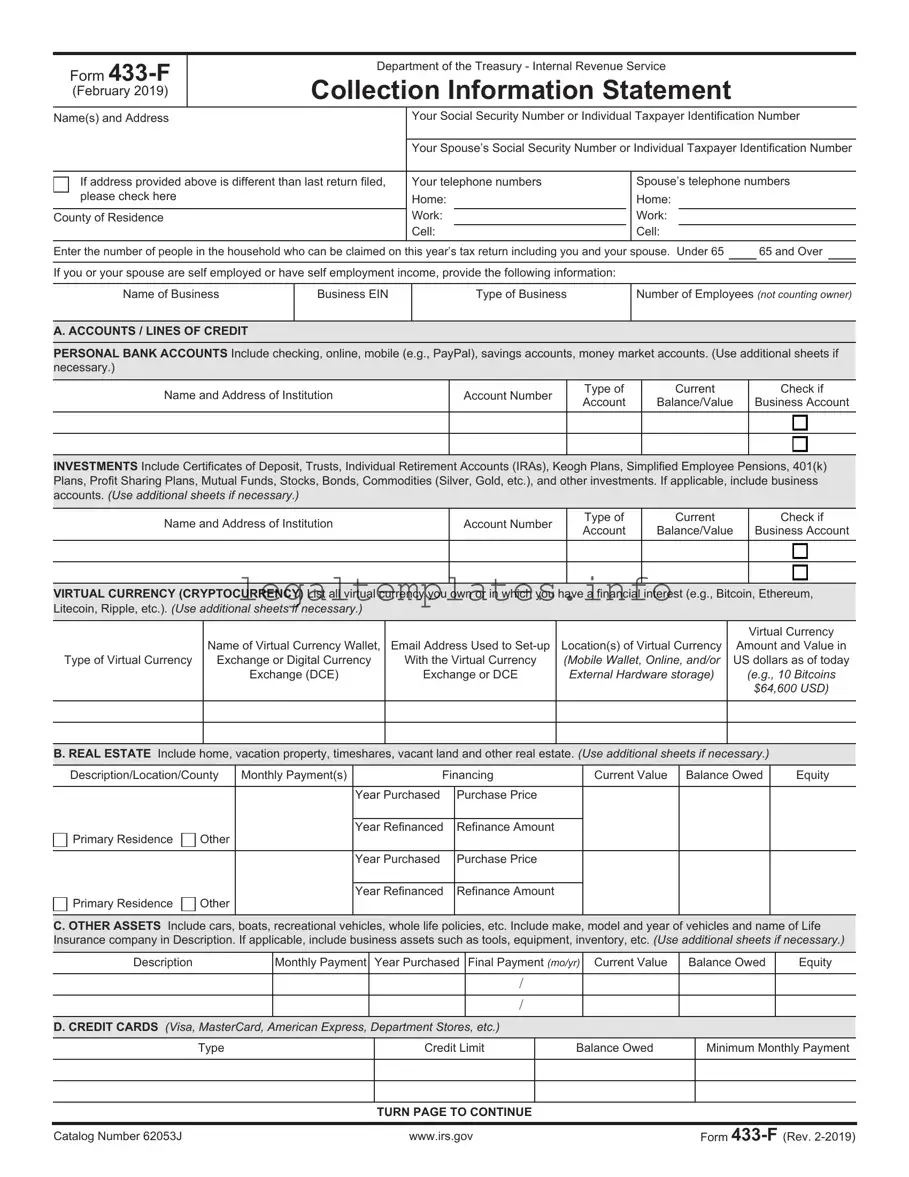

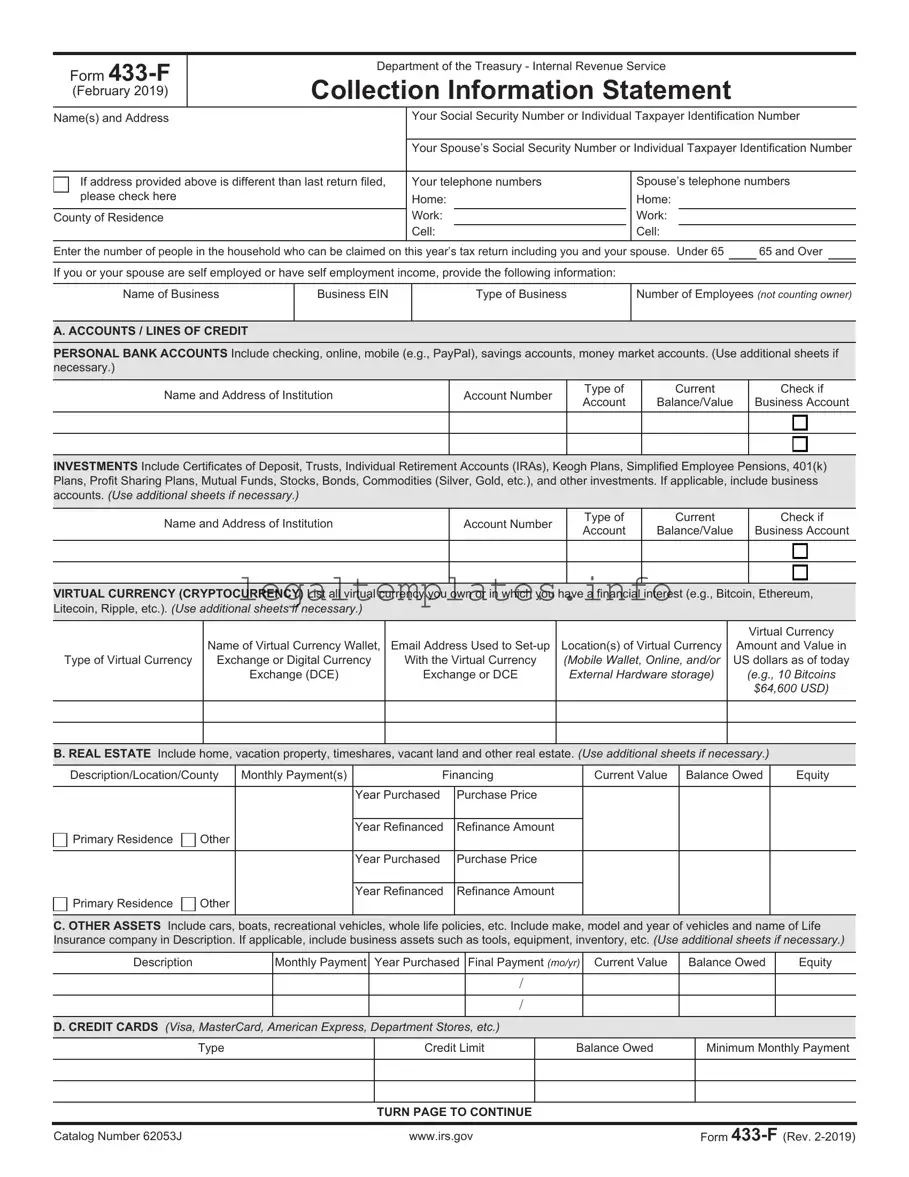

What is the purpose of Form 433F?

Form 433-F is used to obtain current financial information necessary for determining how a wage earner or self-employed individual can satisfy an outstanding tax liability.

Note: You may be able to establish an Online Payment Agreement on the IRS web site. To apply online, go to https://www.irs.gov, click on “I need to pay my taxes,” and select “Installment Agreement” under the heading “What if I can't pay now?”

If you are requesting an Installment Agreement, you should submit Form 9465, Installment Agreement Request, along with Form 433-F. (A large down payment may streamline the installment agreement process, pay your balance faster and reduce the amount of penalties and interest.

