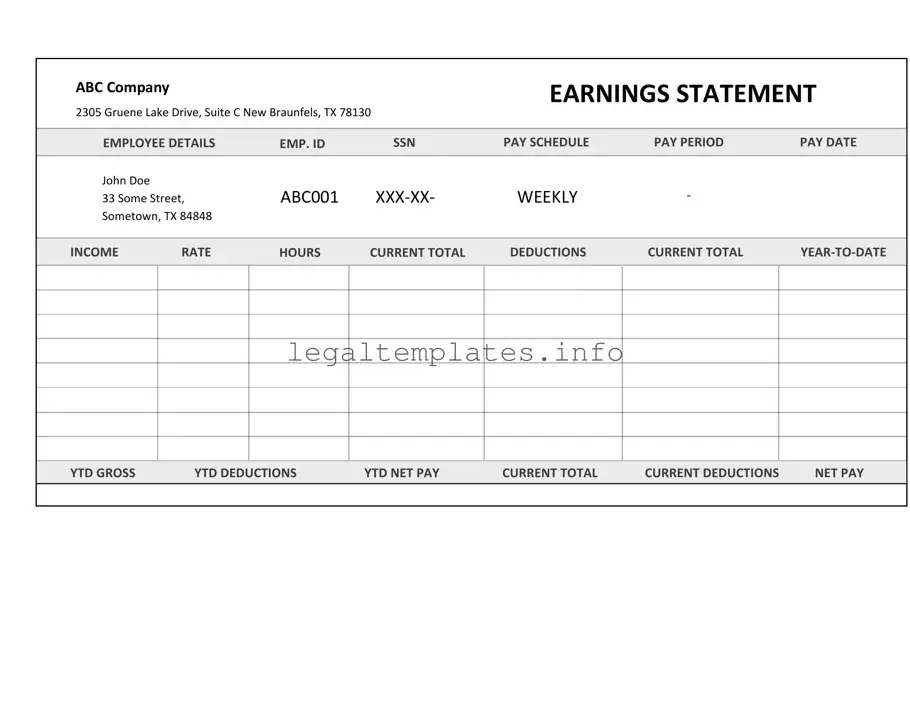

What information is included on an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub typically includes the contractor's name and contact information, the payer's name and contact information, the pay period, the total amount paid before deductions (if any), a breakdown of any deductions (such as for materials or tools), and the total amount paid after deductions.

How can an independent contractor create a Pay Stub?

Independent contractors can create a Pay Stub using various methods including accounting software, templates available online, or by manually creating a document that includes all the necessary information. It's important to ensure that the Pay Stub is accurate and reflects all payments and deductions correctly.

Are there any legal requirements for providing Pay Stubs to independent contractors?

While the specific legal requirements can vary by jurisdiction, in general, there is no legal obligation for companies to provide Pay Stubs to independent contractors as they do for employees. However, it's a best practice to offer detailed payment records to maintain transparency and professionalism.

Can an Independent Contractor Pay Stub be used as a legal document?

Yes, an Independent Contractor Pay Stub can be used as a legal document for the purposes of income verification and in disputes regarding payment. Therefore, it is critical for both parties to maintain accurate records of payments made and received.

How often should independent contractors receive a Pay Stub?

The frequency at which an independent contractor receives a Pay Stub depends on their agreement with the payer. Typically, it coincides with each payment, which could be upon completion of a project or on a regular billing cycle, such as monthly.

What should an independent contractor do if there is a discrepancy in their Pay Stub?

If an independent contractor finds a discrepancy in their Pay Stub, they should immediately contact the payer to discuss and resolve the issue. Keeping detailed records of hours worked and communication regarding payment terms can help prevent and solve these discrepancies efficiently.

Do Independent Contractor Pay Stubs need to be kept for tax purposes?

Yes, it is crucial for independent contractors to keep their Pay Stubs for tax purposes. These documents serve as proof of income and can be invaluable in case of an audit by the IRS or other tax authorities.

Is it mandatory for independent contractors to deduct taxes from their payments?

Independent contractors are responsible for managing their own taxes, including income tax and self-employment tax. Unlike employees, taxes are typically not withheld from their payments by the payer. Therefore, it is essential for independent contractors to accurately report their income and manage their tax obligations effectively.