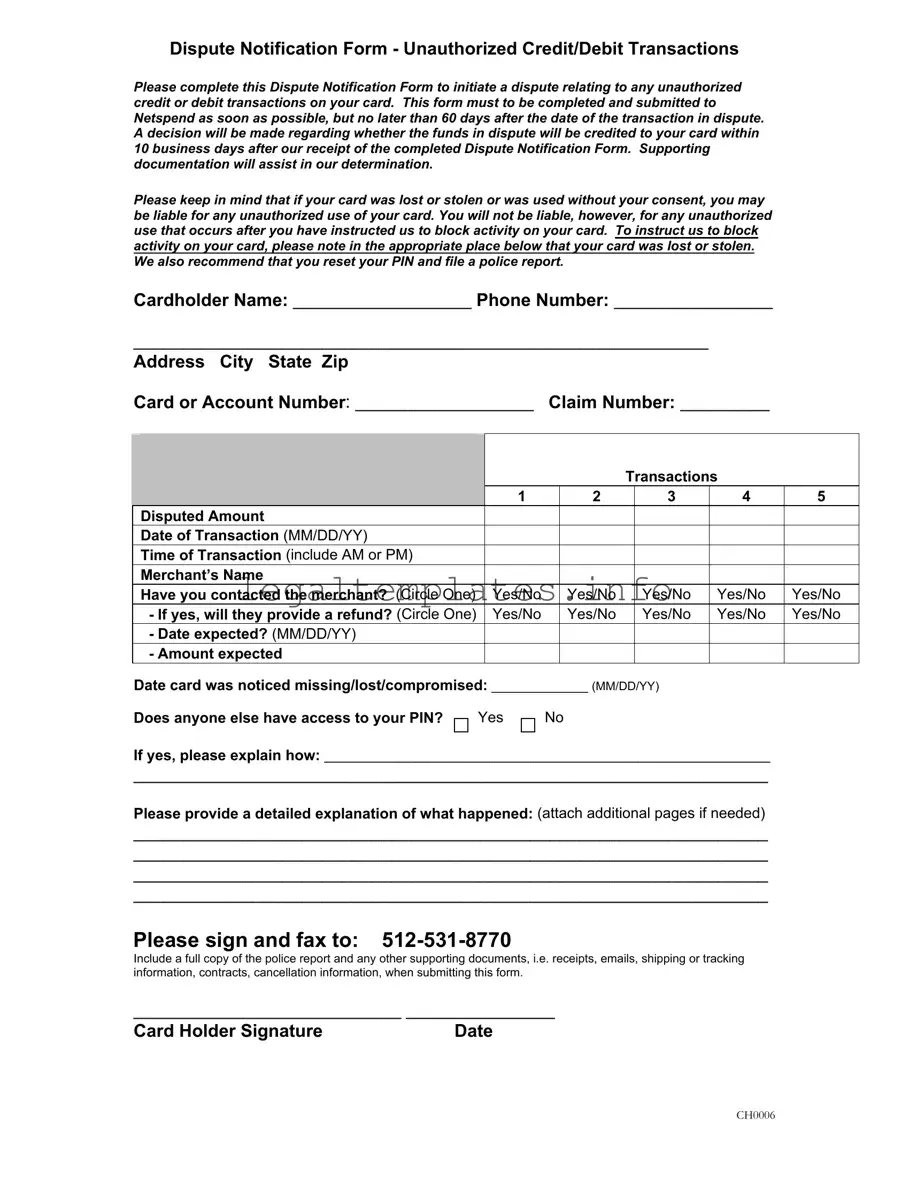

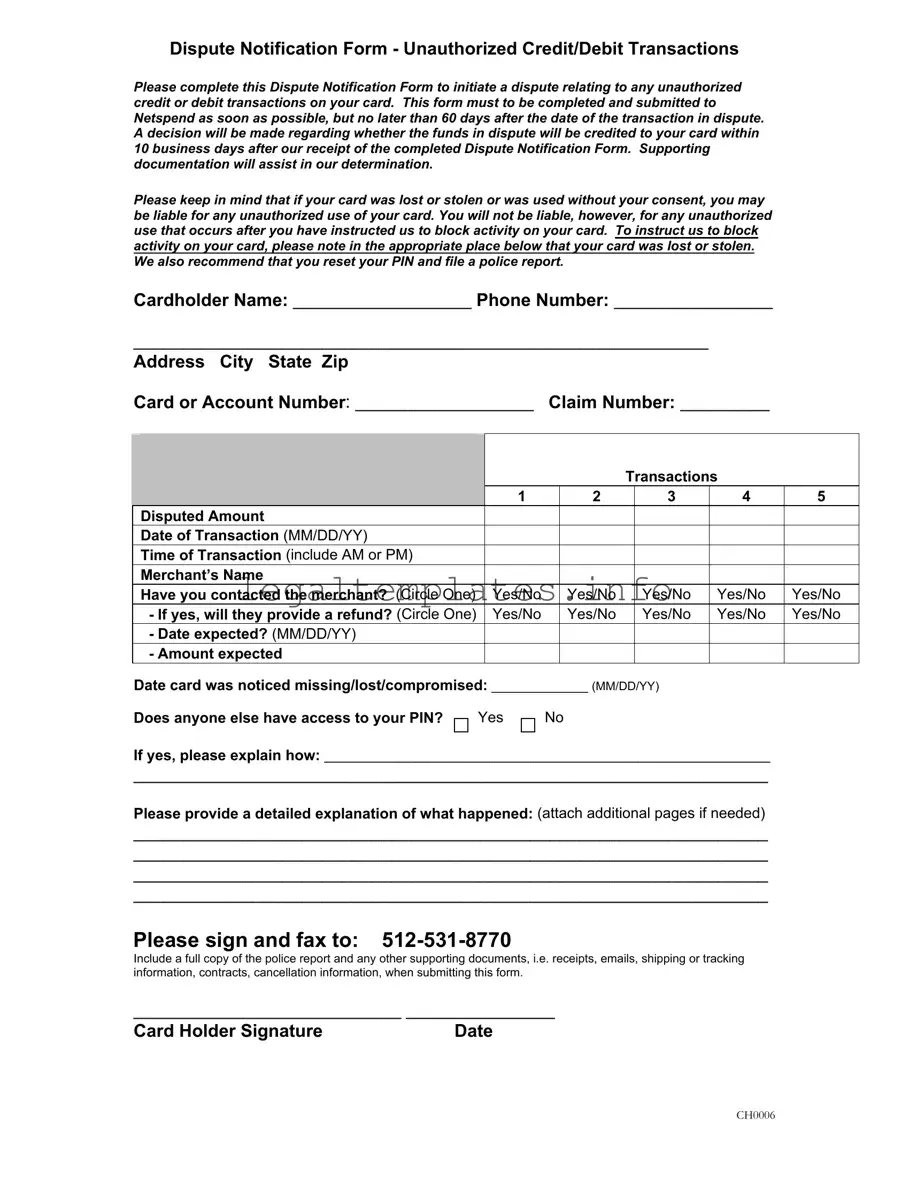

What is the Netspend Dispute form used for?

The Netspend Dispute form is used to initiate a dispute relating to any unauthorized credit or debit transactions on your card. It is essential for informing Netspend about instances where your card has been used without your consent, allowing them to investigate and potentially refund the disputed transactions.

How soon after noticing an unauthorized transaction do I need to submit the Dispute Notification Form?

The Dispute Notification Form must be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the disputed transaction. Prompt submission is crucial for the investigation process and for any potential reversal of unauthorized charges.

What happens after I submit the Dispute Notification Form?

Once Netspend receives your completed Dispute Notification Form, they will begin an investigation into the disputed transactions. A decision about whether the funds will be credited back to your card is made within 10 business days after receipt of the form. Providing supporting documentation can assist in the determination process.

Am I liable for unauthorized transactions made with my card?

You may be liable for unauthorized use of your card if it was lost or stolen or used without your consent. However, you will not be held liable for any unauthorized use that occurs after you have notified Netspend to block activity on your card. It's important to report the loss or theft and block your card as soon as possible.

What should I do if my card was lost or stolen, or I notice unauthorized use?

If your card was lost, stolen, or used without your consent, you should immediately instruct Netspend to block activity on your card, reset your PIN, and file a police report. Indicating on the Dispute Notification Form that your card was compromised and providing a copy of the police report will aid in the investigation.

Can I submit disputes for multiple transactions on one form?

Yes, you can submit disputes for up to 5 transactions on one Dispute Notification Form. Each transaction needs to be detailed with the disputed amount, date of transaction, time, merchant's name, and whether the merchant has been contacted about a refund. This consolidation makes the dispute process more efficient.

What supporting documents should I include with my Dispute Notification Form?

When submitting the Dispute Notification Form, it's beneficial to include any supporting documents that can back up your claim. This could include copies of receipts, emails, shipping or tracking information, contracts, cancellation information, and importantly, a full copy of the police report if your card was lost or stolen. These documents can significantly assist in the investigation of your dispute.