What is the IRS 2553 Form?

The IRS 2553 Form, also known as the Election by a Small Business Corporation form, is used by small businesses to request S corporation status for tax purposes. By electing to be treated as an S corporation, companies can pass corporate income, losses, deductions, and credits directly to their shareholders to be taxed at individual rates, thereby avoiding double taxation.

Who can file Form 2553?

Only certain entities can file Form 2553. These include domestic corporations and Limited Liability Companies (LLCs) that have made an election to be treated as a corporation. The entity must meet the IRS's requirements to qualify as a small business corporation, including having a permissible number of shareholders, having only allowable shareholders (which include individuals, certain trusts, and estates but not partnerships or non-resident alien shareholders), and having only one class of stock.

When should Form 2553 be filed?

Form 2553 must be filed no later than two months and 15 days after the beginning of the tax year the election is to take effect. Alternatively, it can be filed any time during the tax year preceding the tax year it is to take effect. For an election to be effective for the current tax year, the form must be filed by the aforementioned deadline. Late elections may still be accepted if the corporation can show that the failure to file on time was due to reasonable cause.

How to file Form 2553?

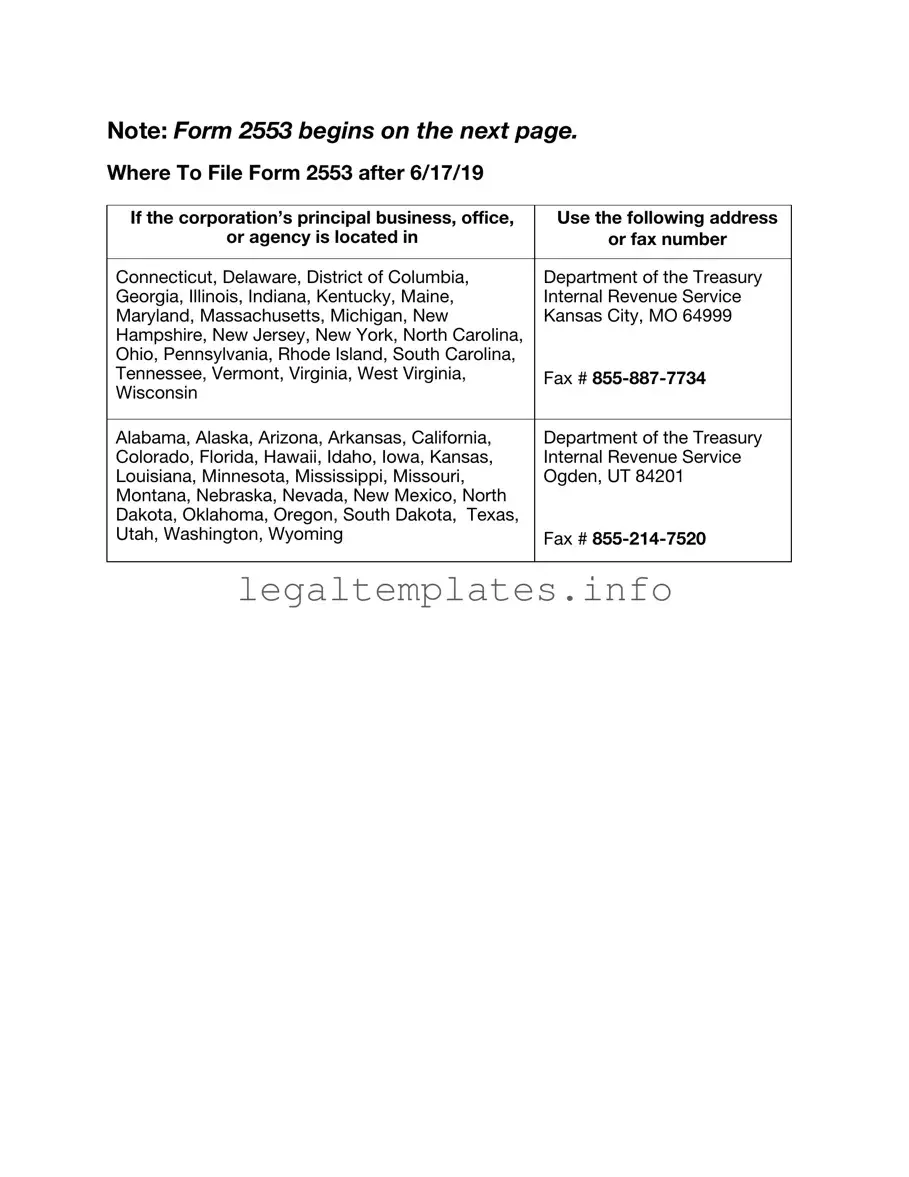

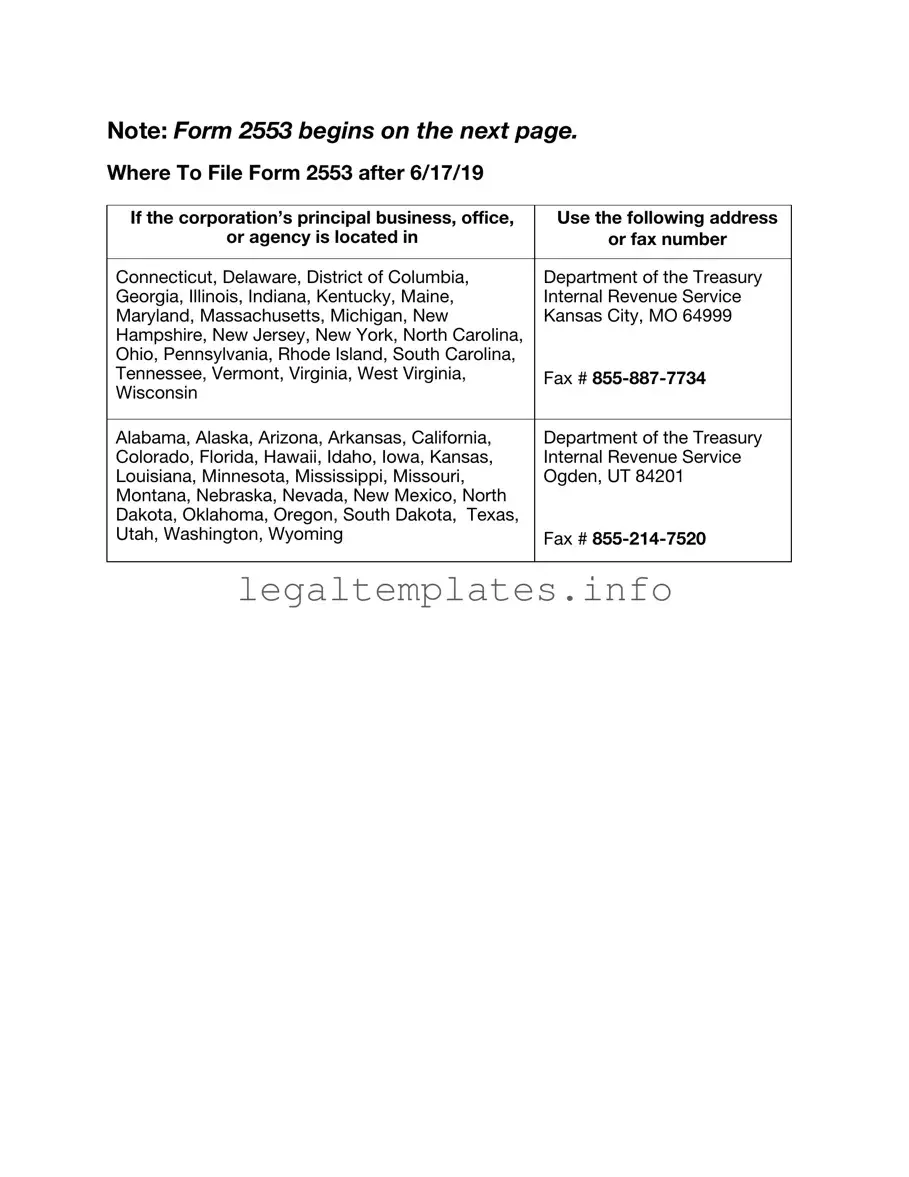

Form 2553 can be filed via mail or fax. The specific mailing address or fax number depends on the state where the business's principal business, office, or agency is located. The form requires comprehensive information about the corporation, including its name, address, employer identification number (EIN), and the tax year for which the election applies. Additionally, all shareholders must consent to the election by signing the form.

