What is a Letter of Intent to Purchase Business?

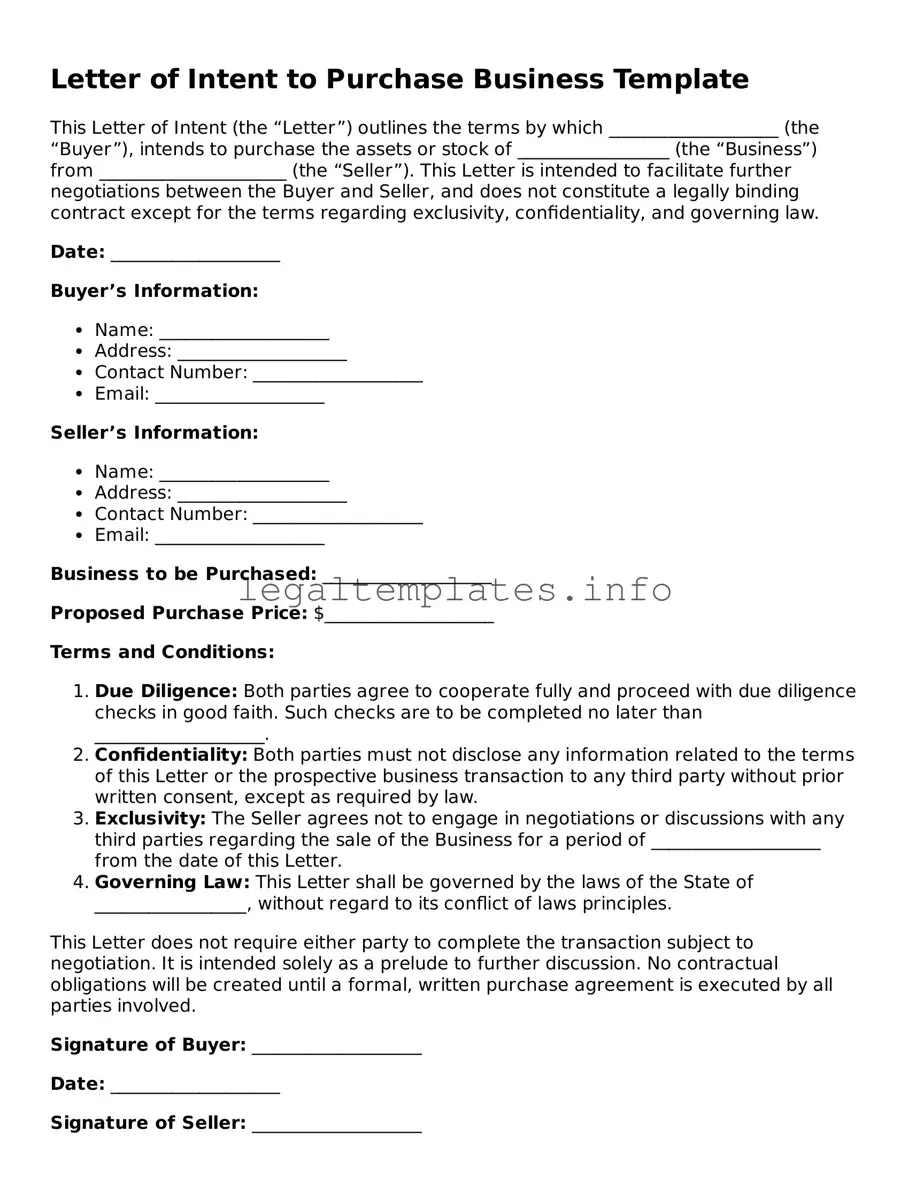

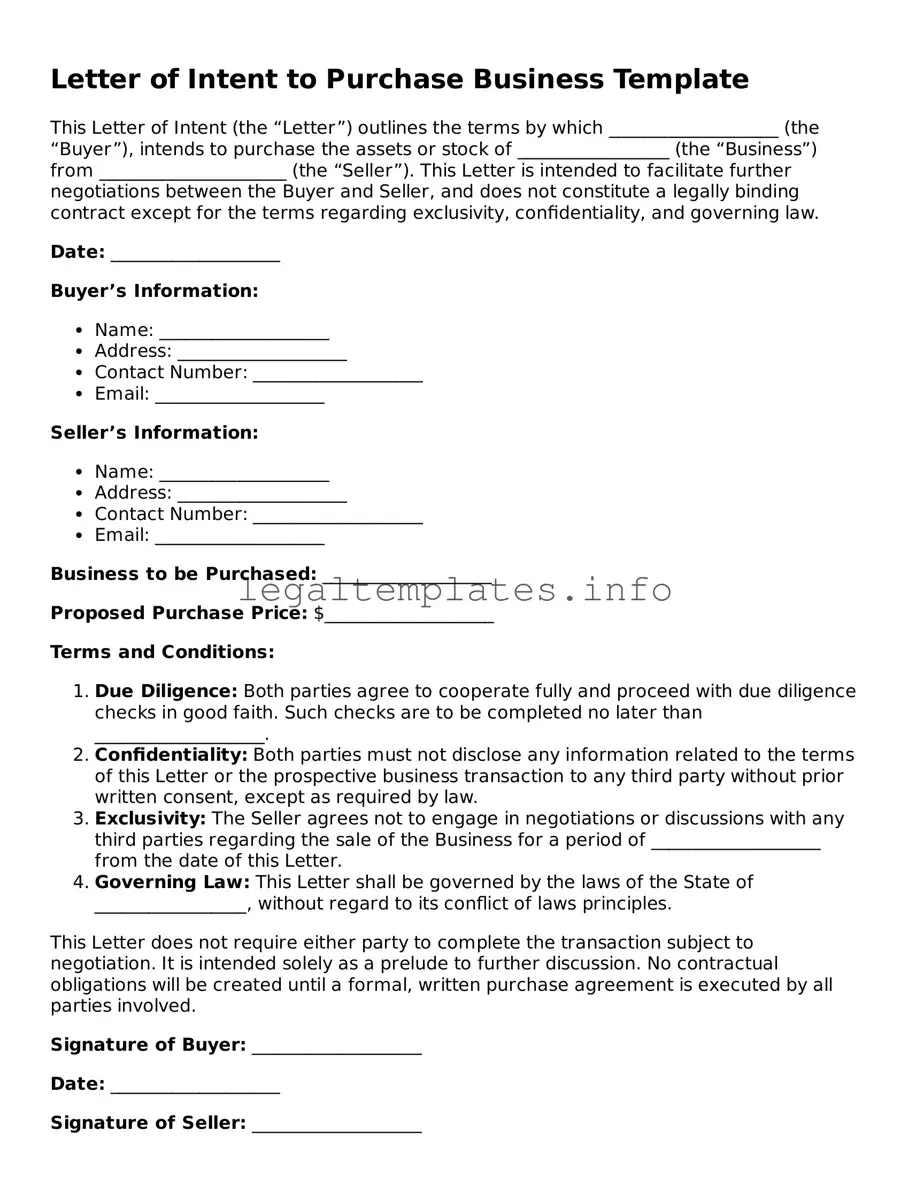

A Letter of Intent to Purchase Business is a formal document that signifies a potential buyer's intention to buy a specific business. This letter outlines the preliminary terms and conditions under which the buyer is willing to purchase the business. It serves as a foundation for negotiations and can help both parties reach an initial understanding before drafting a detailed purchase agreement.

Why use a Letter of Intent to Purchase Business?

Using a Letter of Intent to Purchase Business has several benefits. It sets clear intentions between the buyer and seller, reduces misunderstandings, and streamlines the negotiation process by identifying key deal points early. Additionally, it can mark the start of due diligence, showing the seller that the buyer is serious. However, it's typically non-binding regarding the purchase agreement, allowing flexibility for both parties during negotiations.

What key terms should be included in a Letter of Intent to Purchase Business?

A comprehensive Letter of Intent should include terms such as the proposed purchase price, payment method, due diligence requirements, confidentiality obligations, exclusivity period, any conditions precedent to the transaction, and the proposed timeline for finalizing the purchase agreement. Clear articulation of these terms can set the stage for smoother negotiations.

Is the Letter of Intent legally binding?

