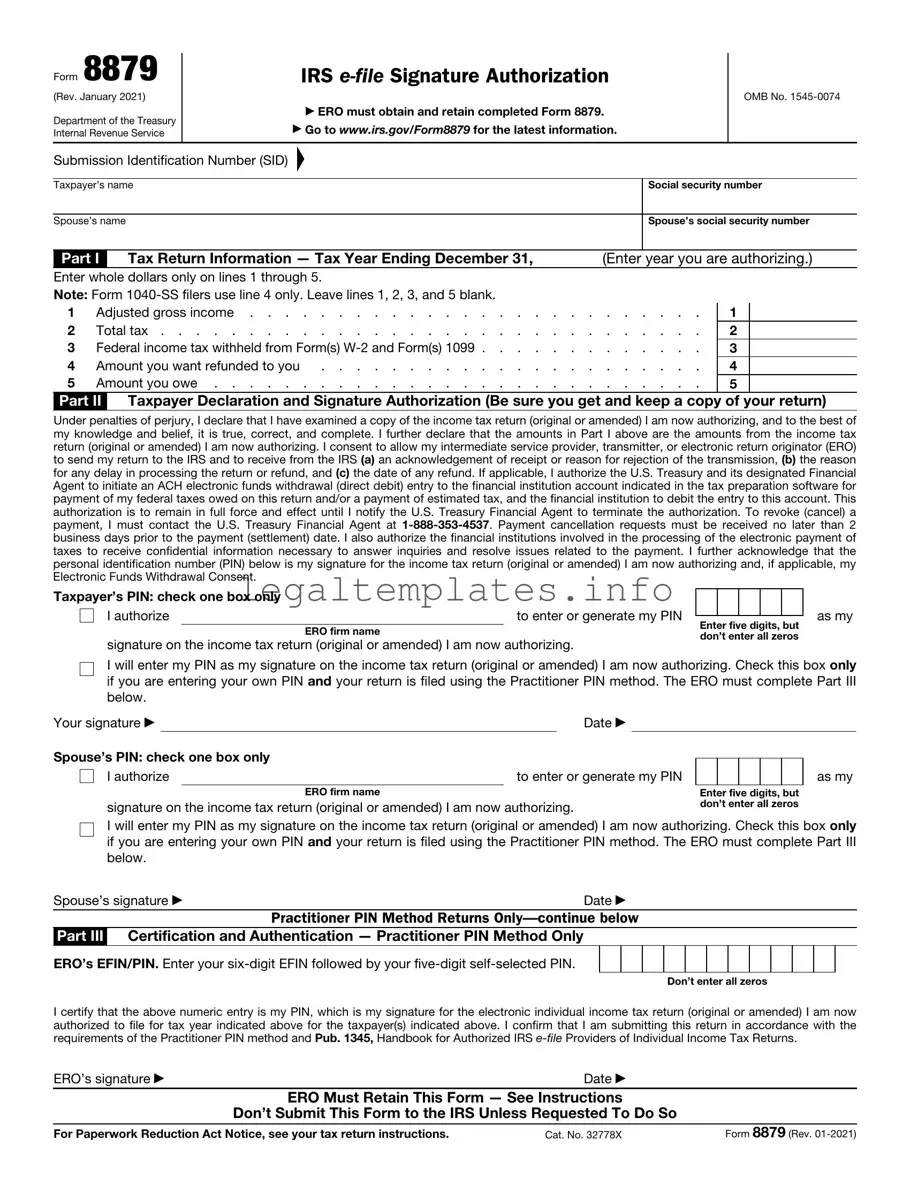

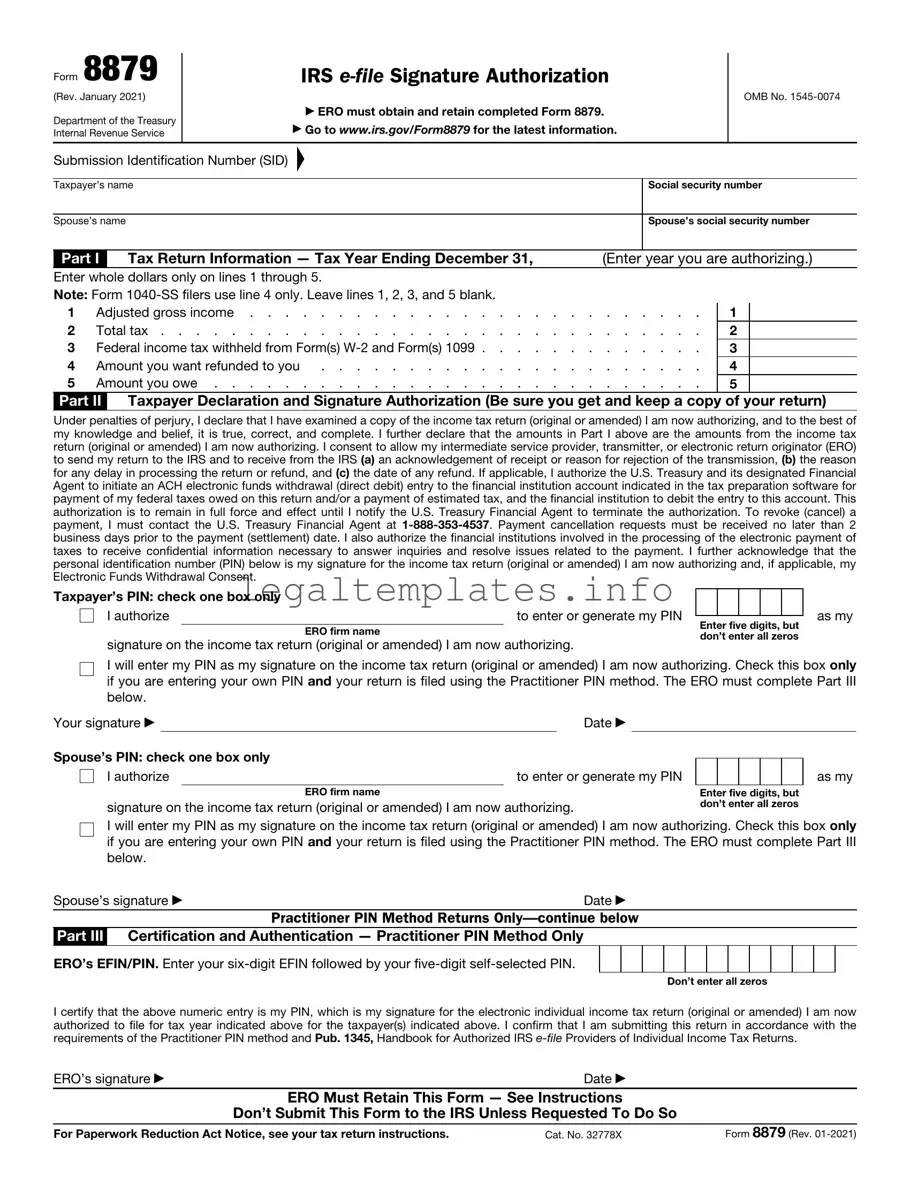

What is the IRS 8879 form?

The IRS 8879 form is an electronic signature authorization form used by taxpayers in the United States. When you file your taxes electronically, this form authorizes the e-file provider to transmit tax return information to the IRS on your behalf. It serves as your official approval of the tax return information submitted, verifying that the information is accurate and complete to the best of your knowledge.

Who needs to sign the IRS 8879 form?

Any taxpayer who decides to file their taxes electronically should sign the IRS 8879 form. This includes both individual taxpayers and those filing jointly. In cases of joint returns, both spouses are required to sign the form to authorize the electronic filing of their tax return.

Is the IRS 8879 form required for all electronic filings?

Yes, for most electronic filings, the IRS 8879 form is required. It is a crucial component of the e-filing process, acting as a digital signature for your tax return. However, there may be specific exceptions or additional requirements depending on the nature of the return or the e-file provider's process.

How do I submit the IRS 8879 form?

Typically, your tax preparer or e-file provider will present you with the IRS 8879 form to sign after completing your tax return. The submission process varies depending on the service provider, but often, you can sign electronically using a secure method they provide. After you sign, the preparer or provider will complete the electronic filing process on your behalf.

Do I need to mail anything to the IRS after signing Form 8879?

