What is a Notice of Intent to File a Lien in Florida?

A Notice of Intent to File a Lien is a legal document that a service provider, such as a contractor or supplier, sends to a property owner to inform them of the provider's plan to place a lien on the property. This action is usually due to unpaid bills for labor, professional services, or materials provided to improve the property. In Florida, this notice is a prerequisite that must be served at least 45 days before officially filing a lien, as stipulated by Florida Statutes §713.06(2)(a).

Why is serving a Notice of Intent to File a Lien necessary?

Serving a Notice of Intent to File a Lien is necessary because it fulfills a legal requirement under Florida law, specifically helping to ensure that property owners are duly informed about the outstanding debt and the potential filing of a lien against their property. It offers an opportunity for the property owner to resolve the debt before the lien is officially recorded, thereby avoiding legal complications and additional costs such as attorney's fees and court expenses. The notice acts as a formal warning, encouraging prompt payment and possibly preventing the need for further legal action.

How can one serve the Notice of Intent to File a Lien in Florida?

In Florida, the Notice of Intent to File a Lien can be served through several methods including certified mail with return receipt requested, registered mail, hand delivery, delivery by a professional process server, or publication. The chosen method should ensure that the notice is directly and effectively delivered to the property owner, and where applicable, to the general contractor. A Certificate of Service at the bottom of the notice documents the method of service, which is crucial for proving that the property owner was properly informed.

