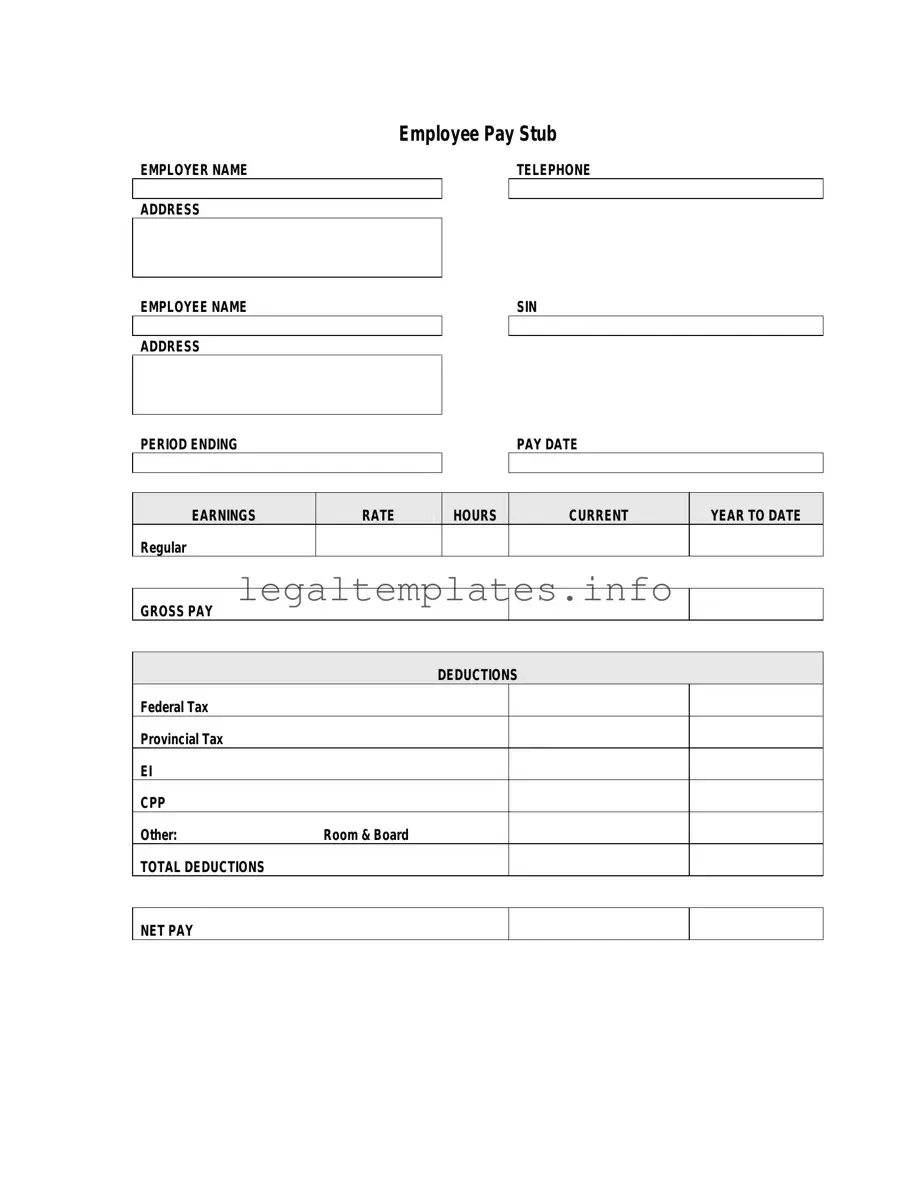

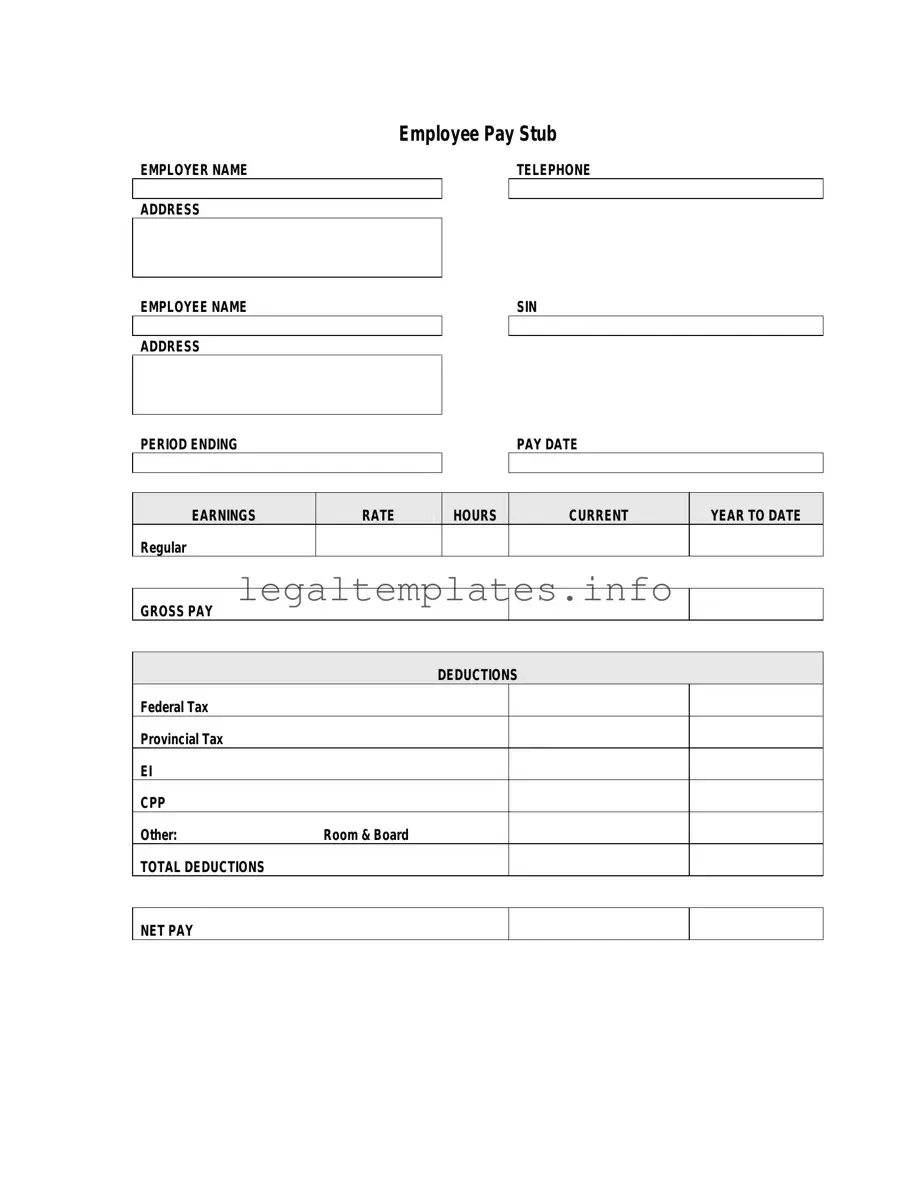

When filling out a pay stub form, one common mistake is entering incorrect employee information. This can include misspelling names, incorrect Social Security numbers, or addresses. Such errors may seem minor, but they can lead to significant issues, such as misfiled taxes or misplaced checks, affecting employees' financial integrity.

Another error involves inaccuracies in the gross pay. This part of the pay stub represents the total earnings before any deductions. Errors here can stem from not including overtime, bonuses, or incorrectly calculating the number of hours worked. These inaccuracies not only impact an employee's immediate financial situation but also their overall earnings record, potentially affecting future loans or benefits.

Miscalculating deductions is also a frequent mistake. Deductions include federal and state taxes, Social Security, Medicare, and any voluntary withholdings, such as 401(k) contributions or health insurance premiums. Incorrect deductions can result in employees either receiving too much or too little in their net pay, leading to a complicated correction process.

Failure to properly calculate net pay, which is the amount an employee takes home after all deductions, is yet another common error. Net pay inaccuracies can cause confusion and mistrust among employees, affecting their satisfaction and trust in their employer's payroll competence.

Not paying attention to state-specific requirements can be a critical misstep. Each state may have unique rules regarding what needs to be included on a pay stub. Ignoring these requirements can lead to legal complications and potential fines for non-compliance with state labor laws.