Can Form 2553 be filed electronically?

As of the last known update, Form 2553 cannot be filed electronically. It must be submitted through mail or fax, following the instructions provided by the IRS for the specific filing addresses or fax numbers applicable to your entity's location.

What happens after Form 2553 is filed?

After Form 2553 is filed, the IRS will process the election and send a letter of acceptance or rejection. Acceptance letters confirm the S corporation status and its effective date. If the form is rejected, the letter will explain the reasons for rejection, and entities may have the opportunity to address any issues and resubmit the form.

Are there any deadlines for the IRS to respond to a Form 2553 filing?

The IRS does not have a fixed deadline to respond to a Form 2553 filing. However, it typically takes around 60 days to receive a response. It is advisable to call the IRS if a confirmation letter has not been received within this timeframe to check on the status of the filing.

What are the common mistakes to avoid when filing Form 2553?

Common mistakes include not obtaining all required shareholder signatures, incorrect or incomplete information about the corporation, filing the form late without a reason that meets the IRS's reasonable cause criteria, and not using the form's most current version. Ensuring accuracy and completeness when filing can help avoid processing delays or rejections.

Can the S corporation election be terminated or revoked?

Yes, an S corporation status can be terminated or revoked either voluntarily by the shareholders or involuntarily by failing to meet the IRS's eligibility criteria. To revoke the election voluntarily, a statement must be filed with the IRS indicating the desire to revoke the election, signed by shareholders holding more than 50% of the shares. There are specific rules and implications for termination, so consultation with a tax advisor is recommended.

