What is a Release of Promissory Note?

A Release of Promissory Note is a legal document that signifies that the borrower has fulfilled all obligations under a promissory note. Essentially, it's a receipt indicating the loan has been paid in full, and the lender releases any claim against the borrower related to the note.

When should a Release of Promissory Note be used?

This document should be used as soon as the borrower has completed paying off the loan according to the terms laid out in the promissory note. It’s an important step in formally concluding the loan process and clearing the borrower of any further obligations.

Who should sign the Release of Promissory Note?

The lender, or the party who provided the funds under the promissory note, is responsible for signing the release. This action verifies that the debt has been fully satisfied by the borrower.

Is a witness or notarization required for a Release of Promissory Note?

The requirement for a witness or notarization can vary by state law. While not always mandatory, having the document notarized or witnessed can add a layer of security and authenticity to the release, making it harder to dispute.

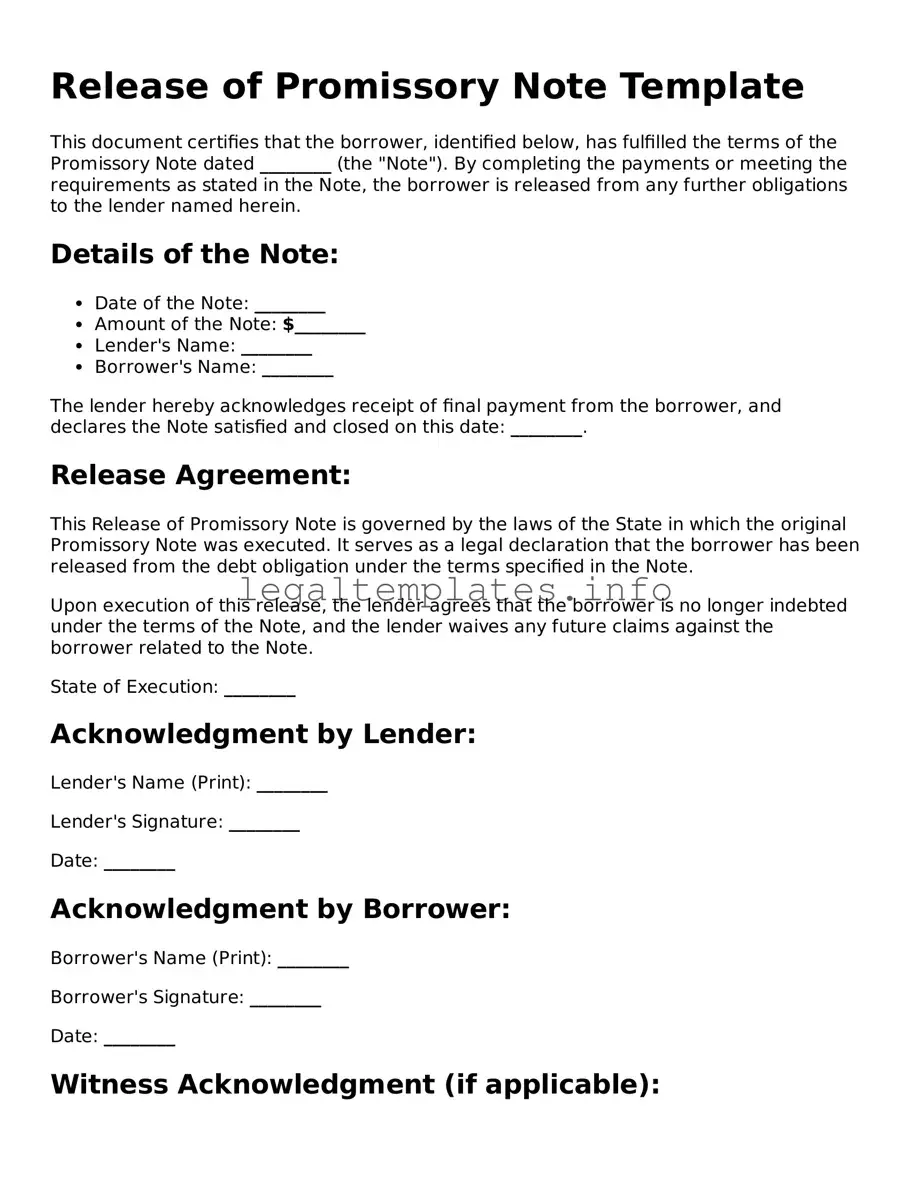

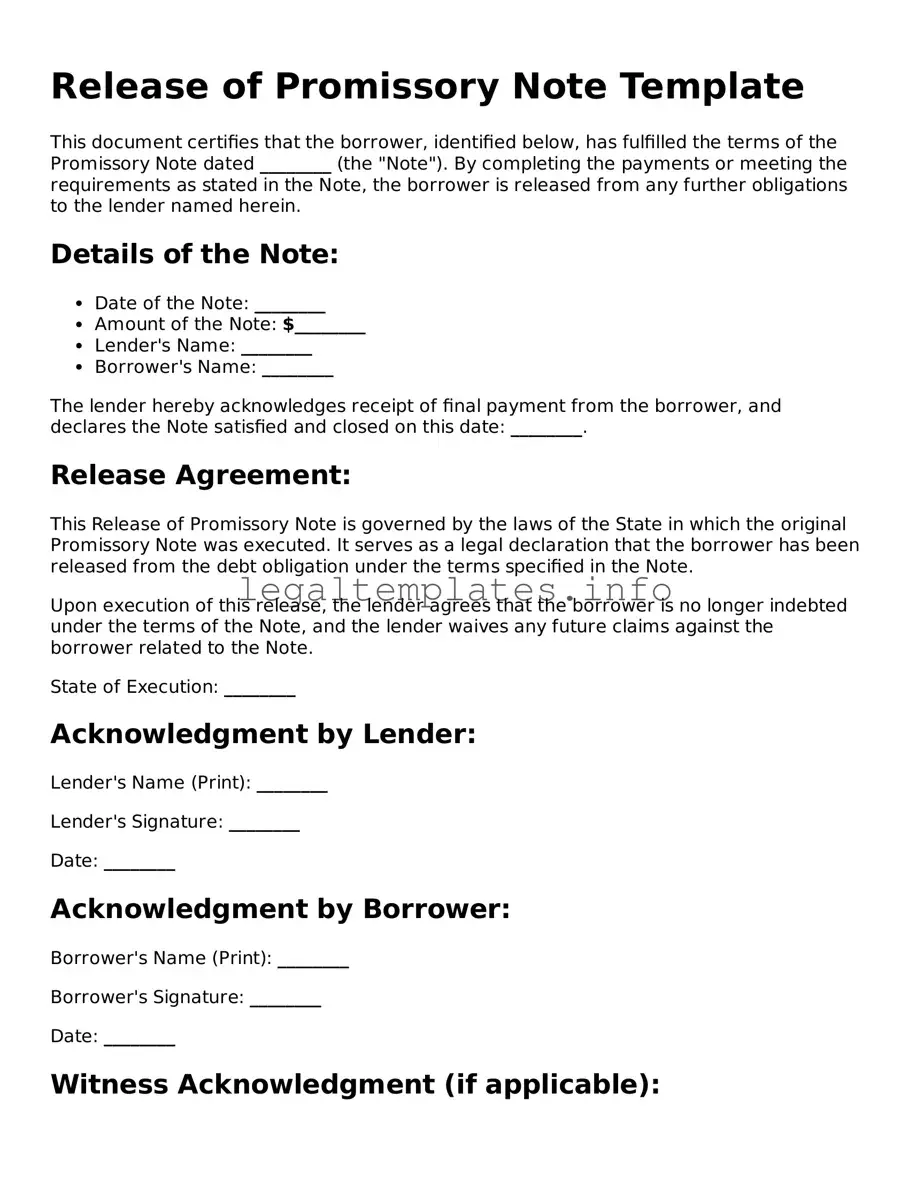

What information is included in a Release of Promissory Note?

The document typically includes the names and addresses of the borrower and lender, the date the promissory note was issued, the amount borrowed, and a statement that the loan has been fully paid. Additionally, the release date and the signature of the lender are also necessary components.

What happens if I don't obtain a Release of Promissory Note?

Without this document, there could be a lingering question or claim about whether the debt has been completely settled. This might lead to future legal disputes or difficulties in proving that the loan no longer exists. It's a safeguard for both parties.

Can I create a Release of Promissory Note on my own?

Yes, you can draft this document yourself provided you include all the necessary information. However, it might be beneficial to use a template or consult with a legal professional to ensure that the release complies with state laws and is properly executed.

What do I do with the Release of Promissory Note after it's signed?

After the document is signed, the borrower should keep the original release for their records. It’s a good idea to also file a copy with any relevant financial institutions or agencies, and the lender may keep a copy as well.

Is the Release of Promissory Note different from a lien release?

Yes, they serve different purposes. A Release of Promissory Note indicates that a personal loan has been fully repaid. In contrast, a lien release is used when a secured debt — typically involving collateral like a vehicle or property — is satisfied, and it removes the lender's legal right to seize the asset in case of nonpayment.