Generally, a Letter of Intent to Purchase Business is not legally binding concerning the sale itself. However, certain provisions, like confidentiality and exclusivity, may carry legal obligations. It’s crucial to specify which portions of the letter, if any, are intended to be binding. Always consult legal counsel for advice tailored to your specific situation.

Can I withdraw from a Letter of Intent to Purchase Business?

Yes, since the Letter of Intent is typically non-binding regarding the purchase, a buyer can withdraw from the process. However, if the letter includes binding terms like exclusivity or confidentiality, these must still be adhered to. Withdrawal could still have implications, including damage to reputation or relationships, so it should be approached with consideration.

How does a Letter of Intent differ from a Purchase Agreement?

A Letter of Intent serves as a preliminary agreement outlining the intentions of both parties to enter into a transaction but does not bind either party to complete the sale. In contrast, a Purchase Agreement is a legally binding contract that finalizes the terms of the sale and obligates both the buyer and the seller to execute the transaction under the agreed terms.

Should I consult a lawyer when drafting a Letter of Intent to Purchase Business?

Yes, consulting with a lawyer is highly recommended when drafting a Letter of Intent to Purchase Business. Legal professionals can ensure that the letter accurately reflects your intentions, includes necessary legal provisions, and doesn't inadvertently bind you to terms you're not ready to commit to. They can also provide valuable advice on structuring the deal to your advantage.