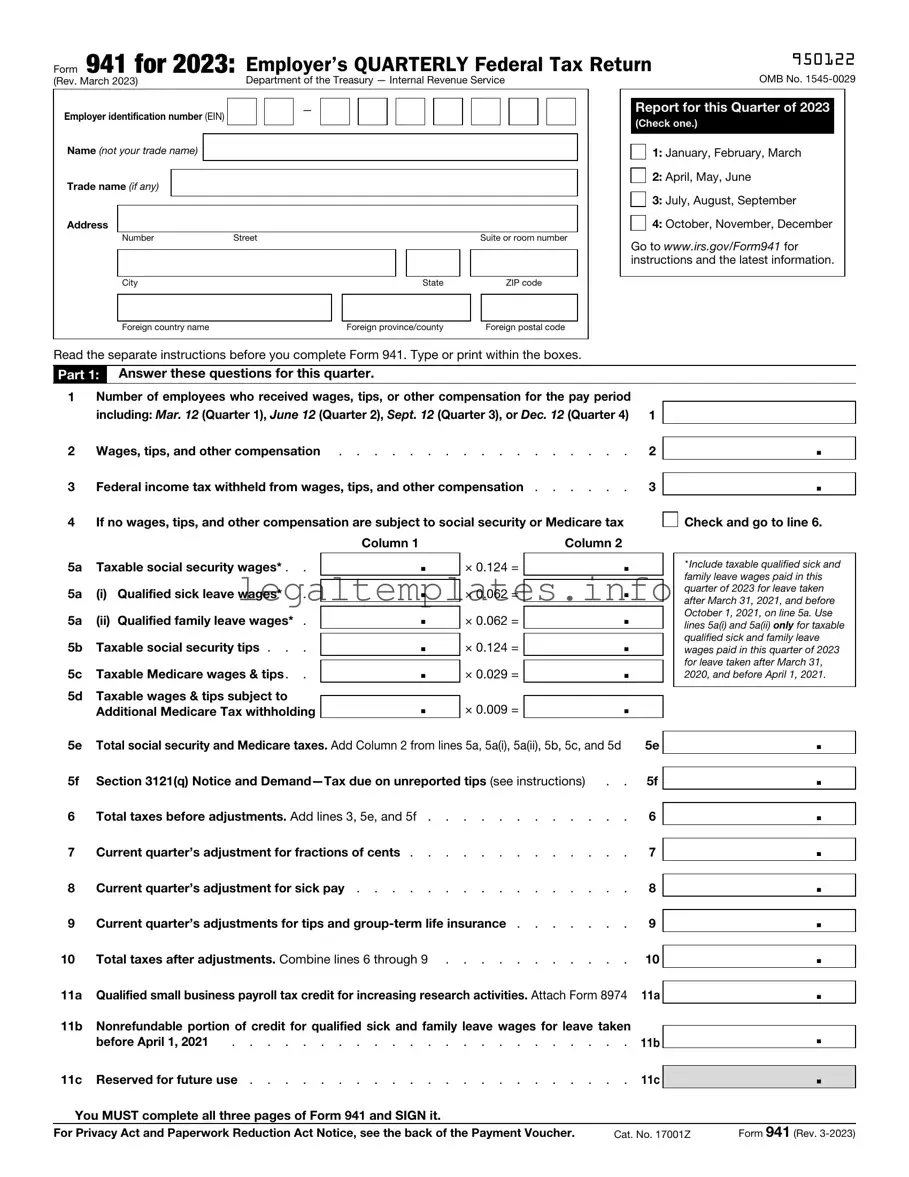

The IRS W-2 form shares similarities with the IRS 941 form as both are crucial for reporting wages and taxes. While the 941 form is used by employers to report quarterly federal tax returns, including withheld income tax, Social Security, and Medicare taxes, the W-2 form serves to report an employee's annual wages and the amount of taxes withheld from their paycheck. Employers use these forms to ensure they meet their tax obligations and provide employees with the information needed to file personal tax returns.

Similarly, the IRS 1099 form parallels the IRS 941 in its purpose to report income, albeit for non-employee compensation. The 941 form is used by employers to report taxes withheld from employees' paychecks, whereas the 1099 form is used to report payments made to independent contractors and other non-employees. Both play vital roles in the tax filing process, ensuring that the IRS receives accurate information about income and taxes from diverse sources.

