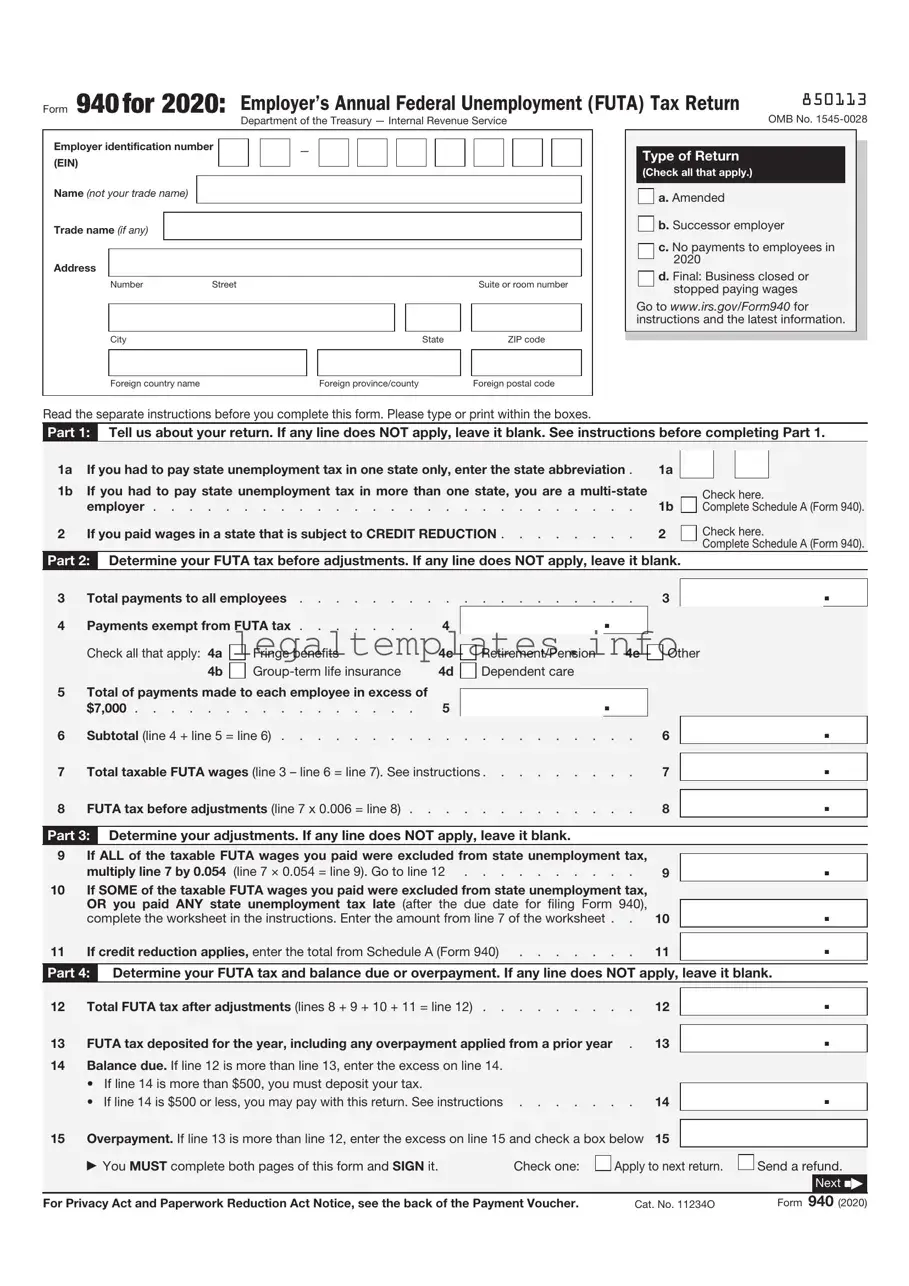

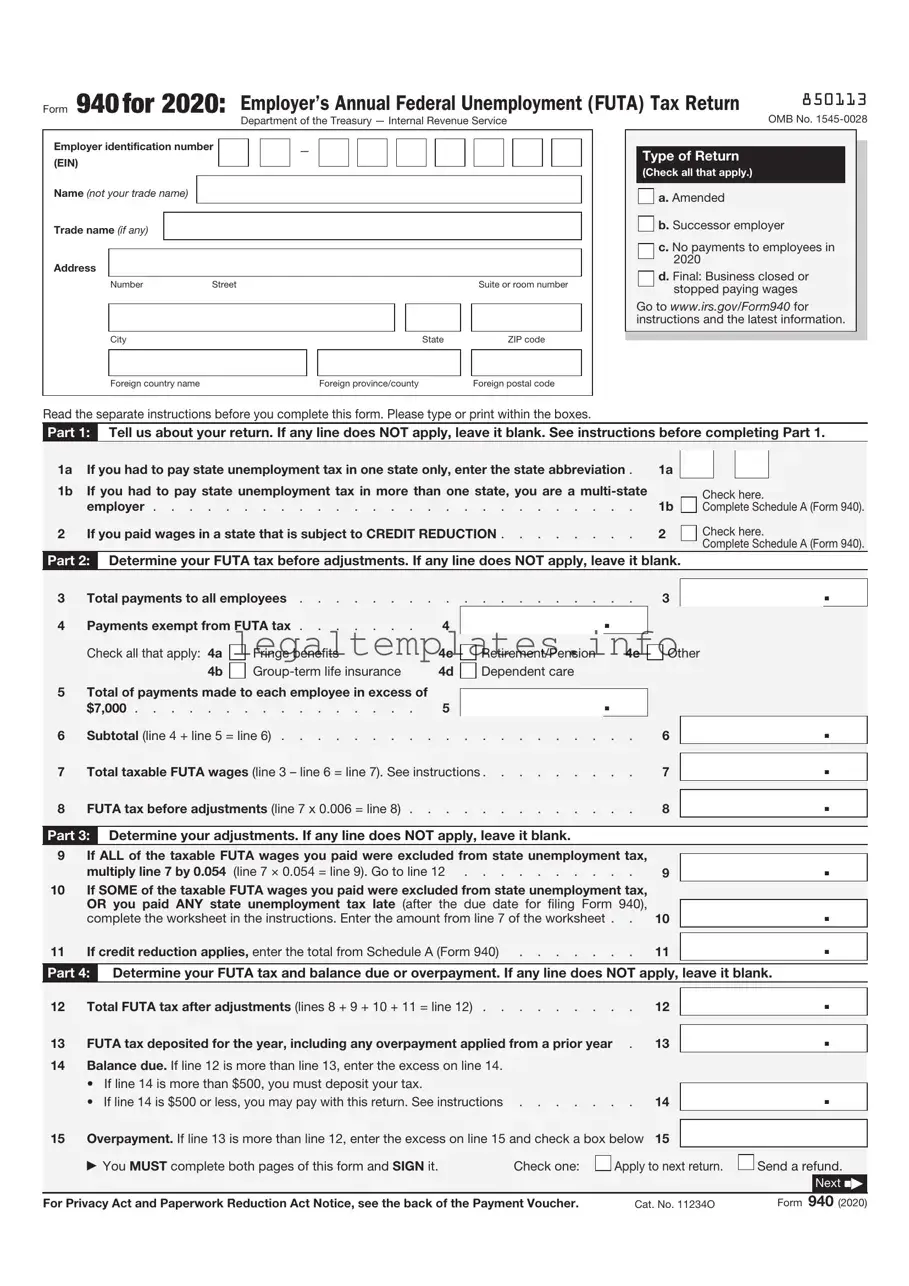

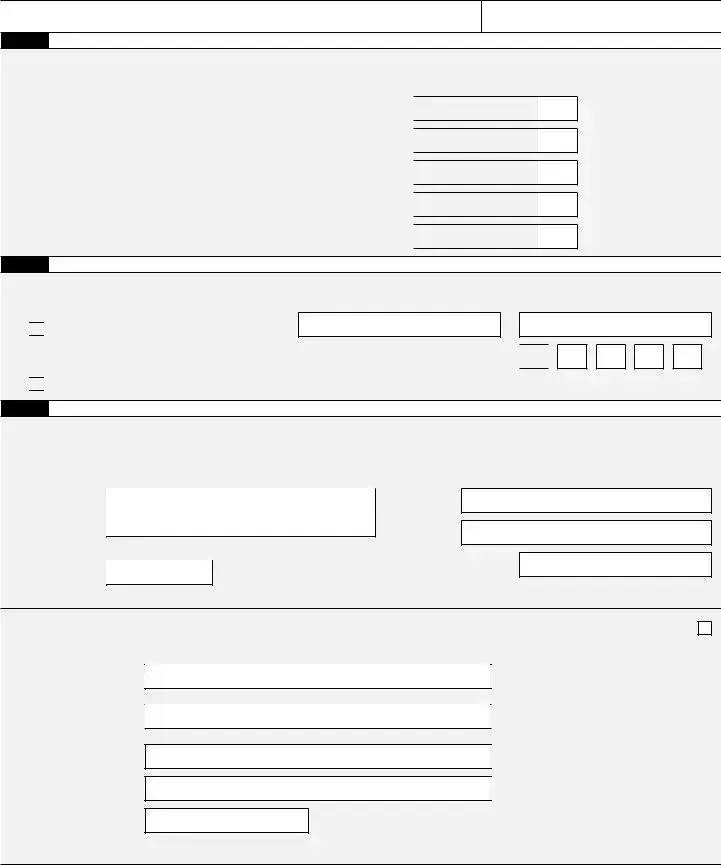

What is the IRS 940 form?

The IRS 940 form, officially known as the "Employer's Annual Federal Unemployment (FUTA) Tax Return," serves a crucial role for businesses. It's designed to report the annual amount of unemployment tax that employers are required to pay on behalf of their employees. This tax contributes to the federal government's ability to oversee unemployment benefits to those who have lost their jobs.

Who needs to file the IRS 940 form?

Generally, the obligation to file the IRS 940 form falls upon businesses that have either paid wages of $1,500 or more to employees in any quarter of the calendar year or had at least one employee working for some part of a day in any 20 or more different weeks of the year. This requirement holds regardless of whether the employees are full-time, part-time, or temporary.

When is the IRS 940 form due?

The deadline to file the IRS 940 form is January 31st of the following year. If an employer has made all FUTA tax payments on time throughout the year, the IRS may extend the filing deadline to February 10. It’s critical for businesses to adhere to this timeline to avoid potential penalties for late filing.