Please retain a copy of your completed form and supporting documentation. After we review your completed form, we may contact you for additional information. For example, we may ask you to send supporting documentation of your current income or substantiation of your stated expenditures.

If any section on this form is too small for the information you need to supply, please use a separate sheet.

Section A – Accounts / Lines of Credit

List all accounts, even if they currently have no balance. However, do not enter bank loans in this section. Include business accounts, if applicable. If you are entering information for a stock or bond, etc. and a question does not apply, enter N/A.

Section B – Real Estate

List all real estate you own or are purchasing including your home. Include insurance and taxes if they are included in your monthly payment. The county/description is needed if different than the address and county you listed above. To determine equity, subtract the amount owed for each piece of real estate from its current market value.

Section C – Other Assets

List all cars, boats and recreational vehicles with their make, model and year. If a vehicle is leased, write “lease” in the “year purchased” column. List whole life insurance policies with the name of the insurance company. List other assets with a description such as “paintings”, “coin collection”, or “antiques”. If applicable, include business assets, such as tools, equipment, inventory, and intangible assets such as domain names, patents, copyrights, etc. To determine equity, subtract the amount owed from its current market value. If you are entering information for an asset and a question does not apply, enter N/A.

Section D – Credit Cards

List all credit cards and lines of credit, even if there is no balance owed.

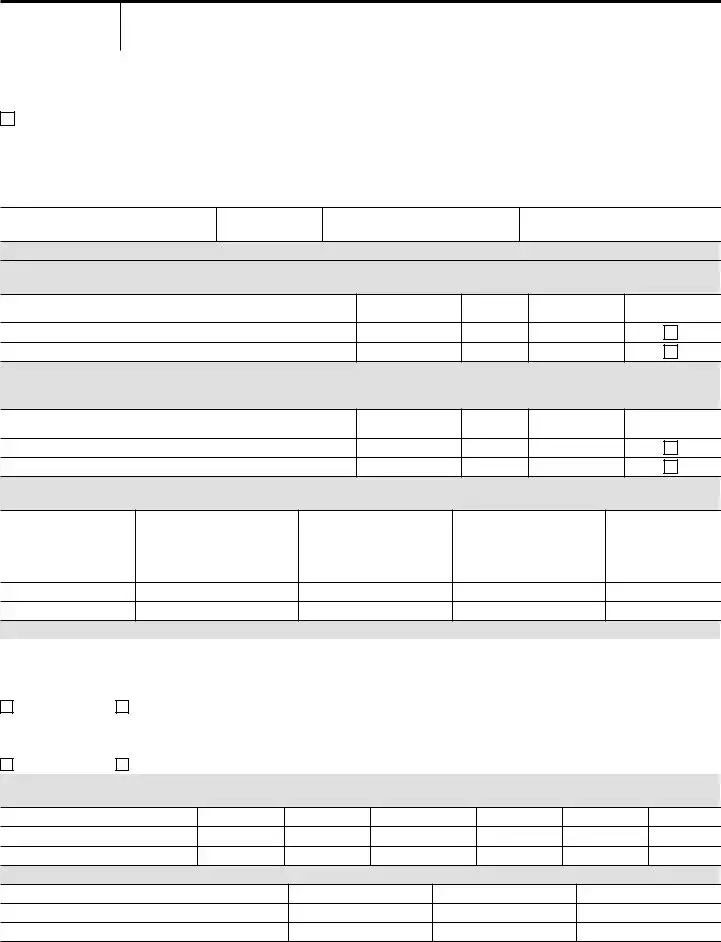

Section E – Business Information

Complete this section if you or your spouse are self-employed, or have self-employment income. This includes self-employment income from online sales.

E1: List all Accounts Receivable owed to you or your business. Include federal, state and local grants and contracts.

E2: Complete if you or your business accepts credit card payments (e.g., Visa, MasterCard, etc.) and/or virtual currency wallet, exchange or digital currency exchange.

Section F – Employment Information

Complete this section if you or your spouse are wage earners.

