What is an Employee Loan Agreement?

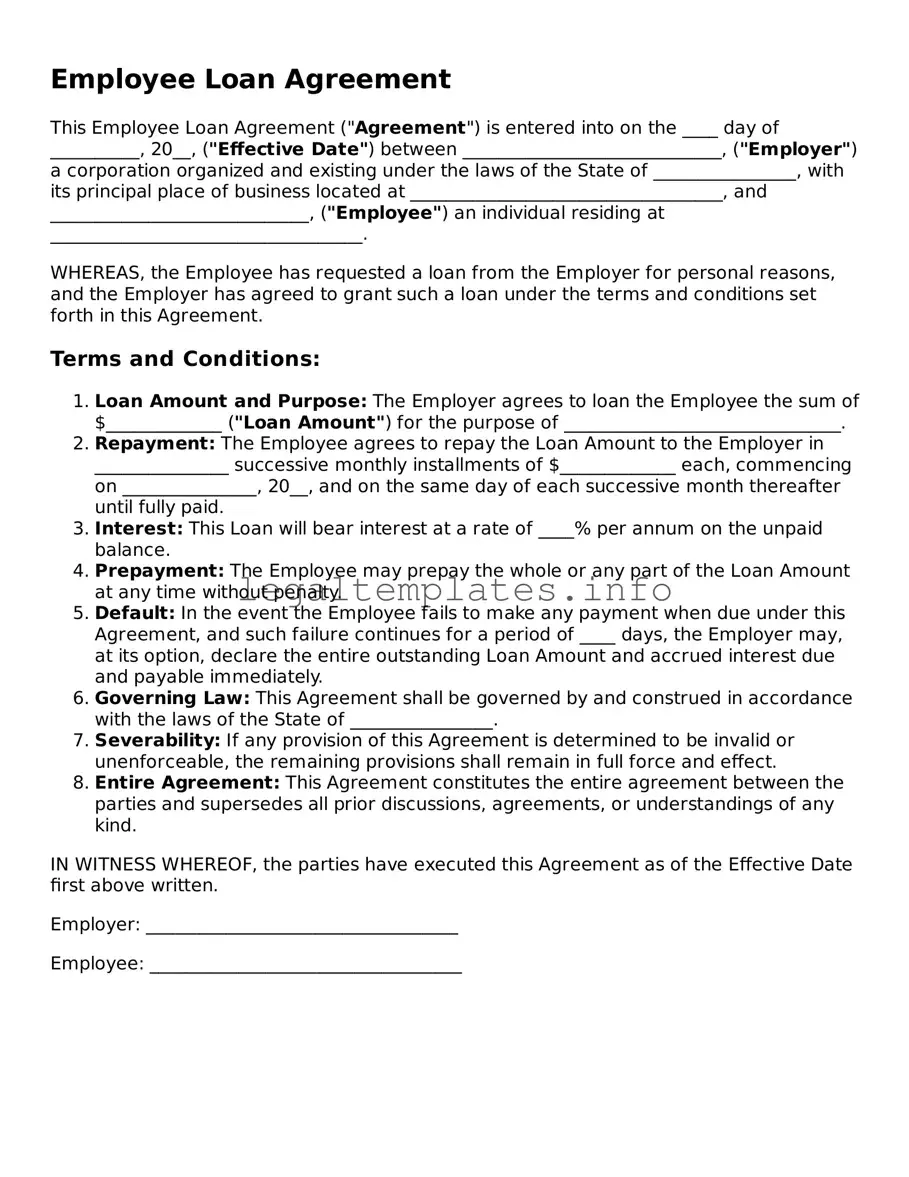

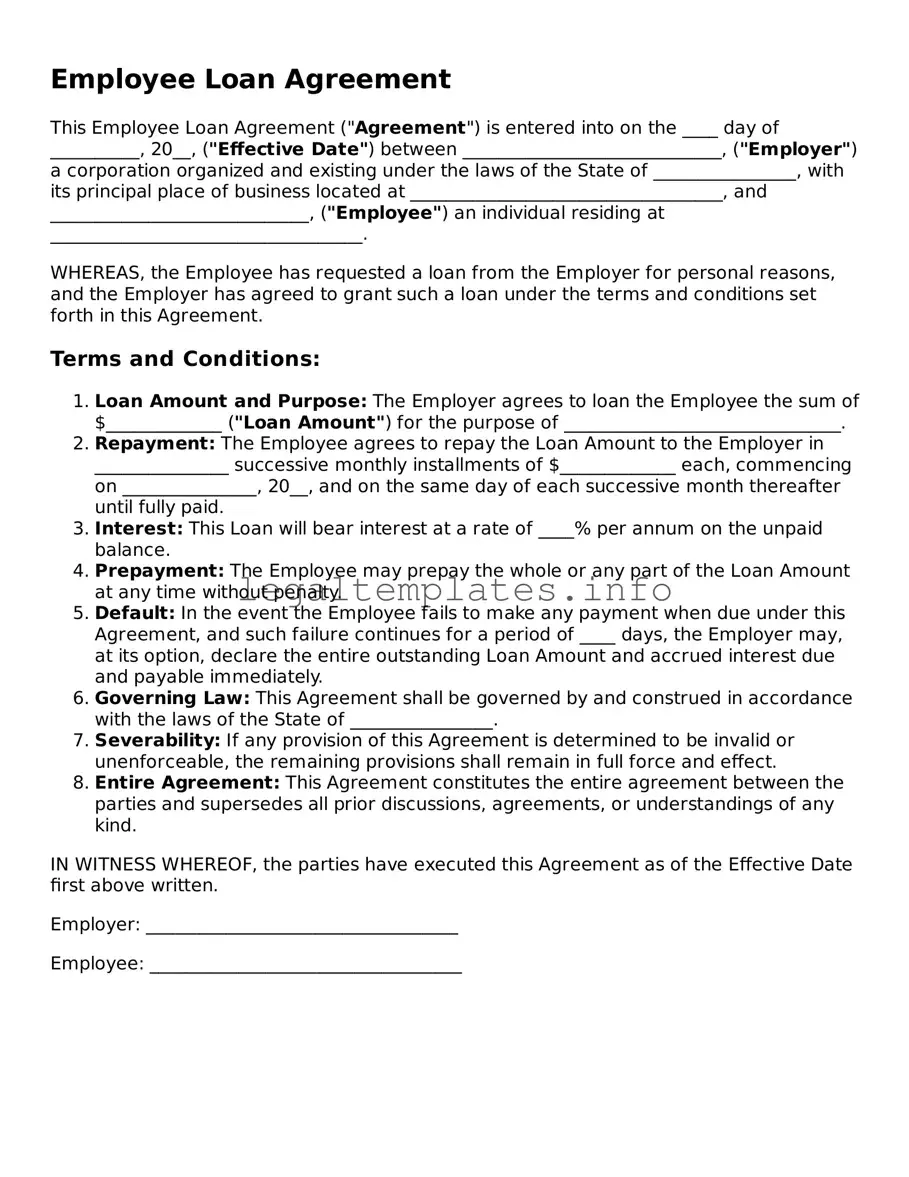

An Employee Loan Agreement is a formal contract between an employer and an employee that sets out the terms and conditions for a loan provided by the employer to the employee. This agreement details the loan amount, repayment schedule, interest rate, and any other rules related to the loan.

When should I use an Employee Loan Agreement?

Use an Employee Loan Agreement any time an employer agrees to loan money to an employee. This could be for various purposes like helping with personal emergencies, education, or purchasing a home. It ensures that both parties understand their obligations.

What details need to be included in the Employee Loan Agreement?

The agreement should include the names and contact information of the employer and employee, the loan amount, the interest rate (if applicable), the repayment schedule, any collateral securing the loan, consequences of default, and signatures of both parties.

Is the interest on an Employee Loan taxable?

Yes, if the loan has an interest component, it is typically considered taxable income for the employee. However, specific tax implications can vary, so it's advisable to consult a tax professional for advice tailored to your situation.

Can an Employee Loan Agreement include a provision for deducting repayments directly from an employee's paycheck?

Yes, an agreement can include a clause that allows the employer to deduct loan repayments directly from the employee's paycheck. However, such deductions must comply with local labor and employment laws.

What happens if the employee leaves the company before repaying the loan?

The agreement should specify the options available in such cases. Options may include requiring immediate repayment in full or continuing the agreed-upon repayment schedule. It's crucial that this is clearly outlined to avoid confusion or legal issues.

How can both parties ensure the agreement is legally binding?

To ensure the agreement is legally binding, it must include all necessary terms, be signed by both parties, and adhere to state and federal laws. Consulting with a legal professional can help verify compliance and enforceability.

Are there any legal restrictions on Employee Loans?

Yes, there are legal restrictions, and they can vary based on local, state, and federal laws. These may include limits on interest rates, prohibition on requiring loans as a condition of employment, and others. It's important to research and understand these restrictions before drafting an agreement.

How can an employer protect themselves if the employee does not repay the loan?

An employer can include provisions in the agreement for recourse in case of non-repayment, such as taking legal action or deducting the amount from the employee's final paycheck (if allowed by law). Having collateral as security for the loan can also provide protection.

Is it necessary to have a witness or notarize the Employee Loan Agreement?

While having a witness or notarizing the agreement can add an extra layer of verification, it's not always required for the document to be legally binding. However, the requirements can vary by jurisdiction, so it's advisable to check local laws.