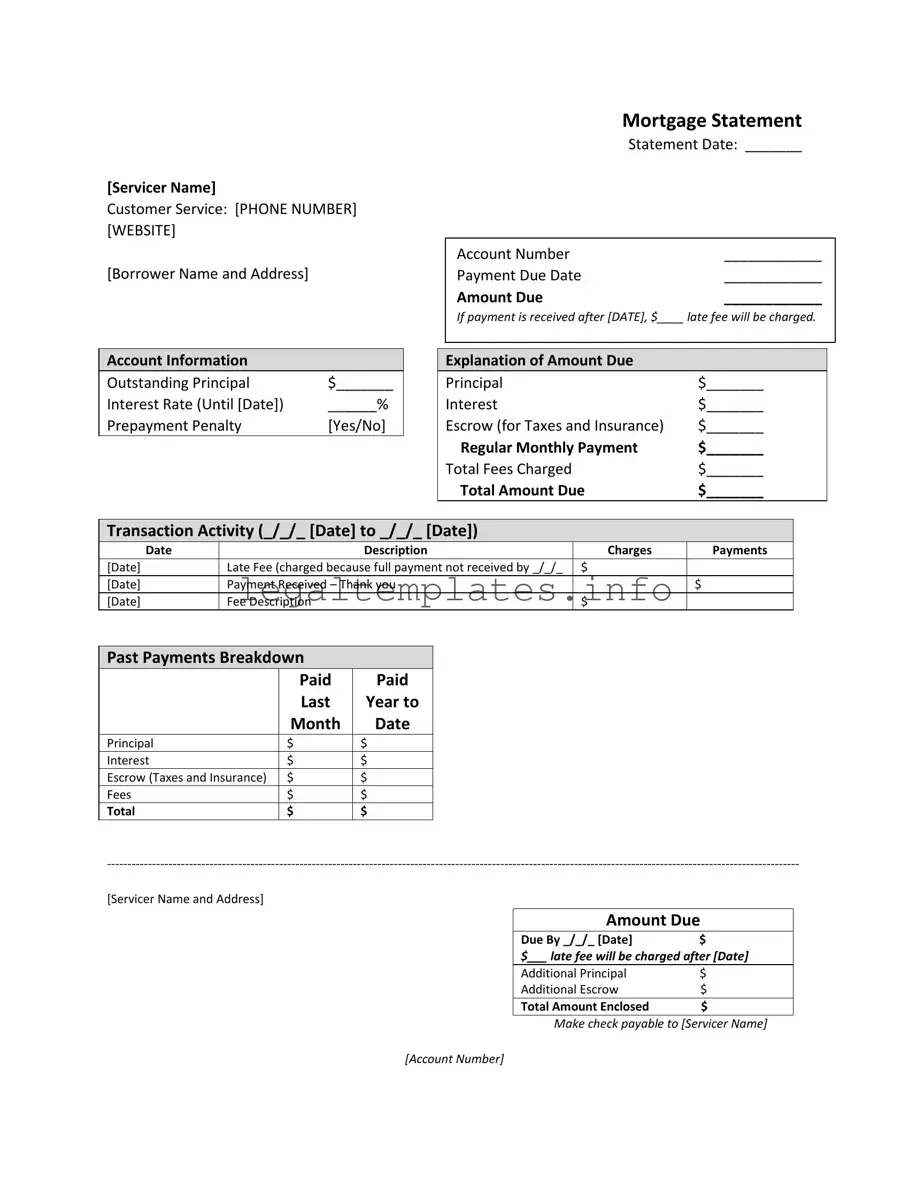

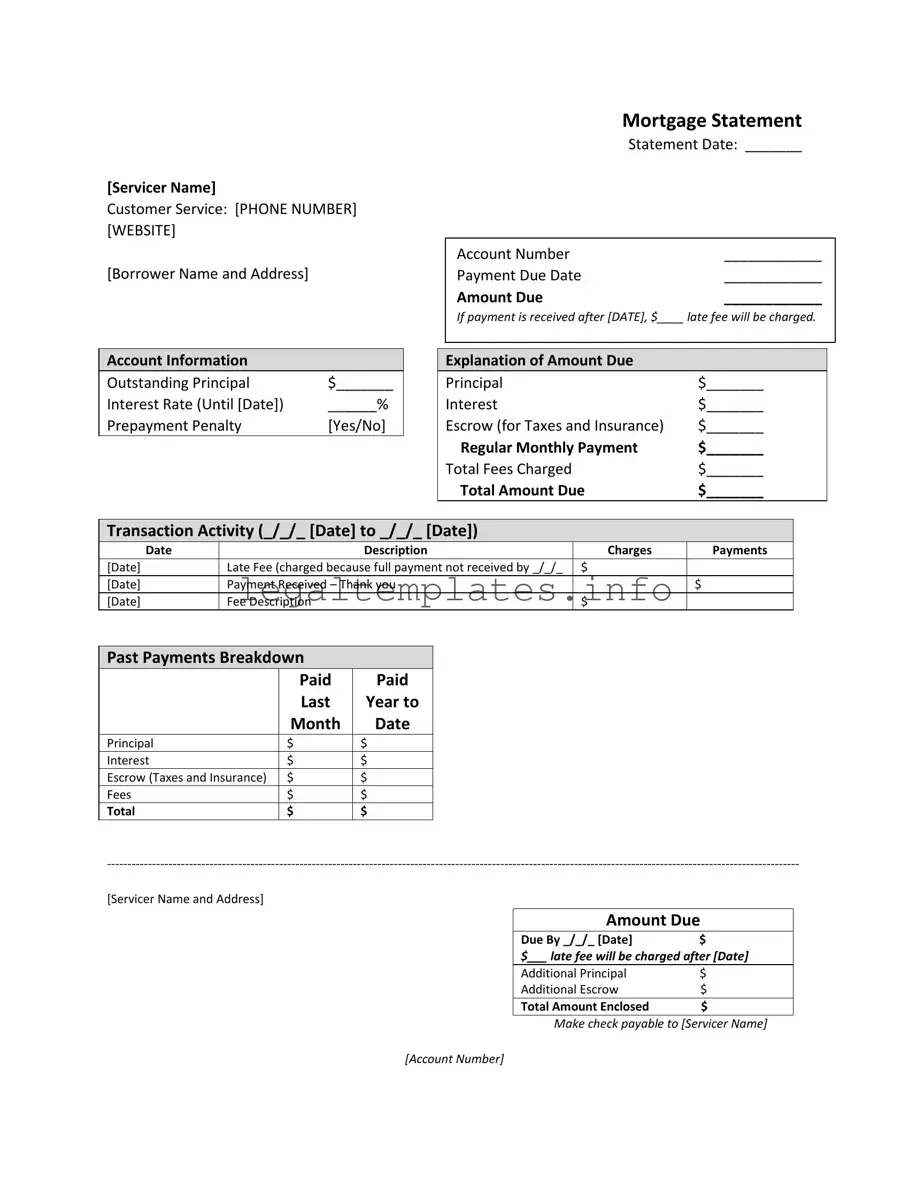

Fill a Valid Mortgage Statement Form

A Mortgage Statement form is a detailed document provided by the mortgage servicer that outlines the current status of a mortgage loan. It includes critical information such as the outstanding principal, interest rate, payment due date, and a breakdown of the current payment covering principal, interest, escrow for taxes and insurance, fees, and any past payment activities. To ensure you're up-to-date with your mortgage details and to avoid any late fees or potential foreclosure, carefully review your Mortgage Statement and take action accordingly by clicking the button below.

Access Mortgage Statement Online

Fill a Valid Mortgage Statement Form

Access Mortgage Statement Online

Access Mortgage Statement Online

or

Click for PDF Form

This form won’t take long

Edit, save, and complete Mortgage Statement online.