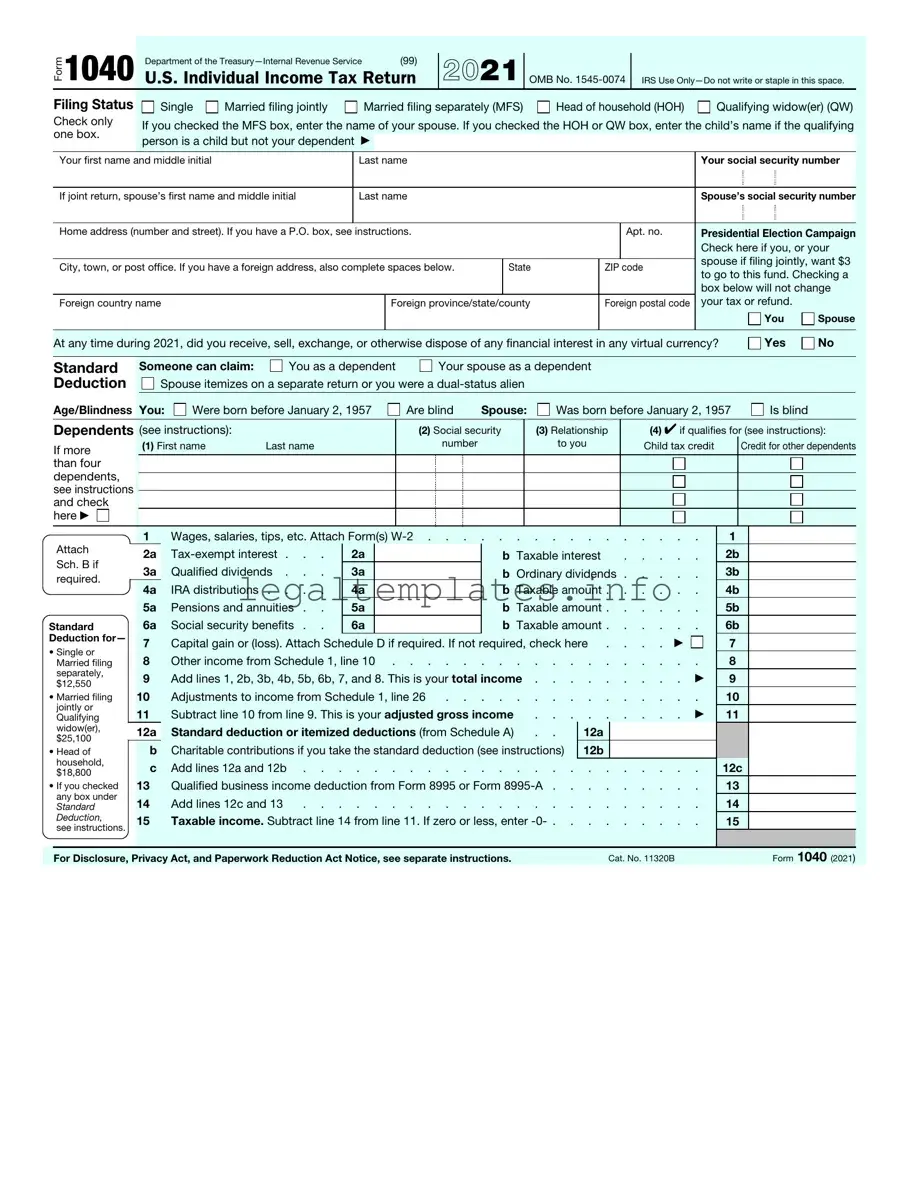

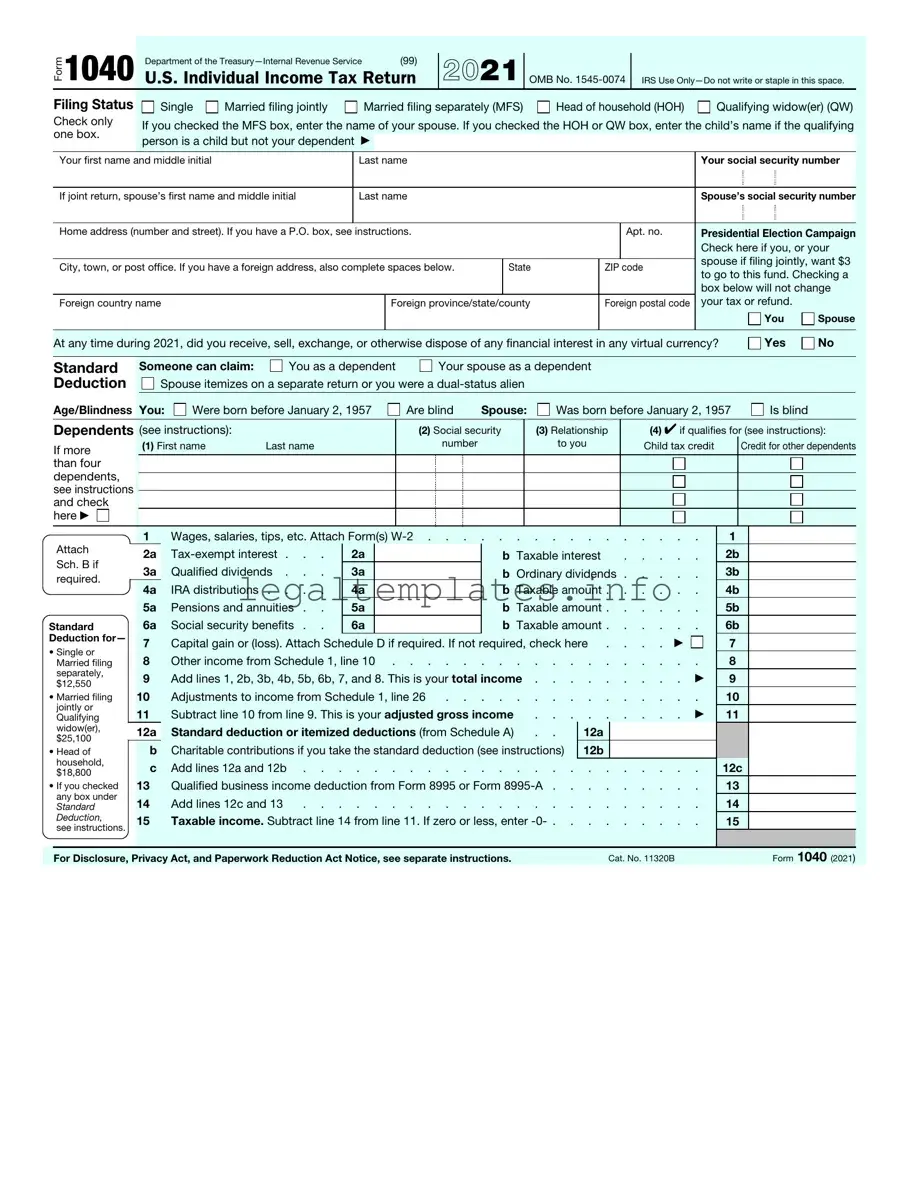

The IRS 1040 form is primarily used for filing individual income tax returns in the United States. Similar to this form, the IRS 1040-SR form is designed for senior citizens, offering a more readable format with larger print and a chart to help calculate the standard deduction. This adaptation acknowledges the specific needs of older taxpayers, simplifying the tax filing process for them.

Another document akin to the IRS 1040 is the Schedule C form, which is used by sole proprietors to report profits or losses from a business. This form complements the IRS 1040, as it details the income and expenses related to self-employment or business ownership, which then factors into the individual's overall tax liability or refund.

The IRS 1040-ES form, meant for estimated tax payments, also shares similarities. Freelancers, independent contractors, and other self-employed individuals use this form to pay their taxes quarterly, ensuring they cover their tax liability for the year, thus avoiding underpayment penalties. These estimated payments are eventually reconciled with the annual tax return filed using the IRS 1040 form.

Similar to the 1040 form, the IRS W-2 form is an essential document that details an employee's annual wages and the amount of taxes withheld by their employer. While the W-2 is not filed with the taxpayer’s return, the information it contains is crucial for accurately completing the 1040 form, as it affects the computation of taxable income and potential refunds or tax dues.

The 1099-MISC form, like the IRS 1040, is integral to the tax filing process but from the perspective of freelance or contract work. It reports income from various sources other than wages, salaries, and tips. The information from 1099-MISC needs to be reported on the 1040 form, affecting the tax calculations for individuals receiving this form.

The IRS Form 4868 offers a parallel in the sense that it is used to request an extension for filing taxes. This form applies when individuals need more time beyond the April deadline to submit their 1040 form. Though it grants an extension for filing, it does not extend the time to pay any taxes owed, emphasizing the need to estimate and pay taxes to avoid penalties.

Form W-4 is employed by employees to inform employers of their withholding preferences. This document directly influences how much federal income tax is withheld from their paycheck, impacting the final tax obligation reported on the IRS 1040 form. Updates to the W-4 can result in changes to the refund or amount owed when the individual files their yearly tax return.

Lastly, the Schedule A (Itemized Deductions) form bears resemblance to the IRS 1040 in its role in tax computation. Taxpayers use Schedule A to list allowable deductions, such as medical expenses, charitable contributions, and mortgage interest, which can potentially lower their taxable income reported on the 1040 form. This method contrasts with taking the standard deduction and is chosen based on which option yields the greater tax benefit.