The Form 940 from the IRS aligns closely with the 941 form, as both pertain to employer tax responsibilities. Form 940 is specifically designed for reporting annual Federal Unemployment Tax Act (FUTA) tax, whereas the 941 form is directed at reporting wages paid, federal income tax withheld, and both the employer’s and employees' shares of social security and Medicare taxes on a quarterly basis. Each form ensures compliance with different aspects of federal tax regulations, supporting the financial infrastructure of social security and unemployment benefits.

The IRS Schedule C form also shares attributes with the 941 form, although they address different taxpayer needs. Schedule C is used by self-employed individuals to report profits or losses from their business activities, while the IRS 941 form is used by employers to report tax withholdings from employees. Both forms are essential for calculating taxes owed or refunds due, contributing to the overall accuracy of tax reporting and payments.

The W-3 form works in conjunction with the W-2 form and shares a connection to the IRS 941 form by providing a summary of employee wages and withheld taxes. Whereas the 941 form is filed quarterly and details tax withholdings and wages on a broader scale, the W-3 is an annual submission that summarizes the total of each item reported on the W-2 forms for all employees. This form helps the IRS cross-reference the annual wage reports with quarterly tax payments.

The IRS W-4 form, although primarily used by employees to indicate their tax withholding preferences, indirectly relates to the information reported on the 941 form. Employers use the data from W-4 forms to determine the amount of federal income tax to withhold from employees' wages, which is then reported quarterly via the 941 form. The intertwined use of these forms ensures that withholdings align with employees' tax liabilities, contributing to accurate federal tax reporting.

The IRS 944 form is another document that closely mirrors the IRS 941 form but is specifically designed for smaller employers. The 944 form allows these smaller businesses to report employee wage and tax information on an annual basis, rather than quarterly as with the 941 form. This adjustment helps simplify tax reporting for small business owners while still fulfilling federal tax obligations.

The State Unemployment Tax Act (SUTA) forms, while varying by state, have objectives similar to the IRS 941 form in terms of reporting related to employment taxes. Employers are required to report wages and pay unemployment taxes to their respective state agencies, akin to how the 941 form is used to report to the federal government. Both sets of forms ensure appropriate taxes are collected to support unemployment benefits.

The IRS 945 form, used for reporting withheld federal income tax from non-payroll payments, shares common goals with the 941 form. While the 941 form focuses on payroll taxes, the 945 form encompasses taxes withheld from other payments such as pensions, annuities, and gambling winnings. Each serves a unique purpose in the broader context of tax reporting, ensuring proper withholding and payment of federal taxes.

Lastly, the IRS W-9 form, requested by businesses or financial institutions to obtain taxpayer identification numbers, indirectly supports the tax reporting process encapsulated by the IRS 941 form. By verifying contractor or non-employee information, the W-9 helps ensure accurate reporting of payments (later documented on 1099 forms) and complements the overall tax documentation process that includes quarterly employee tax reporting on the 941 form.

