What is a Notice to Owner (NTO) in Florida?

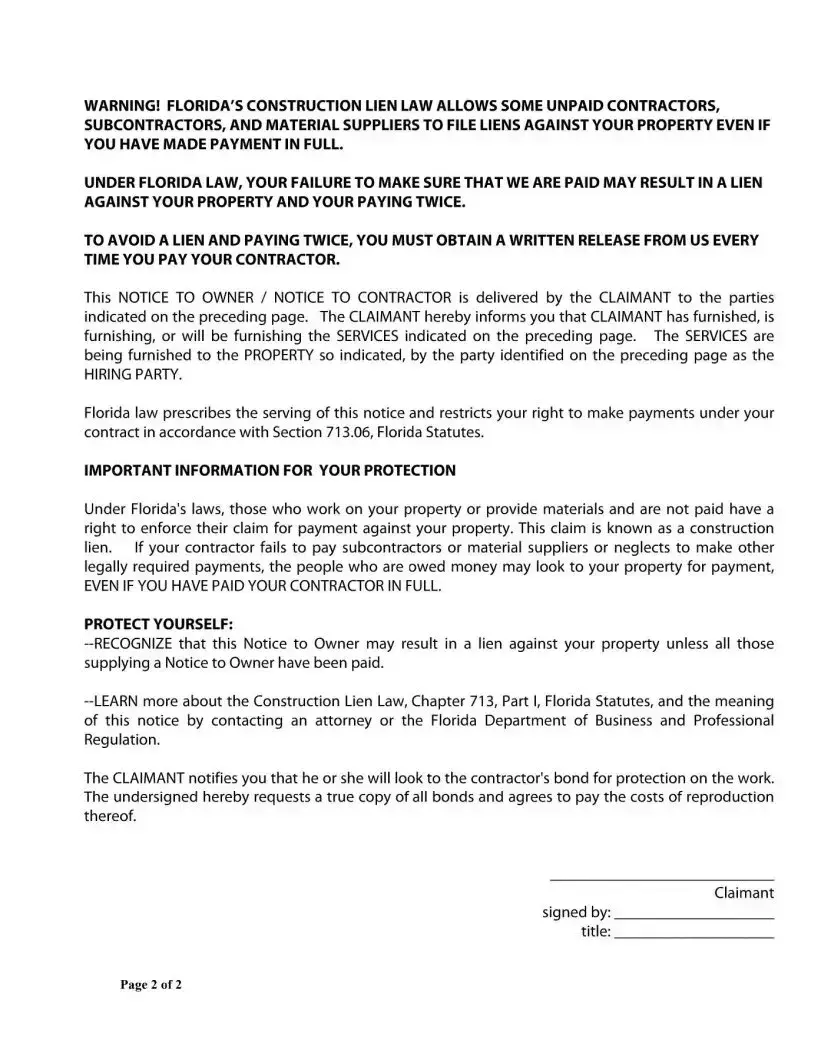

A Notice to Owner (NTO) in Florida is a legal document that subcontractors, material suppliers, and other construction-related parties can use to inform the property owner, prime contractor, and other relevant parties that they are providing labor, materials, or services to a property. This notice is a prerequisite for securing a right to file a construction lien against the property if they are not paid for their services. The notice is designed to protect both the property owners from paying twice for the same services and the service providers from non-payment.

When should a Notice to Owner be sent?

In Florida, a Notice to Owner must be sent within 45 days of the claimant beginning to provide labor, materials, or services to the project. It's crucial for ensuring that the property owner is aware of who is contributing to the project and might have a right to claim a lien on the property if they are not paid.

Who should receive the Notice to Owner?

The Notice to Owner should be sent to the property owner, the prime contractor (if different from the claimant), the hiring contractor (the party who hired the claimant, if different), and the construction lender, if there is one. By notifying these parties, the claimant ensures that those in control of payments are aware of the claimant's legal rights to seek payment through a lien if necessary.

How is the Notice to Owner sent?

The Notice to Owner in Florida should be sent via certified mail, with a record of delivery. This method ensures that there is proof that the notice was sent and received, providing the claimant with documented evidence of compliance with Florida's Construction Lien Law requirements.

What information must be included in the Notice to Owner?

The Notice to Owner must include the name and address of the property owner, the prime contractor, the hiring contractor (if different), and any construction lender involved. It must also detail the claimant's name and address, the property's address and legal description, and a description of the labor, materials, or services provided. This comprehensive information ensures clarity about who is involved and what services are subject to a potential lien.

What happens if you don't send a Notice to Owner?

If a claimant fails to send a Notice to Owner within the prescribed period, they may lose the right to file a construction lien against the property. This makes it crucial for contractors, subcontractors, and others who may wish to secure their right to payment to comply with this requirement.

Can sending a Notice to Owner result in multiple payments to the same contractor or supplier?

No, the purpose of the Notice to Owner is to prevent the risk of double payments. When a property owner receives this notice, they are alerted to the fact that specific contractors or suppliers must be paid directly to eliminate the risk of a lien being placed on their property. The notice coupled with obtaining written releases from each contractor or supplier upon payment ensures that all parties are paid appropriately without any duplication.