Forgetting to update the pay stub form to reflect current tax rates and thresholds is a mistake that can have far-reaching consequences. Tax laws change, and using outdated information can result in incorrect withholdings, affecting an employee's annual tax liabilities.

Another oversight is failing to include non-regular earnings or deductions, such as commissions, bonuses, garnishments, or child support payments. Omitting these items can lead to inaccuracies in the gross or net pay and potentially legal issues concerning mandatory deductions like child support.

Incorrectly classifying employees as exempt or non-exempt from overtime is a mistake that can lead to failing to compensate for overtime work correctly. This misclassification not only affects pay accuracy but also can violate federal and state labor laws, opening up the employer to potential legal action and penalties.

Not issuing pay stubs on time or at all is a significant error. Many states require employers to provide employees with a pay stub each pay period. Failing to do so can result in penalties and damage the trust between employees and management.

A final common error is not reviewing the pay stub before issuance. A simple review process can catch many of the mistakes mentioned above. Skipping this step can lead to a cascade of errors affecting multiple aspects of payroll, from employee satisfaction to legal compliance.

In summary, accurately filling out a pay stub is crucial for maintaining compliant payroll practices. Employers must be diligent about details, stay informed about legal requirements, and ensure a thorough review process to avoid these common mistakes. Doing so will uphold their reputation and ensure a trustworthy and transparent relationship with their employees.