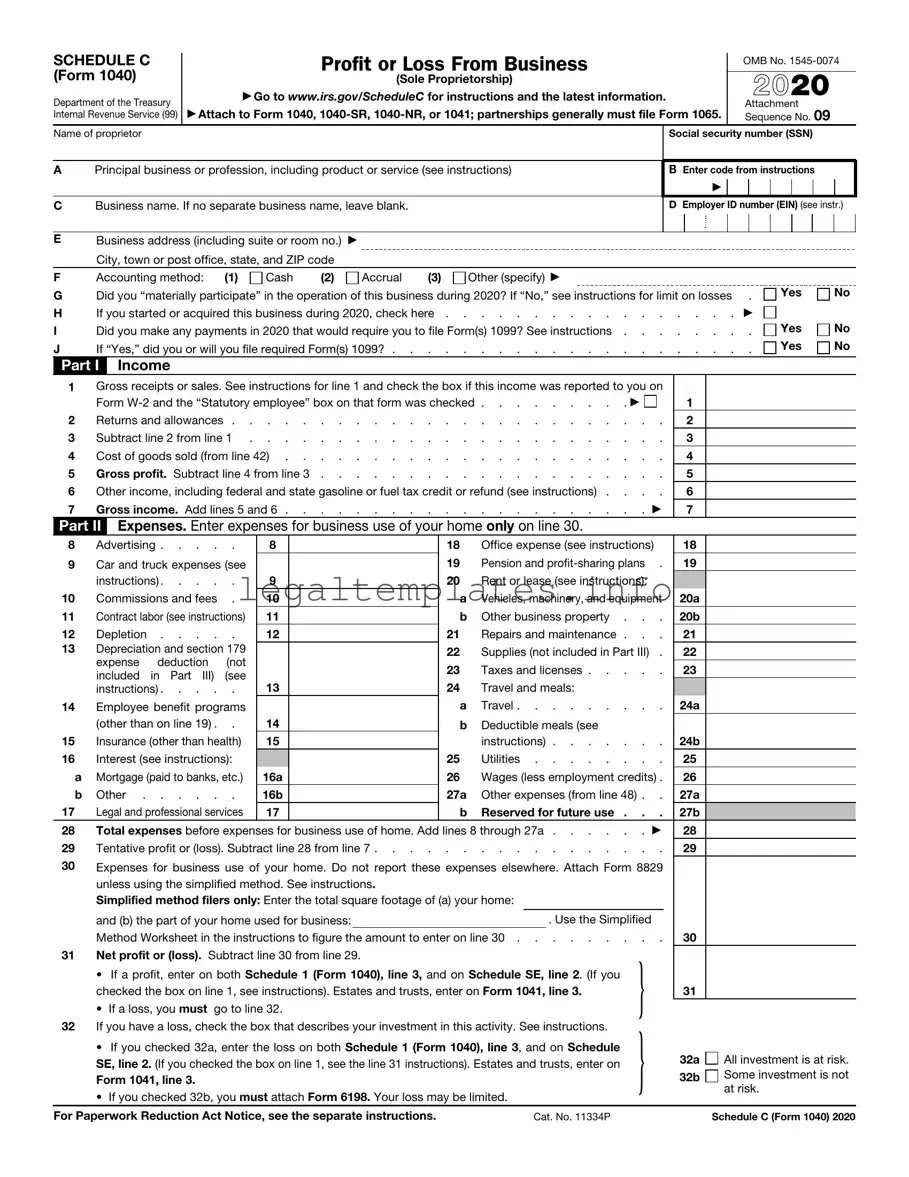

What is the IRS Schedule C 1040 form?

The IRS Schedule C form is a tax document used by sole proprietors and single-member LLCs to report yearly profits or losses from their business activities. It's a part of the individual tax return, Form 1040. The form requires detailed information about the business's income, expenses, and overall profit or loss during the tax year.

Who needs to file a Schedule C Form?

If you operate a business as a sole proprietor or a single-member LLC and have earned income from your business activities, you are typically required to file a Schedule C form. This includes income earned through freelance work, consulting, or any other self-employed activities.

What information do I need to fill out Schedule C?

To complete Schedule C, you'll need your business income details, including gross receipts or sales. You'll also need information on various business expenses you want to deduct, such as cost of goods sold, car and truck expenses, wages paid to employees, and other business expenses. Gathering financial records, receipts, and potentially a mileage log for business use of your vehicle will be helpful.

How does the Schedule C impact my personal taxes?

The profit or loss calculated on Schedule C directly affects your personal income tax return. This result is used to determine your taxable income on Form 1040. A business profit increases your taxable income, while a loss can decrease it, potentially reducing your overall tax liability.

Can I file a Schedule C if I have more than one business?

Yes, if you own more than one business, you need to file a separate Schedule C for each business. It's important to maintain separate financial records for each business to accurately report their income and expenses.

What are some common deductions I can include on Schedule C?

Common deductions on Schedule C include business-related expenses such as advertising, travel, insurance, supplies, wages paid to employees, and home office expenses. Be sure to keep detailed records and receipts of all your business expenses to substantiate these deductions.

Do I need to file Schedule C if my business didn’t make any money?

If your business operated at a loss or didn't earn any income during the tax year, you are generally still required to file a Schedule C to report this. Reporting a loss can have implications for your other income and tax situation, including potential deductions.

What happens if I make a mistake on my Schedule C?

If you realize you’ve made an error on your filed Schedule C, you can amend your tax return using Form 1040X, Amended U.S. Individual Income Tax Return. It's important to correct any mistakes to ensure your tax liability is accurate, avoiding potential penalties and interest on underreported income.

Can I file Schedule C electronically?

Yes, you can file Schedule C electronically along with your Form 1040 through IRS e-file. Filing electronically is generally faster, more secure, and offers quicker confirmation that the IRS has received your tax return.

Where can I get help with my Schedule C?

If you need help filling out your Schedule C or have specific questions about your situation, it might be beneficial to consult with a tax professional. The IRS also provides resources and guides on their website to assist taxpayers in completing this form.

Yes

Yes  No

No

Yes

Yes

No

No

Yes

Yes  No

No

No

No

No

No