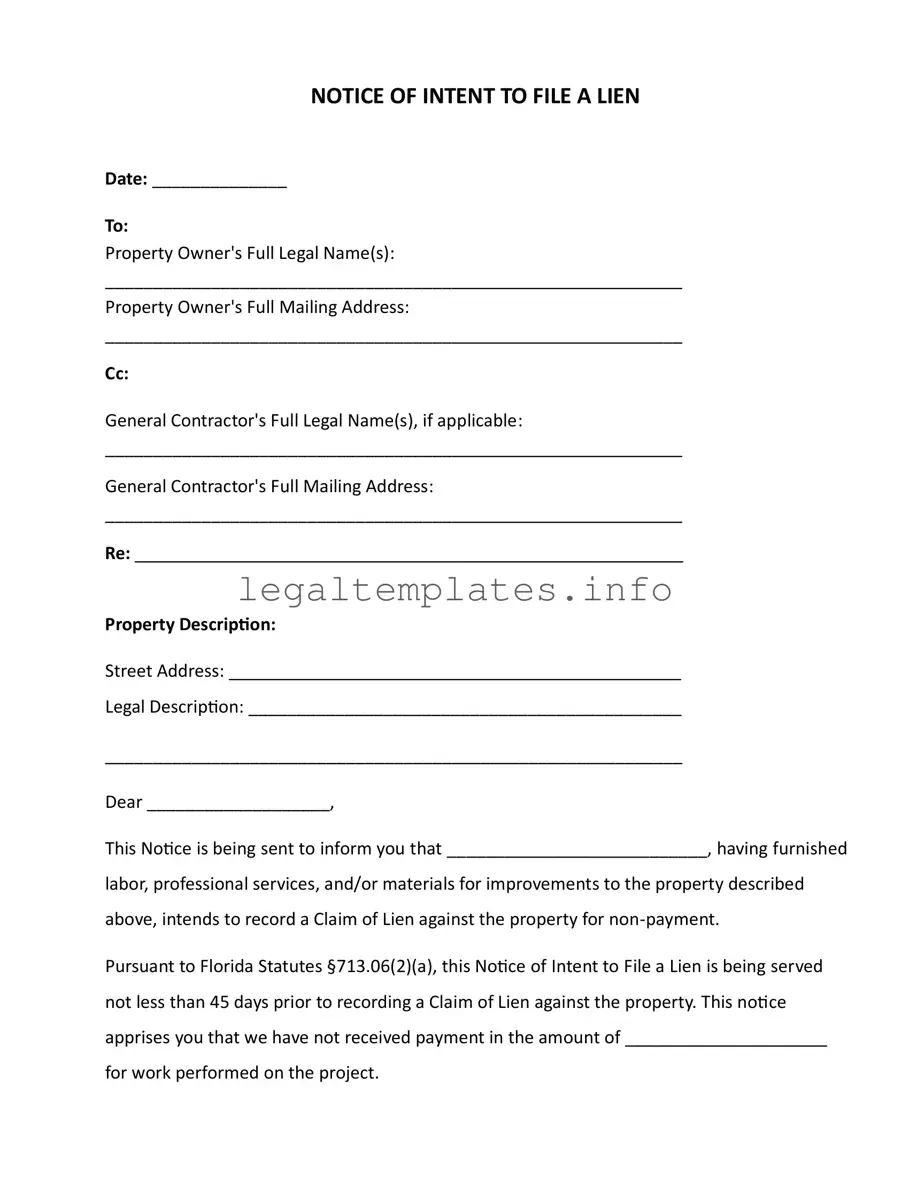

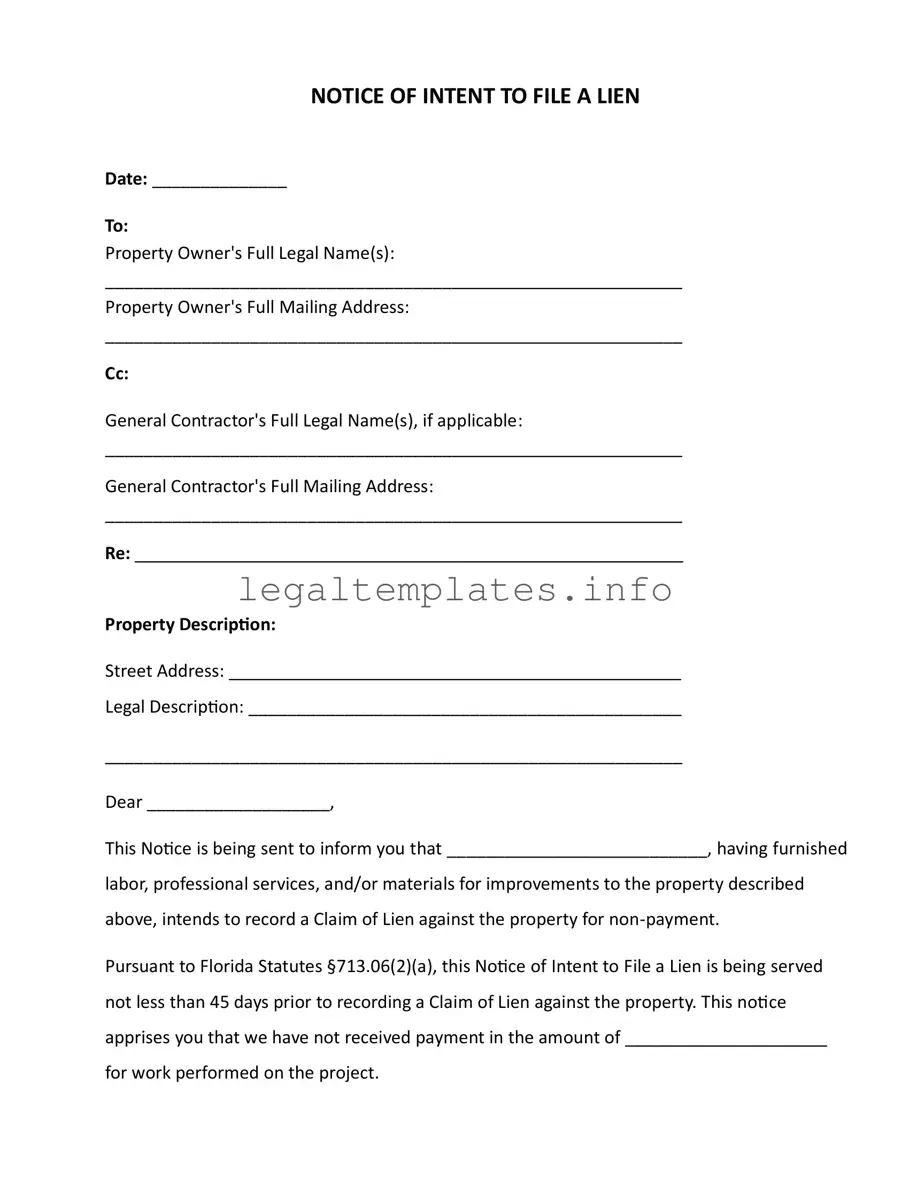

What information must be included in the Notice of Intent to File a Lien?

The Notice must include the date, the property owner’s full legal name, and mailing address, the general contractor’s full legal name and mailing address (if applicable), a brief description of the property involved, and a detailed account of the claim. This includes the unpaid amount and a description of the labor, services, or materials provided. Furthermore, it must state the intent to file a lien against the property if payment is not received within a stipulated period. Official signatures and a Certificate of Service also need to be part of the document.

What should a property owner do upon receiving a Notice of Intent to File a Lien?

Upon receiving a Notice of Intent to File a Lien, the property owner should immediately review the claim to verify its validity and then take steps to resolve the outstanding debt. This can involve directly paying the owed amount or contacting the claimant to dispute the claim if it's believed to be unjustified. Property owners are encouraged to consult with a legal professional to explore their options and understand their rights under Florida law. Prompt action can prevent the lien from being filed, thereby avoiding additional legal fees and potential foreclosure proceedings.

What are the consequences of ignoring a Notice of Intent to File a Lien?

Ignoring a Notice of Intent to File a Lien can lead to significant legal and financial consequences for a property owner. If action is not taken within the specified 30 days, the claimant may proceed with filing the lien, which becomes a public record attached to the property's title. This can hinder the owner's ability to sell or refinance the property. Subsequently, if the debt remains unpaid, it could result in foreclosure proceedings. The property owner may also be liable for attorney's fees, court costs, and other related expenses.

How long does one have to file a lien after serving the Notice of Intent in Florida?

After serving the Notice of Intent to File a Lien, Florida statutes provide a claimant with at least 45 days to proceed with filing the actual lien. This period allows the property owner adequate time to settle the claim and avoid the lien. However, it's important to note that the actual lien needs to be filed within 90 days of the claimant's last date of providing labor, services, or materials, as dictated by Florida law. Thus, timely serving the notice is critical for maintaining the right to file a lien.

Can a filed lien be disputed or removed?

Yes, a filed lien can be disputed or removed. Property owners can challenge the validity of the lien if they believe it has been improperly filed, the amount claimed is incorrect, or the services/materials were not provided as stated. The dispute can be resolved through negotiation, mediation, or legal proceedings. Additionally, the lien can be removed by paying the debt in full, which should be followed by the claimant releasing the lien. If a resolution cannot be reached, the court may be involved to determine the lien’s validity and the appropriate course of action.