What is a Real Estate Purchase Agreement?

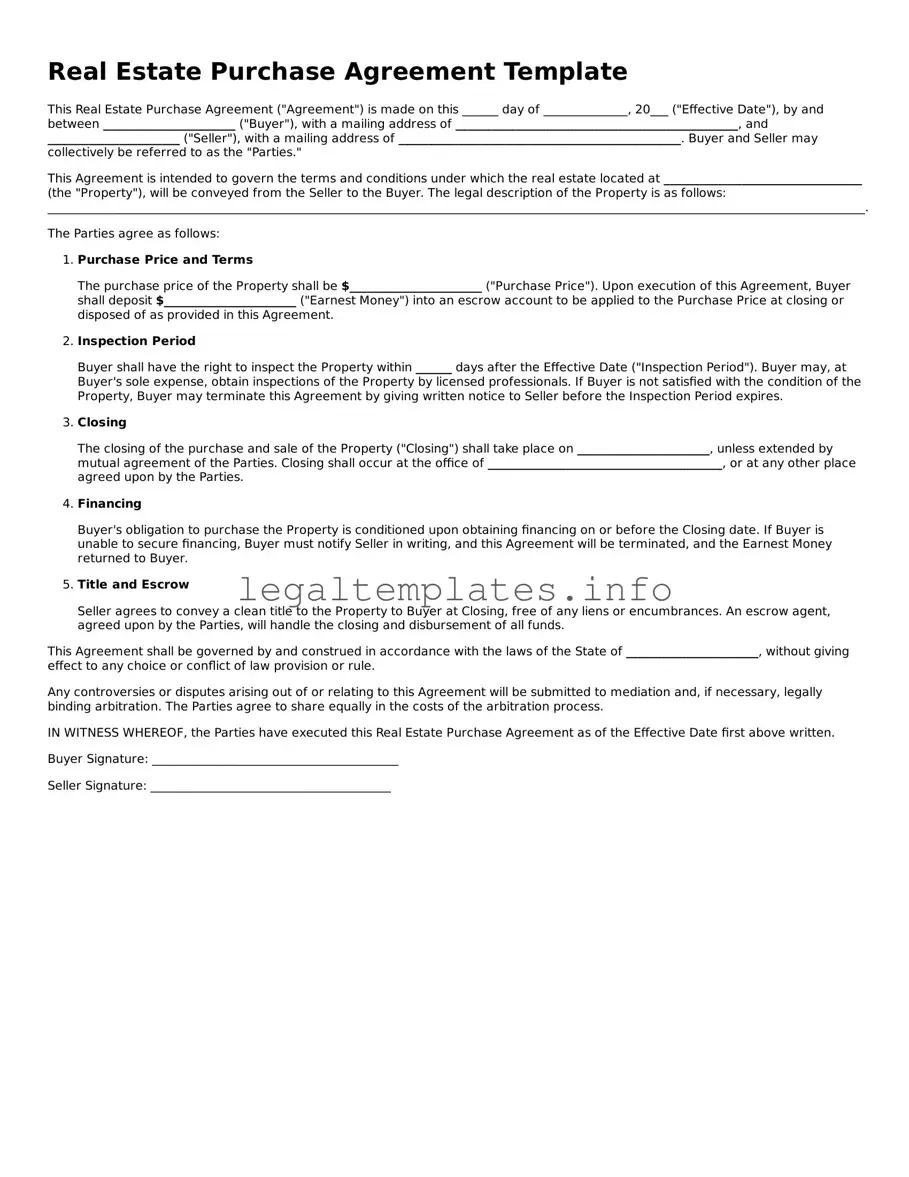

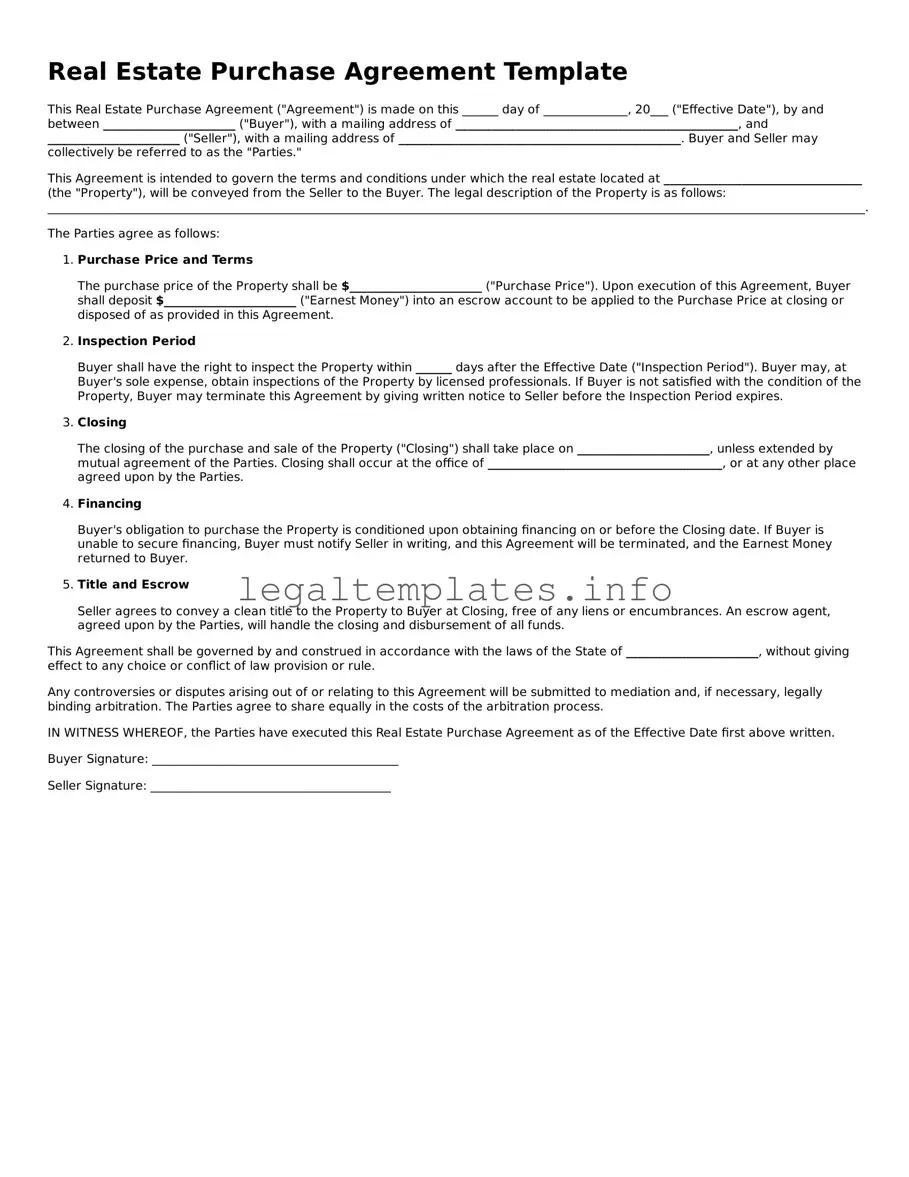

A Real Estate Purchase Agreement is a legally binding contract between a buyer and seller detailing the terms and conditions of the sale of real estate property. This document specifies the price, closing date, property condition, and other important details about the transaction.

Who needs to sign the Real Estate Purchase Agreement?

The agreement must be signed by all parties involved in the transaction. This typically includes the buyer(s) and the seller(s). If the property is owned jointly or if there are multiple buyers, all must sign to validate the agreement legally.

Can I make changes to the Real Estate Purchase Agreement after signing?

Changes can be made after signing, but all parties involved must agree to the amendments. The changes should be made in writing and signed by all parties, often outlined in a separate addendum attached to the original agreement.

What happens if a buyer or seller breaches the agreement?

If either party fails to comply with the terms of the agreement, it is considered a breach. Consequences vary and might include the forfeiture of the deposit, legal actions for damages, or specific performance, where the court forces the breaching party to fulfill their obligations.

Is a Real Estate Purchase Agreement the same in every state?

No. While many elements of a Real Estate Purchase Agreement are similar across states, each state has its own laws and requirements. Some states might require certain disclosures or additional documents to be included in the sale. It's essential to consult with a local legal professional to ensure compliance.

What are common contingencies included in this agreement?

Common contingencies include financing, where the sale depends on the buyer securing a mortgage; inspection, allowing the buyer to have the property inspected; and sale of current home, where the purchase depends on the buyer selling their current home. Each contingency should be clearly detailed in the agreement.

How long is the offer valid?

The validity of an offer should be specified in the agreement. This period, often called the "offer expiration date," allows the seller a fixed time to consider the offer and accept, reject, or make a counter-offer. If the deadline passes without response, the offer typically expires and is no longer binding.

Do I need a lawyer to prepare a Real Estate Purchase Agreement?

While not always required, consulting with a lawyer is highly recommended when preparing a Real Estate Purchase Agreement. A lawyer can ensure that the agreement complies with local laws, addresses all necessary terms, and protects your legal rights throughout the transaction.

What happens at the closing of the agreement?

At the closing, all aspects of the agreement are finalized. This includes the transfer of the property title from the seller to the buyer, the payment of the purchase price, and the settlement of closing costs and other fees. It marks the official change of ownership and the completion of the real estate transaction.