What information is needed to complete the IRS 940 form?

To accurately complete the IRS 940 form, employers need several pieces of information. This includes the total amount of employee wages paid during the calendar year, the amount of FUTA tax that has been deposited, and any adjustments to state unemployment insurance contributions. The form is also designed to calculate the employer’s FUTA tax liability and any overpayments that may be credited to the next year’s return.

How are FUTA taxes calculated?

FUTA taxes are calculated at a rate of 6.0% on the first $7,000 paid to each employee as wages during the year. However, employers who pay their state unemployment taxes in full and on time may receive a credit of up to 5.4%, effectively reducing their FUTA tax rate to 0.6%. This mechanism underscores the importance of timely state tax payments in reducing federal unemployment tax liabilities.

Can I e-file the IRS 940 form?

Yes, employers have the option to e-file the IRS 940 form through the IRS e-file system. This modernized e-file method not only streamlines the filing process but also ensures the security of the transmitted information. Employers can use IRS-approved software or a tax professional who is an authorized IRS e-file provider to file the form electronically.

What happens if I file the form late or fail to pay the FUTA tax?

Late filing of the IRS 940 form or delayed payment of the FUTA tax can result in penalties and interest charges. The IRS calculates penalties based on how late the form and payments are, with interest accruing on unpaid taxes from the due date of the return. Employers are encouraged to file and pay as promptly as possible to minimize these additional charges.

Can I make corrections to a previously filed IRS 940 form?

Yes, employers have the ability to correct previously filed IRS 940 forms. This can be done by filling out and submitting an amended return. The process for making corrections is detailed in the instructions for the form, guiding employers on how to report and remit any additional FUTA tax liability.

Where can I find assistance with the IRS 940 form?

Employers seeking assistance with the IRS 940 form can find resources through several avenues. The IRS website offers comprehensive guides and the form's instructions. Additionally, tax professionals and IRS-approved e-file providers can offer expert guidance tailored to an employer's specific situation, ensuring compliance with federal tax obligations.

.

. .

. .

. .

. .

.

No.

No.