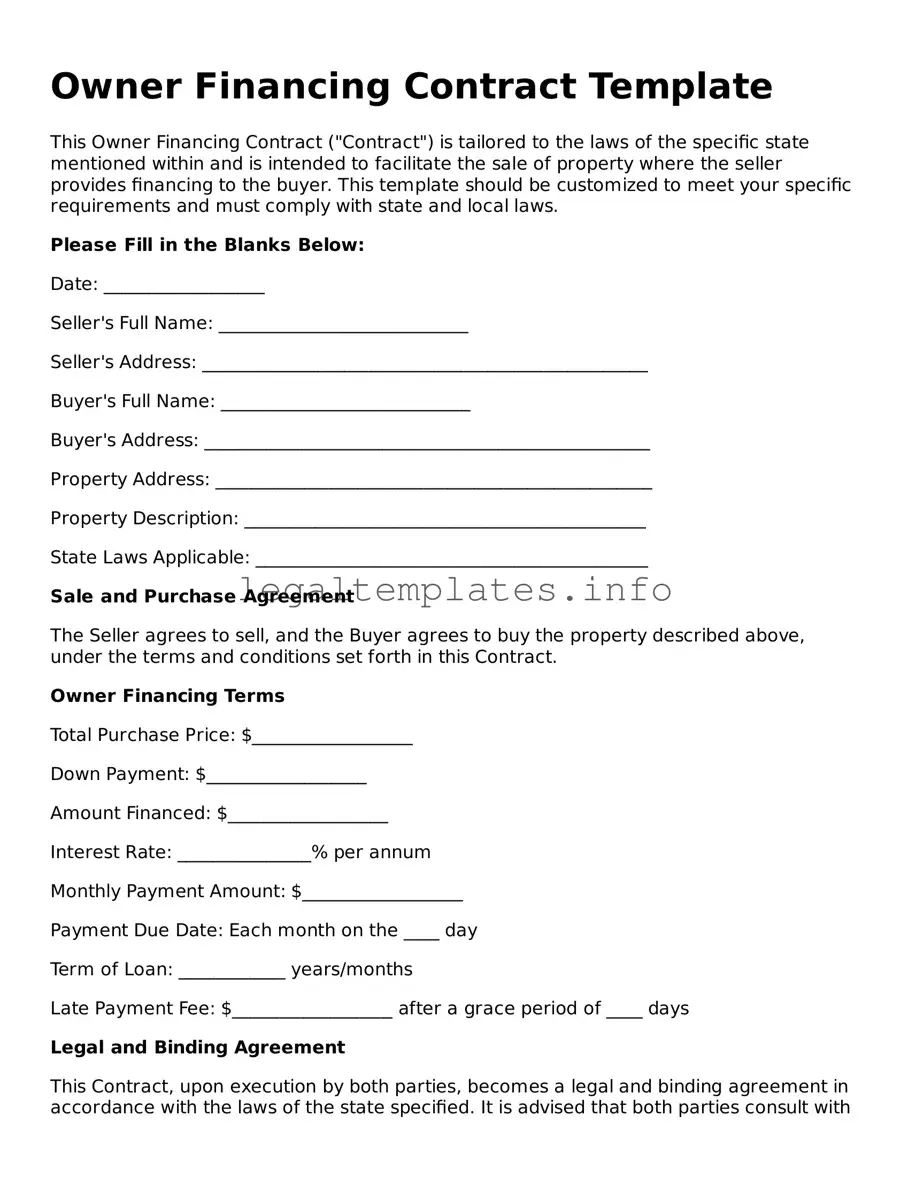

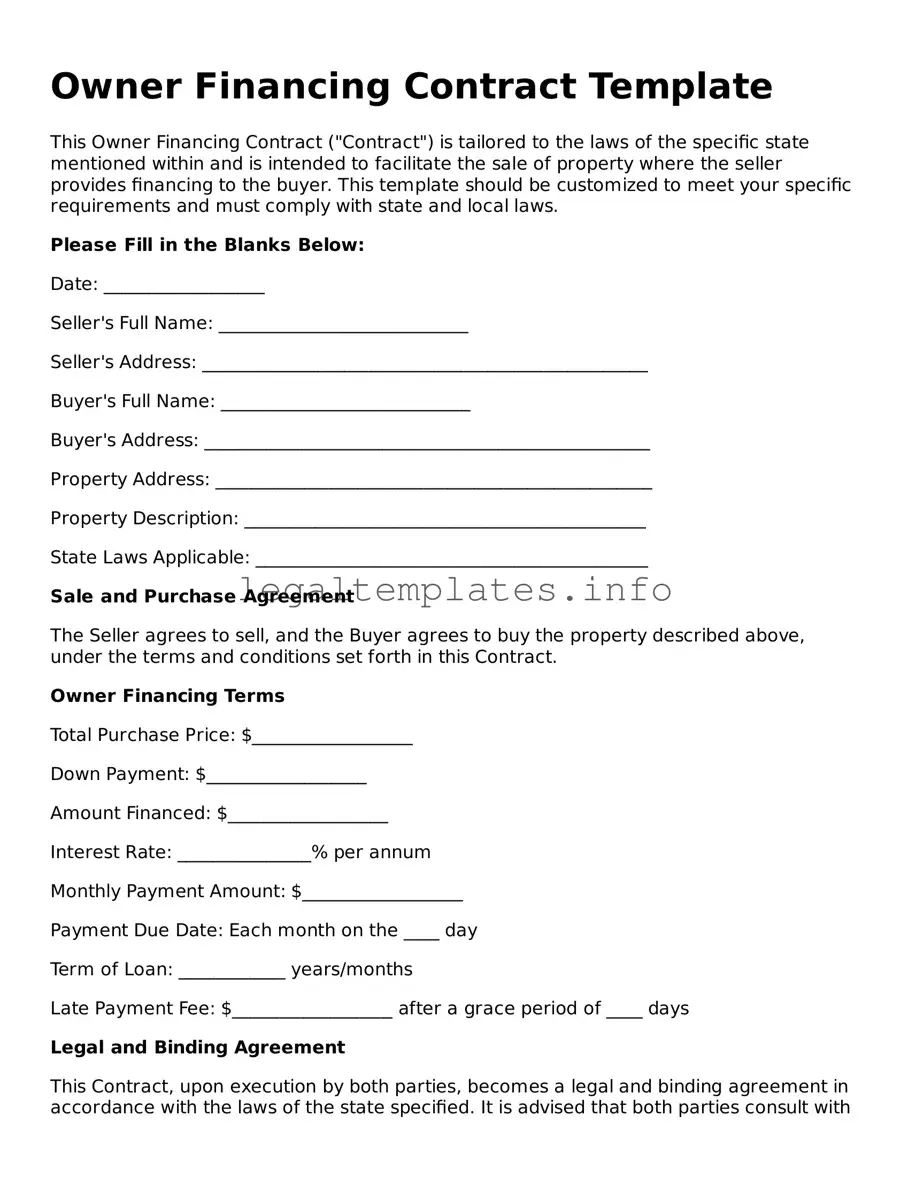

Owner Financing Contract Template

This Owner Financing Contract ("Contract") is tailored to the laws of the specific state mentioned within and is intended to facilitate the sale of property where the seller provides financing to the buyer. This template should be customized to meet your specific requirements and must comply with state and local laws.

Please Fill in the Blanks Below:

Date: __________________

Seller's Full Name: ____________________________

Seller's Address: __________________________________________________

Buyer's Full Name: ____________________________

Buyer's Address: __________________________________________________

Property Address: _________________________________________________

Property Description: _____________________________________________

State Laws Applicable: ____________________________________________

Sale and Purchase Agreement

The Seller agrees to sell, and the Buyer agrees to buy the property described above, under the terms and conditions set forth in this Contract.

Owner Financing Terms

Total Purchase Price: $__________________

Down Payment: $__________________

Amount Financed: $__________________

Interest Rate: _______________% per annum

Monthly Payment Amount: $__________________

Payment Due Date: Each month on the ____ day

Term of Loan: ____________ years/months

Late Payment Fee: $__________________ after a grace period of ____ days

Legal and Binding Agreement

This Contract, upon execution by both parties, becomes a legal and binding agreement in accordance with the laws of the state specified. It is advised that both parties consult with a legal professional before signing.

Closing and Possession Dates

Closing Date: __________________

Possession Date: __________________

Signatures

Both parties affirm that all information provided in this Contract is true and accurate to the best of their knowledge and belief. Furthermore, they agree to abide by all the terms and conditions outlined herein.

______________________ ______________________

Seller's Signature Buyer's Signature

Date: __________________ Date: __________________

Notarization (If Applicable)

This section is to be completed by a notary public if required by the laws of the state governing this Contract.

State of __________________

County of _________________

On __________________ before me, __________________________________, personally appeared _________________________________, personally known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same in their authorized capacity(ies), and that by their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature ____________________

(Seal)