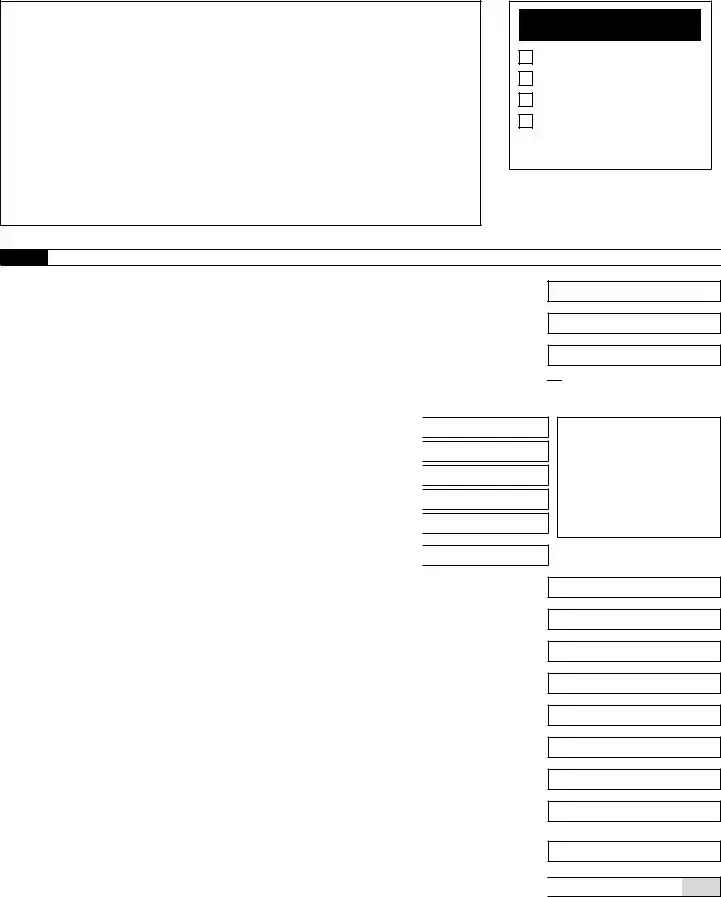

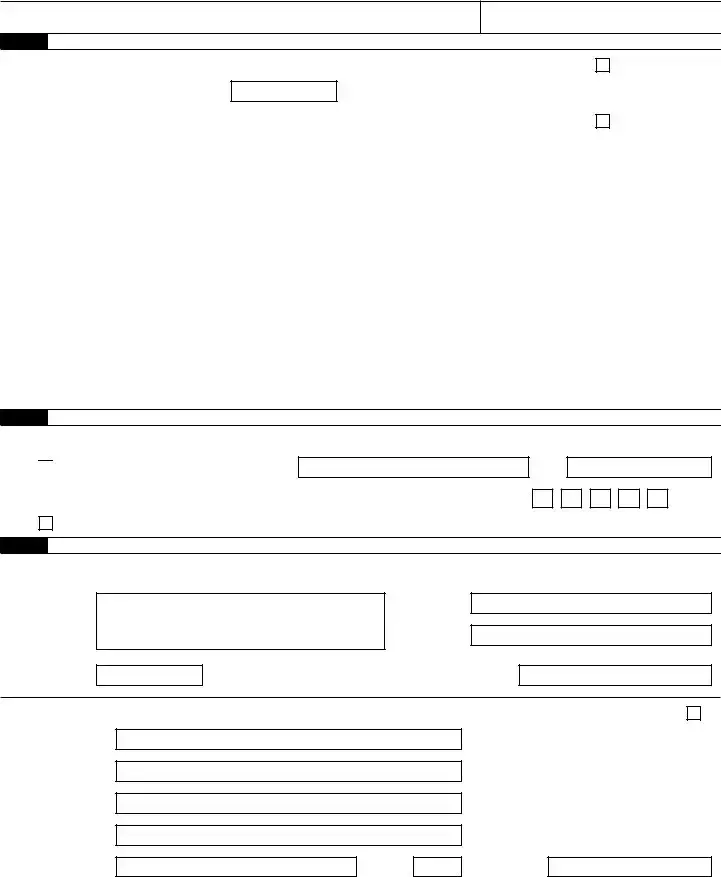

Check and go to line 6.

Check and go to line 6.

.

. .

. .

. .

. .

.

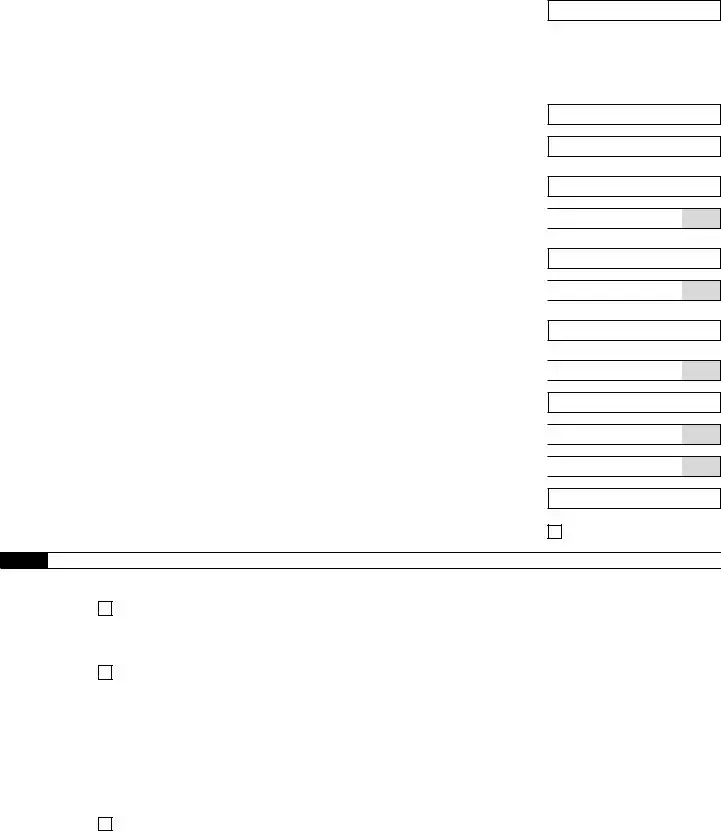

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number