If attaching a copy of current pay stub, you do not need to complete this section.

Section G – Non-Wage Household Income

List all non-wage income received monthly.

Net Self-Employment Income is the amount you or your

spouse earns after you pay ordinary and necessary monthly business expenses. This figure should relate to the yearly net profit from Schedule C on your Form 1040 or your current year profit and loss statement. Please attach a copy of Schedule C or your current year profit and loss statement. If net income is a loss, enter “0”.

Net Rental Income is the amount you earn after you pay ordinary and necessary monthly rental expenses. This figure should relate to the amount reported on Schedule E of your Form 1040.

Do not include depreciation expenses. Depreciation is a non-cash expense. Only cash expenses are used to determine ability to pay).

If net rental income is a loss, enter “0”.

Other Income includes distributions from partnerships and subchapter S corporations reported on Schedule K-1, and from limited liability companies reported on Form 1040, Schedule C, D or E. It also includes agricultural subsidies, gambling income, oil credits, and rent subsidies. Enter total distributions from IRAs if not included under Pension Income.

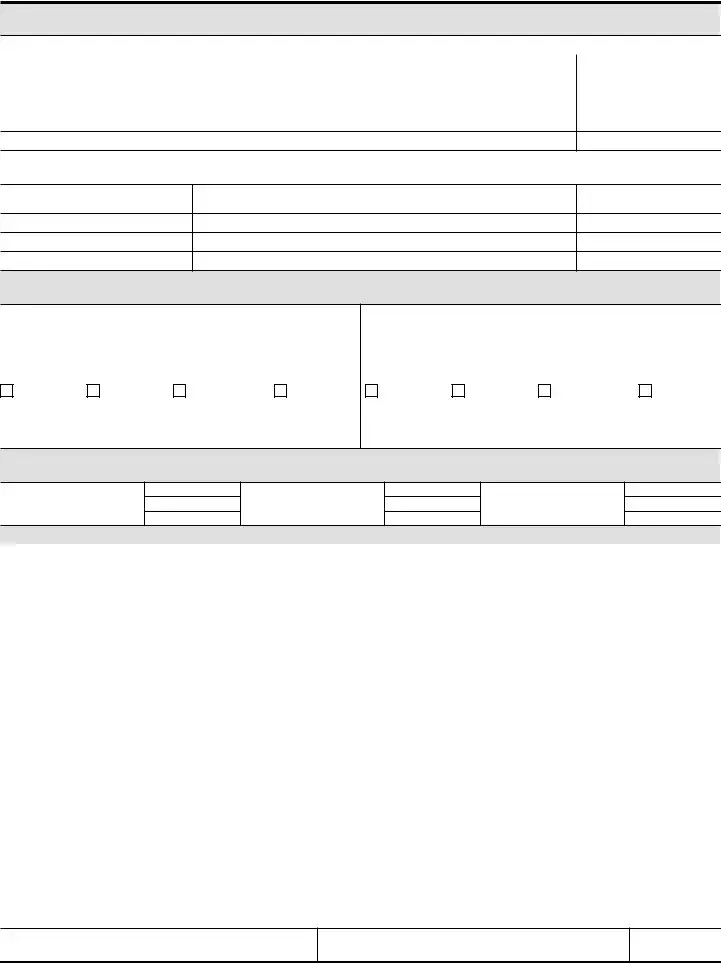

Section H – Monthly Necessary Living Expenses

Enter monthly amounts for expenses. For any expenses not paid monthly, convert as follows:

|

If a bill is paid … |

Calculate the monthly |

|

amount by … |

|

|

|

Quarterly |

Dividing by 3 |

|

|

|

|

Weekly |

Multiplying by 4.3 |

|

|

|

|

Biweekly (every two |

Multiplying by 2.17 |

|

weeks) |

|

|

|

Semimonthly (twice |

Multiplying by 2 |

|

each month) |

|

|