What is a Profit and Loss (P&L) form?

A Profit and Loss form, often referred to as an income statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period, usually a fiscal quarter or year. It provides a snapshot of a company's financial health, showing the net profit or loss after all operating expenses, including taxes and interest, have been subtracted from total revenue.

Why is a Profit and Loss form important?

This form is crucial for both the management of a company and its stakeholders as it highlights the company’s financial performance and profitability over time. For management, it serves as a tool for making informed business decisions. For investors and creditors, it's a reliable source of information to assess the financial health and viability of the company. It also aids in tax preparation, as it supports the calculation of taxable income.

Who needs to fill out a Profit and Loss form?

Generally, any business that seeks to track its operational success and financial health over a period needs to fill out a P&L form. This includes sole proprietors, partnerships, corporations, and limited liability companies. It is also essential for businesses seeking investments, loans, or lines of credit, as potential financiers will review this form to evaluate the company's financial stability and profitability.

What time period does the Profit and Loss form cover?

Typically, a P&L form is generated quarterly and annually. However, the time frame can be adjusted to meet specific needs or objectives, such as monthly reports for more frequent monitoring of financial performance or a custom period for comparative analysis or specific project assessments.

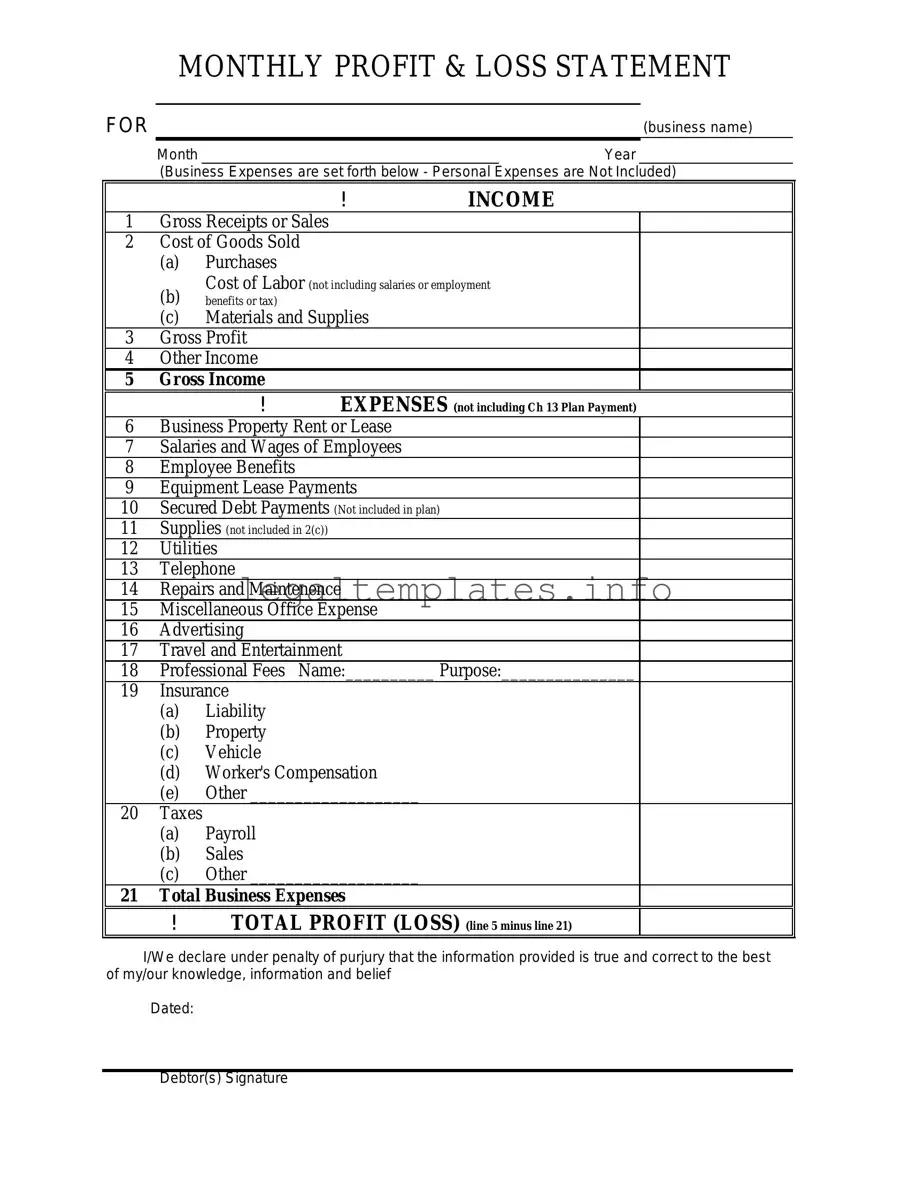

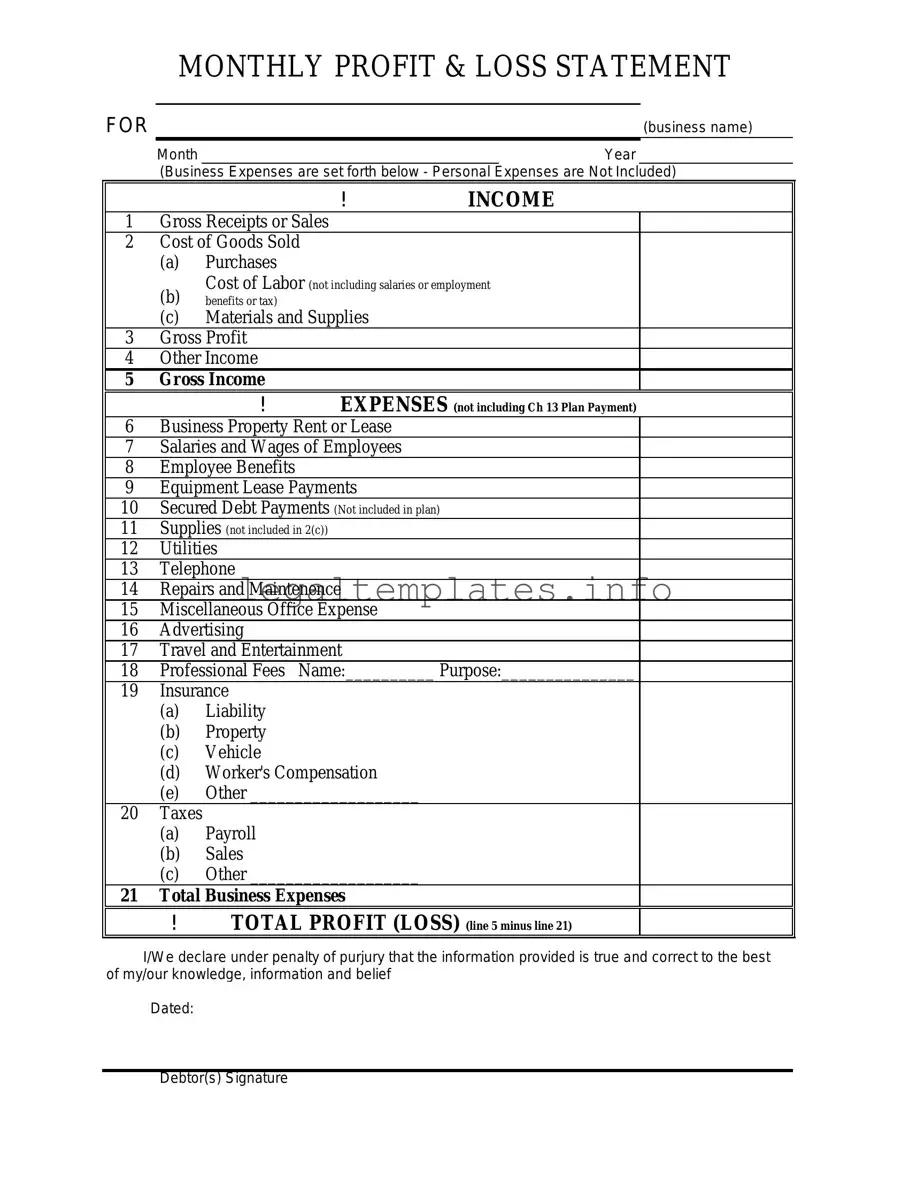

What are the key components of a Profit and Loss form?

The key components of a P&L form include revenue (or sales), cost of goods sold (COGS), gross profit, operating expenses, operating profit, other income and expenses, and net profit. These components collectively provide a detailed account of where revenue comes from, how it is spent, and what is left as profit.

How can one prepare a Profit and Loss form?

Preparing a P&L form involves collecting and categorizing all financial transactions within the reporting period. This process includes recording all revenue earned, subtracting the cost of goods sold to find the gross profit, then deducting operating expenses to reveal operating profit. Any other incomes or expenses must then be considered to calculate the net profit. Accuracy is crucial, and the use of accounting software or consultation with a financial professional might be beneficial.

Can a Profit and Loss form help in improving a business?

Yes, it can. By providing detailed insights into revenue streams and expense categories, a P&L form helps business owners identify areas of strength and pinpoint cost-saving opportunities. It also allows for the tracking of financial performance trends, assisting in strategic planning, budget adjustments, and decision-making processes aimed at enhancing profitability and ensuring sustainable growth.