Is there any relief available for entities that miss the filing deadline?

The IRS provides relief for entities that miss the filing deadline under certain conditions. If an entity can show that the failure to file on time was due to reasonable cause, the IRS may allow a late election. Detailed instructions for requesting late election relief are outlined in the IRS's regulations and revenue procedures related to Form 2553.

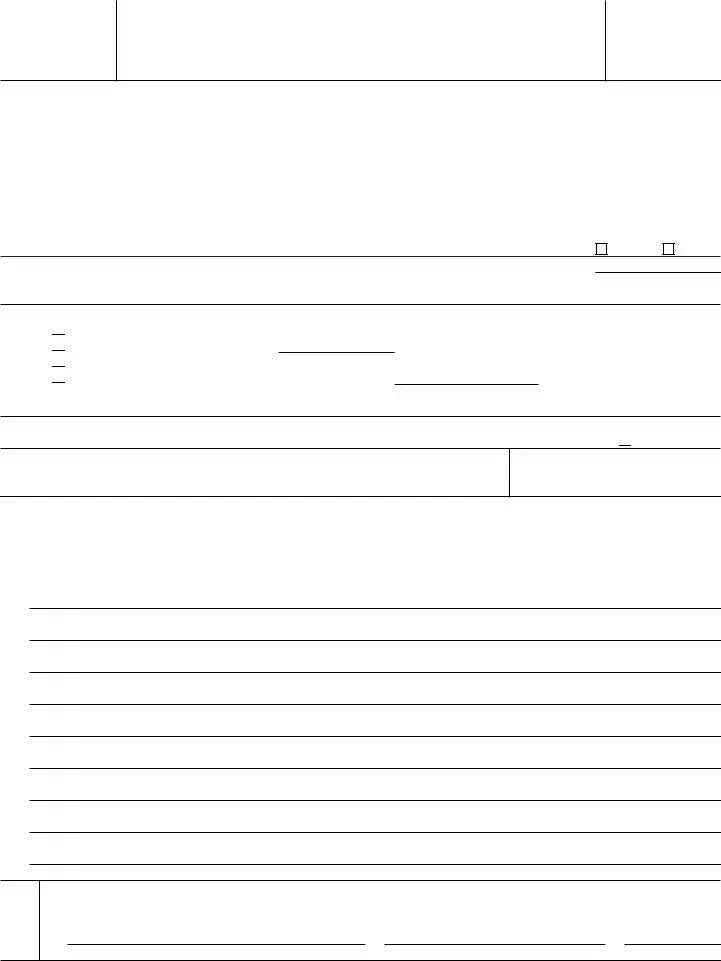

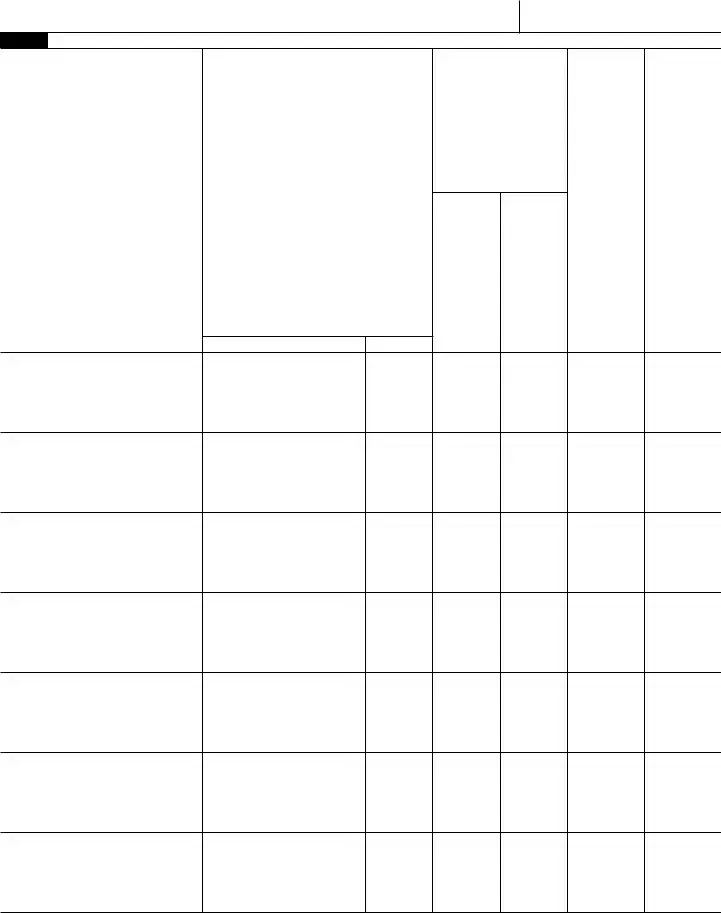

Calendar year

Calendar year Fiscal year ending (month and day)

Fiscal year ending (month and day)

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

to show that the corporation intends to make a

to show that the corporation intends to make a

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.