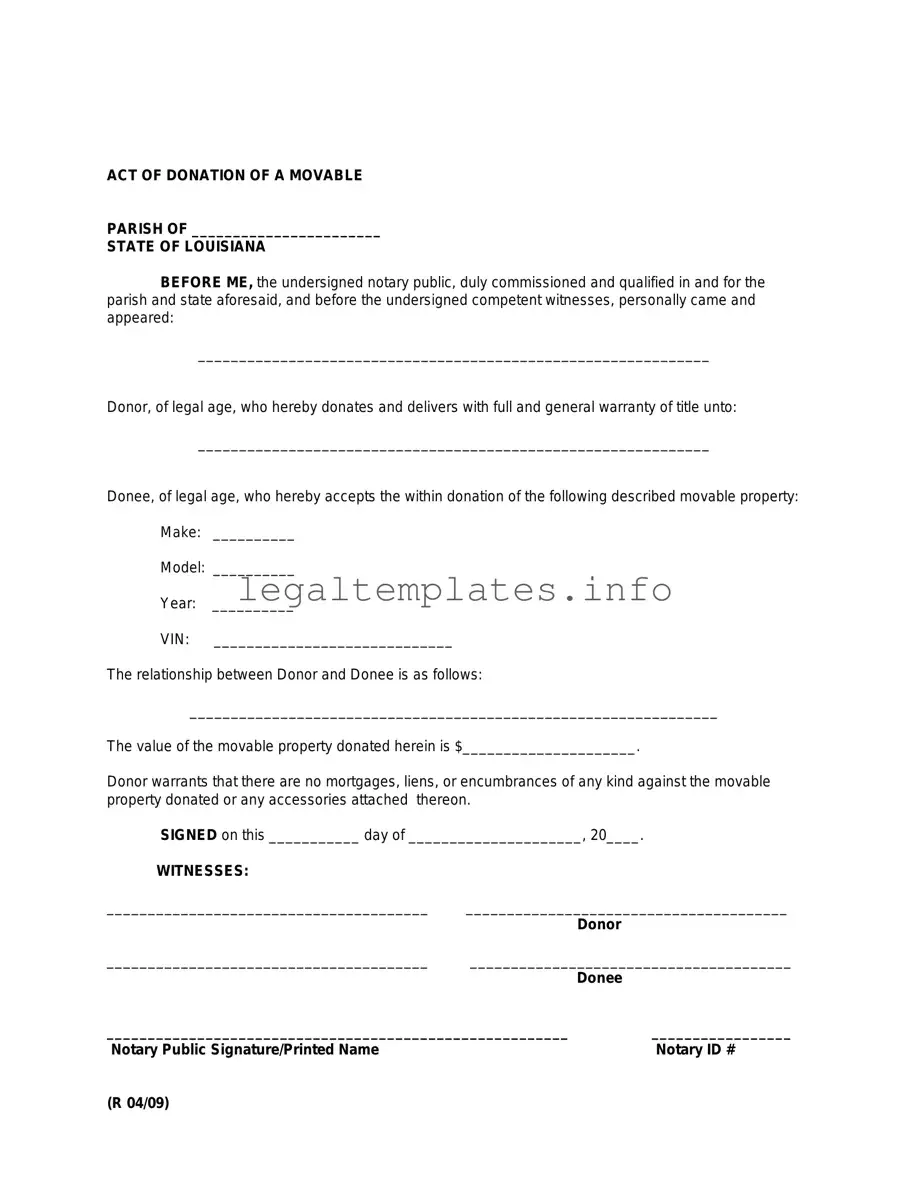

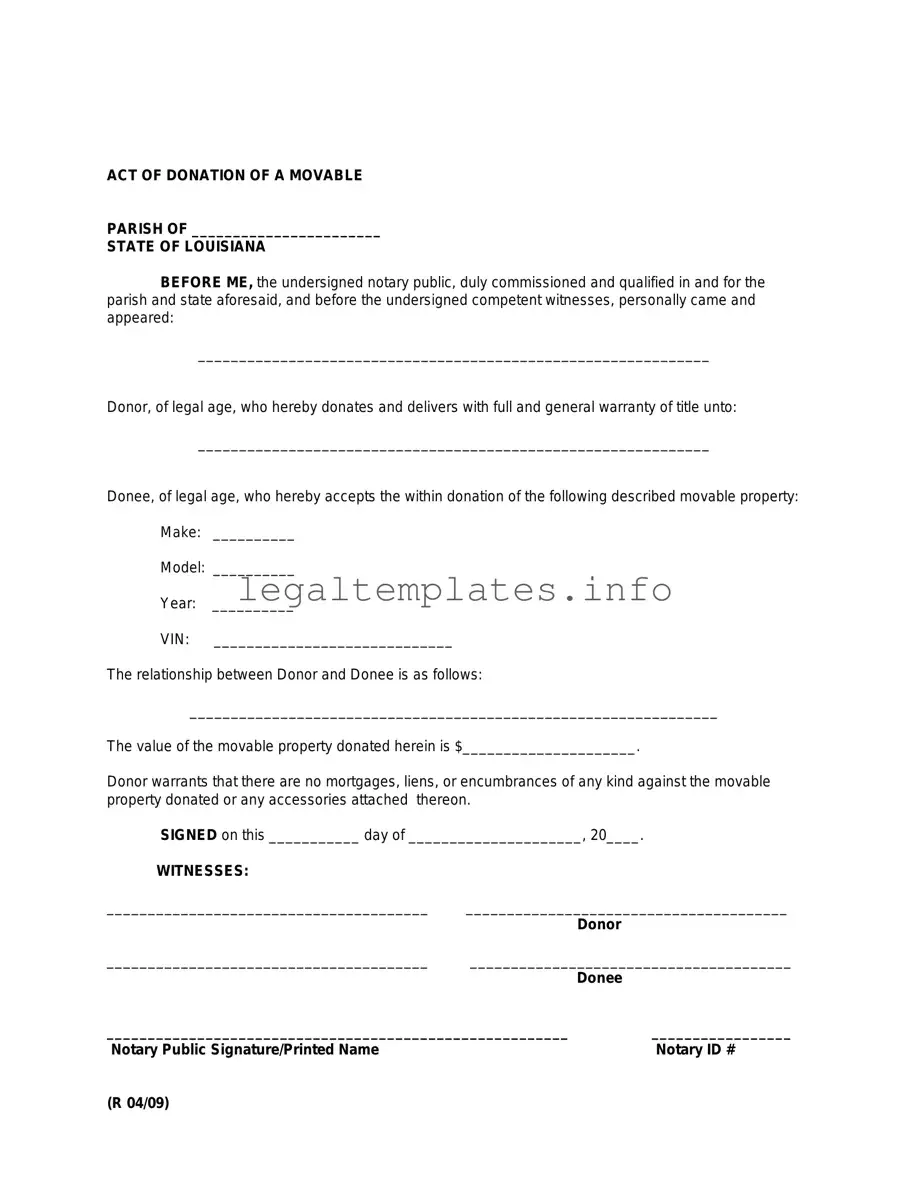

Fill a Valid Louisiana act of donation Form

The Louisiana act of donation form is a legal document used when someone wants to give property, such as land or a vehicle, to another person or organization without receiving payment in return. This act is governed by specific state laws to ensure the process is carried out fairly and legally. Those interested in completing this act of generosity are encouraged to click the button below to begin filling out the form and take a step towards making a meaningful contribution.

Access Louisiana act of donation Online

Fill a Valid Louisiana act of donation Form

Access Louisiana act of donation Online

Access Louisiana act of donation Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete Louisiana act of donation online.