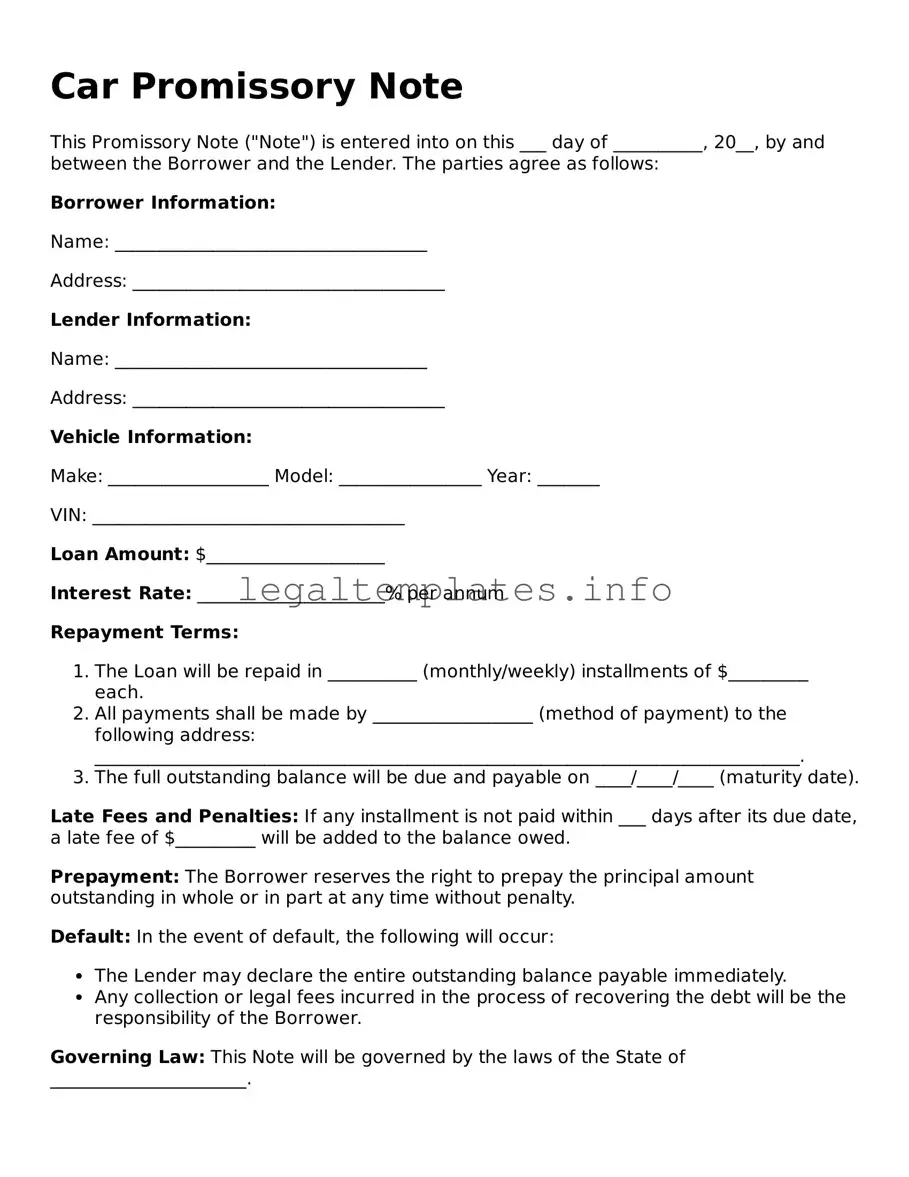

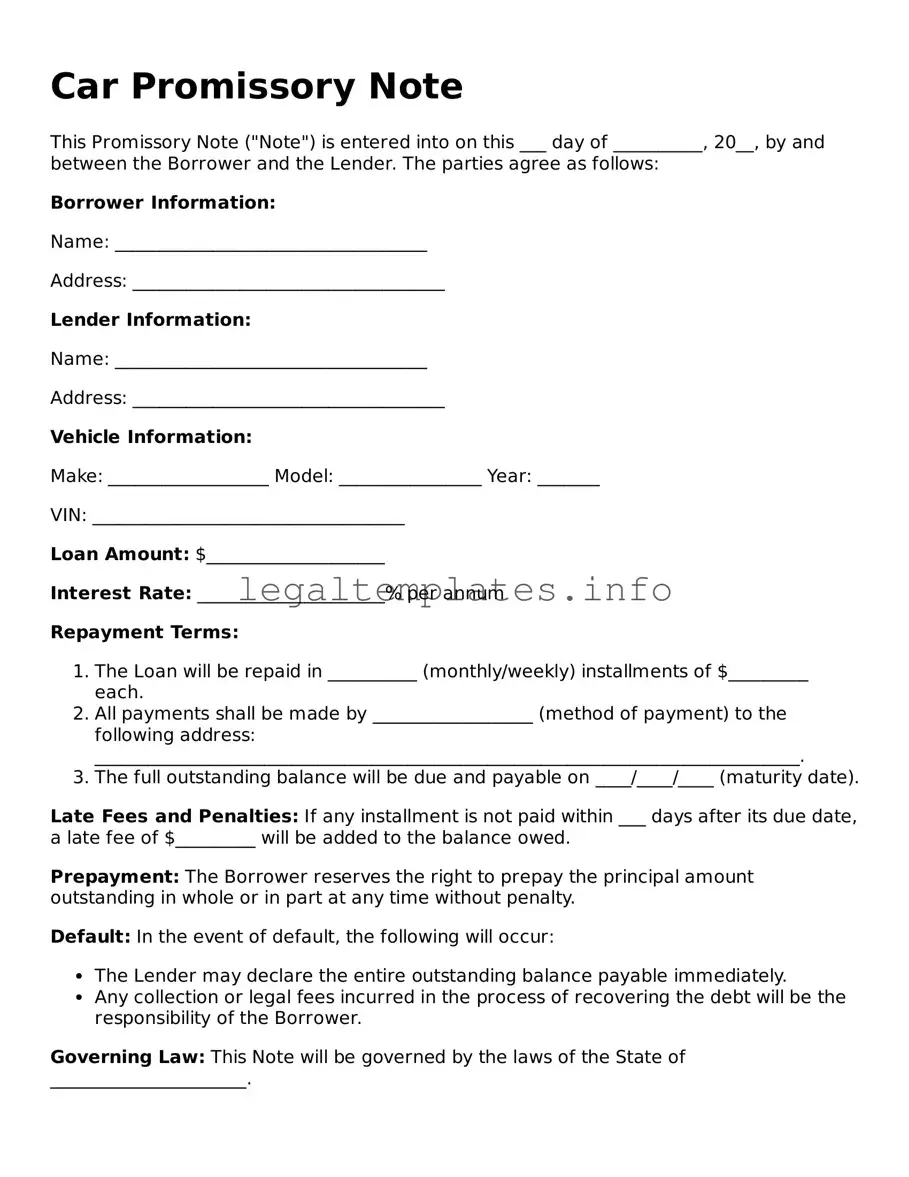

What is a Promissory Note for a Car?

A Promissory Note for a Car is a written agreement between a seller and a buyer where the buyer promises to pay a specified amount of money over a set period to the seller for the purchase of a car. This document outlines the loan's terms, including repayment schedule, interest rate, and what happens if the buyer fails to make payments.

Do I need a Promissory Note to sell or buy a car?

While not always legally required, having a Promissory Note is strongly recommended in private car sales where the buyer intends to make payments over time. It provides a clear record of the agreement and helps protect both parties if there are any disputes or misunderstandings later on.

What should be included in a Promissory Note for a Car?

A comprehensive Promissory Note for a Car should include the full names and addresses of both the seller and the buyer, the total sale price, payment amounts and schedule, interest rate, late payment policies, and the consequences of default. It should also describe the car, including make, model, year, and VIN.

How is the interest rate determined in a Promissory Note for a Car?

The interest rate is a negotiated part of the sales agreement between the buyer and seller. It should be competitive but fair, considering current market rates and the buyer's creditworthiness. Laws in some states may cap the maximum allowable interest rate.

What happens if the buyer misses a payment?

The specific consequences of missing a payment are detailed in the Promissory Note itself. Generally, there might be a grace period followed by late fees. If missed payments continue, it could lead to default, where the seller might have the right to repossess the car or seek other forms of legal remedy.

Can the buyer pay off the Promissory Note early?

Yes, buyers are usually allowed to pay off the remaining balance of a Promissory Note early. The terms of any prepayment penalty or the absence of one should be clearly stated in the agreement.

Is a witness or notary required for a Promissory Note for a Car to be valid?

Legal requirements vary by state. While a witness or notary is not always required for the note to be valid, having the document notarized or witnessed can add a level of protection and authenticity, making it easier to enforce in court if necessary.

What should I do if I lose the original Promissory Note?

If the original Promissory Note is lost, parties should try to agree on a signed written statement that details the loss and reaffirms the obligations under the original terms. It’s also wise to check local laws or consult with a legal professional on the best steps to take.

Can modifications be made to a Promissory Note after it has been signed?

Yes, modifications can be made, but they must be agreed upon by both the buyer and seller, documented in writing, and appended to the original Promissory Note. For transparency and legal protection, any changes should be clearly detailed, agreed to by both parties, and signed.