No, you do not need to mail anything to the IRS if you electronically sign Form 8879. Your e-file provider or tax preparer will transmit your tax return information and the electronic signature authorization directly to the IRS. The form acts as your consent and is retained by the preparer for a period of time as specified by IRS regulations.

What happens if I don't sign the IRS 8879 form?

If you do not sign the IRS 8879 form, your electronic tax return cannot be submitted to the IRS. Signing the form is a mandatory step in the e-filing process, as it validates your agreement with the information being filed. Without your signature, the tax return is considered incomplete, and your filing will not proceed.

Can I revoke my authorization on Form 8879 after submitting it?

Once you've signed and submitted Form 8879, you typically cannot revoke your authorization for that tax year's electronic filing. The form represents your final approval of the tax return information at the time of filing. If you need to make changes to your tax return after filing, you may need to file an amended return through a separate process.

Is there a deadline for signing the IRS 8879 form?

The deadline for signing the IRS 8879 form aligns with the federal tax filing deadline, which is usually April 15 of each year, unless extended by the IRS. To avoid penalties and interest, it's crucial to sign and submit Form 8879 by this deadline. If you file for an extension, you'll have until the extended due date to sign the form.

How long should I keep a copy of the IRS 8879 form?

The IRS recommends that you keep copies of your tax return documents, including Form 8879, for at least three years from the date you filed your original return or two years from the date you paid the tax, whichever is later. Some experts suggest keeping them longer, up to seven years, to cover the period of limitations for various tax-related issues.