What is a Letter of Intent to Lease Commercial Property?

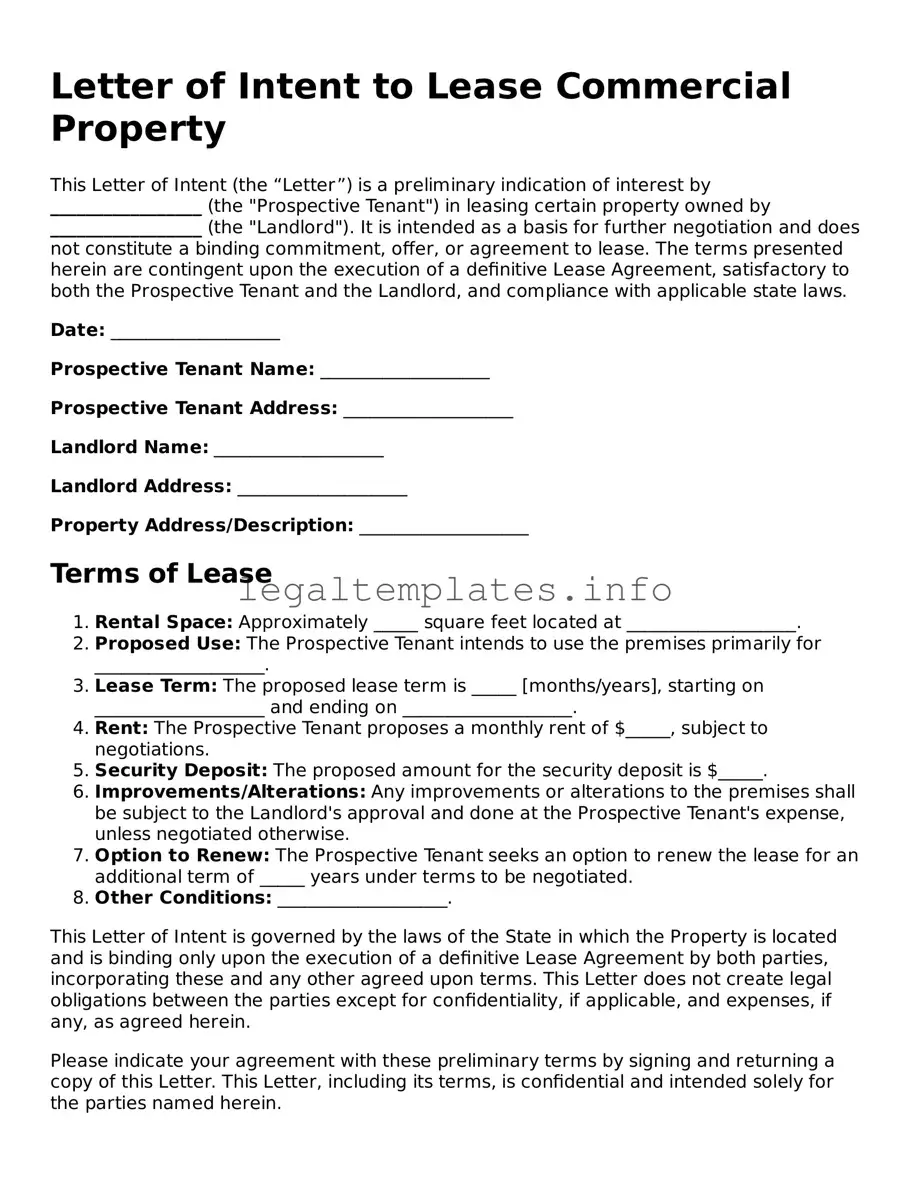

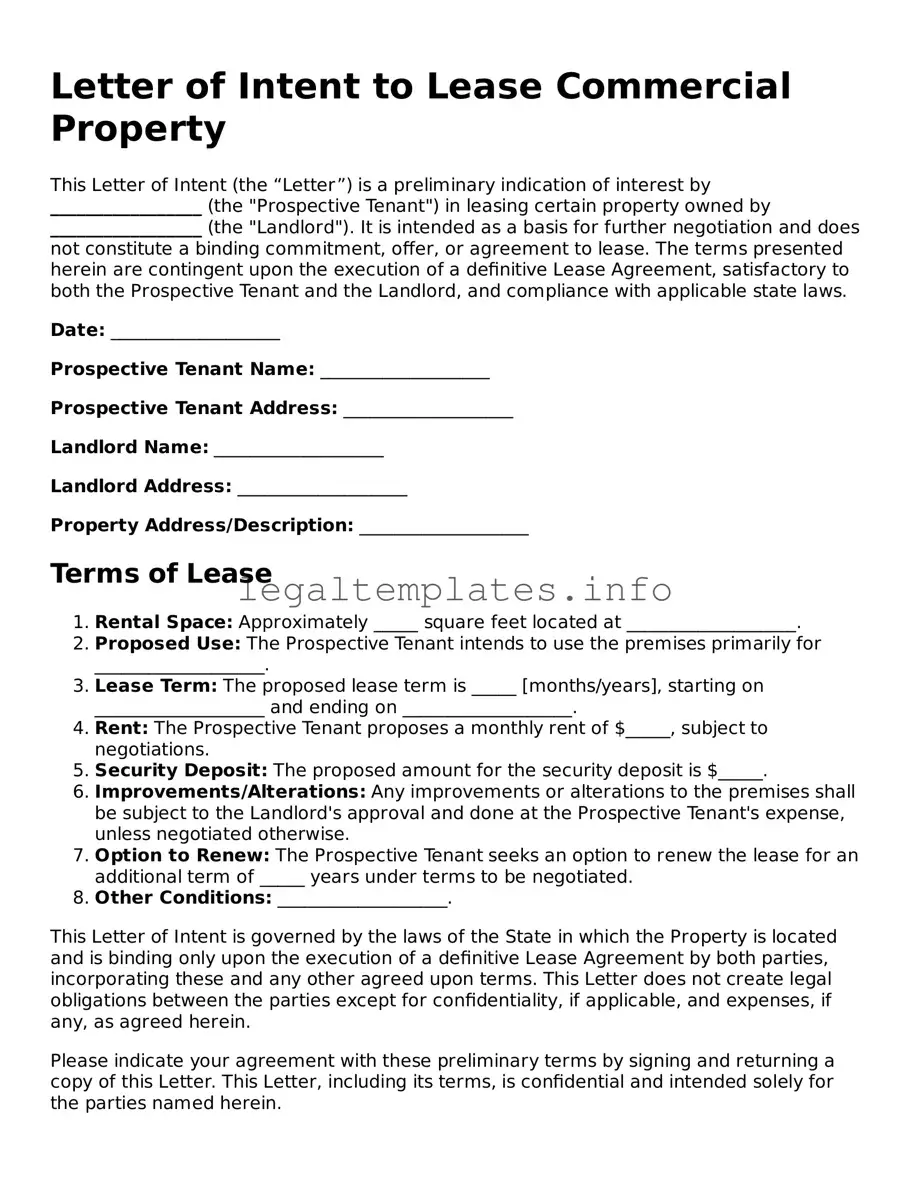

A Letter of Intent to Lease Commercial Property is a preliminary agreement between a potential tenant and a property owner or landlord. It outlines the key terms and conditions of a lease agreement before the actual contract is drafted. This document serves as a foundation for negotiations and demonstrates the serious intent of the parties to move forward with a lease arrangement.

Why is a Letter of Intent important?

This letter is crucial because it sets the stage for the formal lease agreement. It helps both parties to clarify and agree upon the main terms such as rent, lease duration, and property use. This mutual understanding can prevent misunderstandings and conflicts later on. Furthermore, it showcases the commitment of the tenant to the property, potentially securing it against other interested parties.

What typically is included in a Letter of Intent to Lease Commercial Property?

Common elements include the proposed lease term, rental amount, description of the property, intended use of the property, any tenant or landlord improvements, maintenance responsibilities, options for lease renewal, and conditions for terminating the lease. It might also cover insurance requirements and any contingencies that must be met before finalizing the lease agreement.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding regarding the lease agreement itself; it's more of a gentleman's agreement. However, some clauses, such as confidentiality and exclusivity, may be binding if explicitly stated. Parties should be clear about which aspects, if any, are intended to be legally binding.

How detailed should a Letter of Intent be?

It should be detailed enough to cover all significant aspects of the future lease agreement but flexible enough to allow for negotiation and adjustments. The aim is to provide a clear framework for the lease agreement without finalizing every detail at this early stage.

Can changes be made to the Letter of Intent?

Yes, changes can be made as it serves as a starting point for discussions. Both parties must agree to any modifications. It's a living document until both parties finalize the lease agreement based on its terms.

Who drafts the Letter of Intent?

Either party can draft the Letter of Intent, but it is commonly prepared by the tenant or the tenant's legal representative. Since it favors the party that drafts it, the other party should review it carefully and negotiate any terms as necessary.

What happens after the Letter of Intent is signed?

Once signed, both parties work towards finalizing the lease agreement. This involves negotiating any outstanding details, conducting due diligence, and preparing the formal lease document for signing. The Letter of Intent acts as a guide for these next steps.

Is it necessary to hire a lawyer when dealing with a Letter of Intent?

While not always necessary, consulting with a lawyer can be very helpful. A lawyer can provide valuable advice on the terms of the Letter of Intent, ensure your interests are protected, and help negotiate favorable terms. Given that commercial leases can have significant financial and legal implications, professional advice is often recommended.

Can a Letter of Intent be withdrawn?

Yes, a Letter of Intent can usually be withdrawn by either party, depending on the terms outlined within the document and any binding provisions it may contain. However, withdrawing from a Letter of Intent should be done with careful consideration and ideally, in consultation with legal counsel to avoid any potential repercussions.